The Bank of Canada is likely to be put under more pressure by Wednesday's data.

Canada's consumer price index increased 7.7 per cent from May to August, and most economists expect the increase to continue last month.

The photo was taken by Postmedia.

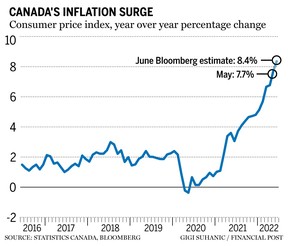

Canada's main gauge of inflation likely topped eight per cent in June, complicating the Bank of Canada's attempts to convince businesses and households that price pressures will eventually ease.

The consumer price index is expected to be updated on Wednesday. For more than a year, the year-over-year change has exceeded the Bank of Canada's comfort zone, which is three per cent.

The May consumer price index increased 7.7 per cent from a year ago, and most economists expect the gain to exceed 8 per cent last month. The Bank of Canada predicts that inflation will fall to three per cent in the second half of the year.

inflation that fast would put additional pressure on the central bank to deliver a larger rate hike in September The Bank of Canada surprised a lot of people last week with a full-point hike.

Macklem told the Canadian Federation of Independent Business that the central bank is committed to getting inflation back to its two-per-cent target.

Macklem told an audience on July 14 that they were trying to avoid higher interest rates down the road. Soft landings follow front-loaded tightening cycles.

The central bank thinks the economy will grow 3.5 per cent this year before slowing to 1.75 per cent next year. Despite an expected economic slowdown and decades-high inflation, Macklem said he believes Canada can avoid a 1970s-style Stagflation environment because the economy had already been overheated in the years leading up to a decade of high inflation.

The high inflation that we have today is not normal, it's not here to stay

Bank of Canada Governor Tiff Macklem

The United States dollar was pegged to gold prices during the 1970s, but countries abandoned the system in the 1980s.

The monetary anchor wasn't replaced with a new one. The monetary policy was not moving in the right direction. It took a long time to respond. Expectations for inflation increased. We had very high inflation for a decade because of the wage price spiral. It took a very sharp recession to bring it back down.

In its July monetary policy report, the Bank of Canada pointed to the Russian invasion of Ukraine as one of the recent disruptions that are expected to end over the next year. Inflation is projected to peak in the third quarter as supply challenges ease and demand slows, according to the report.

Supply shortages and soaring commodity prices caused two-thirds of the central bank's miss on its inflation target.

The consumer price index is expected to average 7.1 per cent this year, after peaking in July, before slowing to 3.6 per cent in 2023, according to economists at Bank of Nova Scotia.

The chief economist said in a July 18 report that a broad range of supply chain indicators and input prices suggest inflation will cool. Wage pressures suggest that inflation will be stronger than anticipated, despite the downward revision to the growth outlook.

The Bank of Canada's policy rate is expected to peak at 3.5 per cent later this year and stay there through 2023, according to Perrault. He said they don't expect the central bank to raise rates above this level.

Macklem has been saying for a long time that the Bank of Canada is getting tougher on inflation and that Canadians shouldn't expect it to keep going indefinitely.

He told the CFIB that the high inflation that we have is not normal. We are committed to bringing inflation down.

The email address is shughes@postmedia.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.