The credit card market has become more crowded with consumer tech companies locked in a fierce competition to differentiate their offerings.

The company says it is able to set credit limits up to 5x higher than traditional card providers because it uses income as a factor in determining credit limits. It is an attractive proposition for people with stable incomes but low credit scores.

"For someone like me, who came from a different country, a credit score is not a true reflection of my ability to repay."

After rolling out its product to a limited group of customers, the card has grown to $50 million in monthly transactions. The product is going to launch to the general public in the coming weeks thanks to a new funding round.

The first-ever investment by a venture capital firm was made by FPV, a new firm from the founder of Google Analytics. New and existing investors participated in the event, according to X1.

X1 raised $12 million in January 2021.

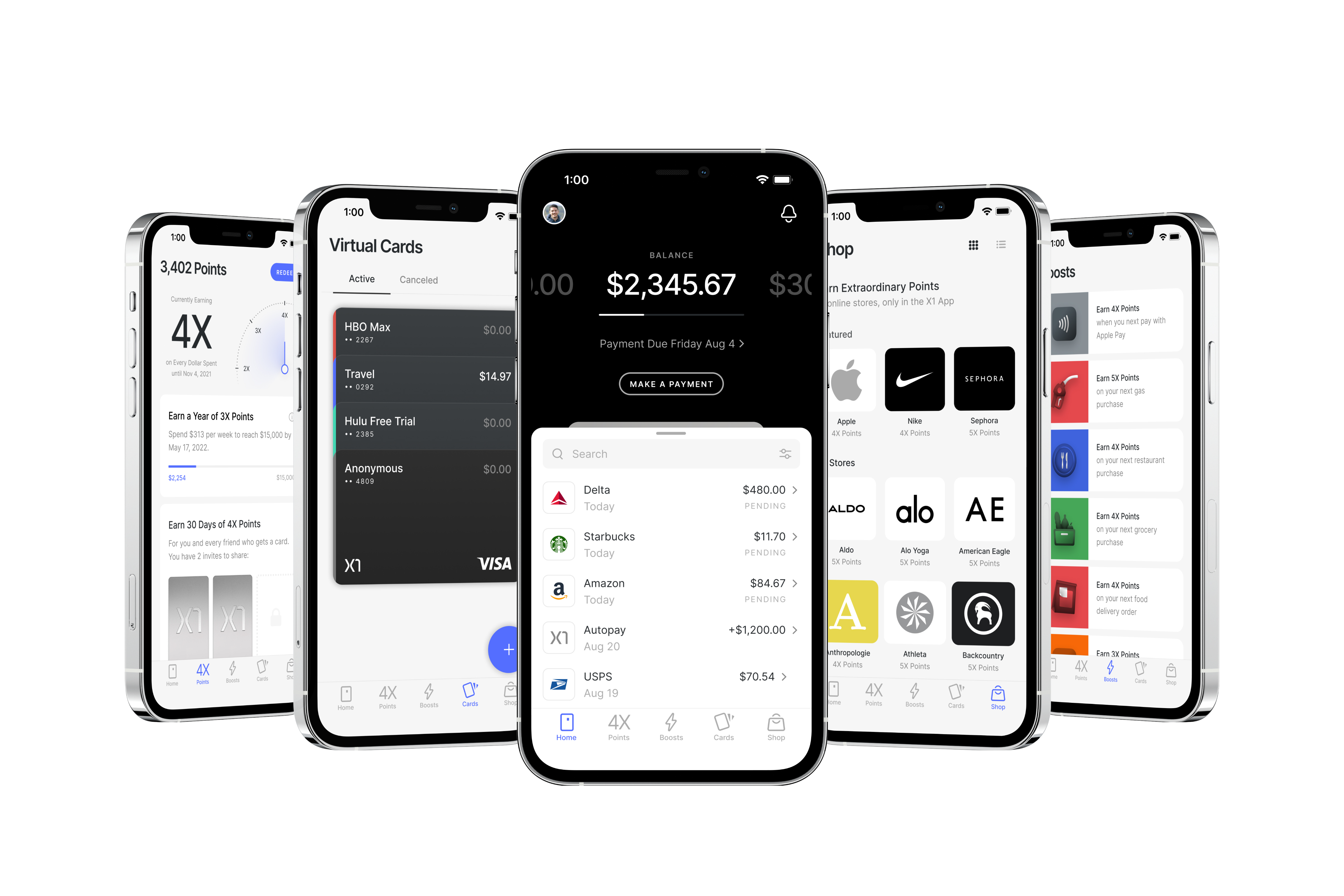

X1 was backed by Chan despite his initial skepticism about investing in a credit card during a time of economic decline. He was drawn to X1 because of its easy to use interface. X1 is able to give customers a loan without a credit score because of the data it gathers from users' bank accounts.

Over half a million people are on X1's wait list. Hearing users rave about the card helped sway him.

X1 has a credit card app.

According to Chan, all of X1's marketing is done through word of mouth.

According to Chan, credit card companies don't have to pay an annual fee to fund their marketing.

2X points on all purchases, as well as an offering tailored to families that want to earn points together, are available on the card. The latest funding will be used to add more products and features to the card, according to him.

The card had already been launched to the public. It is expected to launch in the coming weeks, according to the article.

New bank, who dis? Lifestyle-focused neobank Cogni pivots to web3