It's a good day. There are possible mortgage repayment grace periods in China and restrictions on US chip subsidies. People are talking about something.

China may allow homeowners to temporarily halt mortgage payments on stalled property projects without penalty as authorities race to prevent a crisis of confidence in the housing market from upending the world's second- largest economy.

A potential economic downturn will cause Apple to slow hiring and spending growth. All teams will not be affected by the changes, and Apple still has an aggressive product launch schedule in the future. The cautious tone is notable for a company that has generally beaten Wall Street predictions and has weathered past economic turmoil better than many peers. That is making people worry about the economy.

The Senate is expected to debate a bill on Tuesday that would prohibit certain investment in China by Semiconductor companies if they get subsidies to build plants in the US. There is a provision in the bill that limits China investments for companies that take some of the money dedicated to US chip manufacturing. According to the White House, the incentives are meant to increase investment in the US.

It is bad news for bankers' pay. The investment-banking and trading operations at Goldman, Morgan Stanley, and JP Morgan set aside less money for compensation in the first six months of this year than they did in the same period last year. Goldman vowed to slow hiring and use the reviews to fire its worst performers.

Australia's natural environment is in a state of rapid decline due to climate change and habitat loss.

Over the last 24 hours, this has caught our attention.

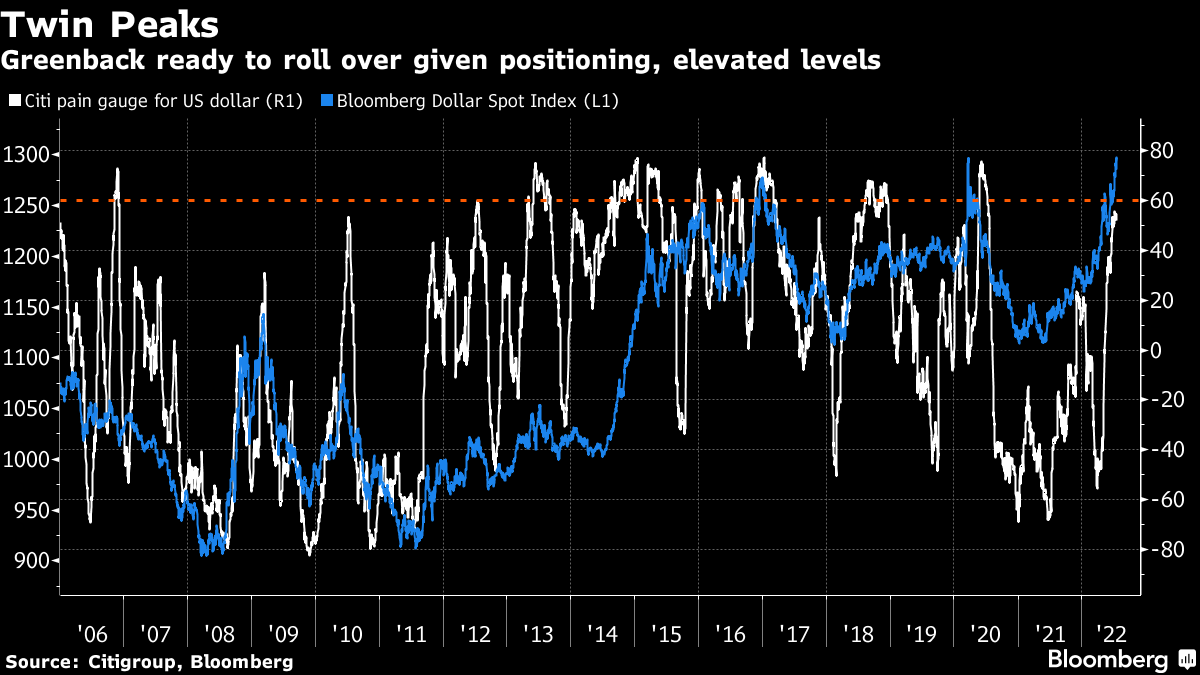

Federal Reserve officials have taken the shine off bets on a full percentage point interest rate hike for this month, which is tarnishing King dollar's crown. This year's strong upward trend is unlikely to break until at least next week's Fed meeting, which will give greater clarity on how close we are to the peak of the tightening cycle. The potential for Russia gas supply curbs, along with this week's European and Japanese central bank gatherings, could give the dollar some new life. Citigroup has a gauge of investor positioning that is close to the 60 level, which is usually just before the dollar goes up. We could see a rapid reversal if the dollar tops out.

Garfield Reynolds is based in Australia.