It's a good day. China is a pariah when it comes to investing. The dollar'sdoom loop. I'm hoping for more oil. Today is what you need to know.

Reasons to avoid the country outweigh incentives to buy now, as investors once were enticed by China's juicy yields. They cite everything from unpredictable regulatory campaigns to economic damage caused by strict Covid policies. The central bank governor said the monetary authority would intensify the implementation of prudent monetary policy for stronger economic support. The property sector crisis is getting worse because officials are censoring crowd-sourced documents.

The world may be in for a lot more pain as a result of the dollar's current trajectory. Concerns over global growth have recently sent the Bloomberg Dollar Spot Index to the strongest level on record, with the US dollar hitting multi-decade highs against currencies. The move risks becoming a self-reinforcing feedback loop because the vast majority of cross-border trade is still in dollars, and a stronger US currency has historically hurt the world economy. Asian stocks are expected to hold their ground Monday, as the dollar falls back.

The US energy envoy said he was confident that Gulf producers would increase oil output after meeting with regional leaders. The State Department has a senior adviser for energy security. Any decision to pump more would be made within the organization. Much of the surge in oil was caused by Russia's war in Ukraine, which has roiled the commodity supply chain.

Thousands of people have been forced to flee their homes across Europe as deadly wildfires sparked by soaring temperatures burn down swathes of woodland. Europe is in the midst of an extreme and deadly heatwave, and the UK is bracing for record-breaking heat on Monday as the hot weather

The national security head and top prosecutor were removed by the president of the country. The Security Service chief was fired because of his agency's counter intelligence work. Russia's defense minister instructed military units to increase combat activity in Ukraine because of advanced Western weapons. In Indonesia, a summit of finance heads from the world's top economies blamed Russia for the global inflation wave.

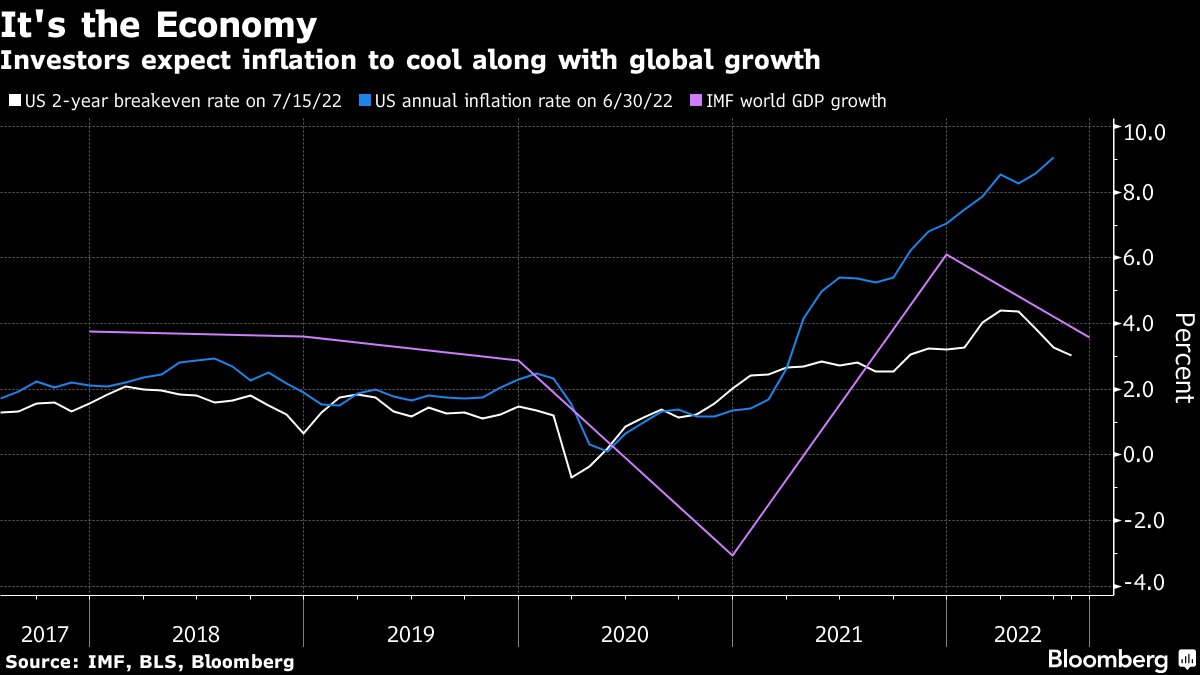

When it comes to inflation, investors look to be in a good place. The breakeven rate is what the Treasuries market expects inflation to be over the next two years. That looks to be a combination of expected base effects and the impact of the Federal Reserve raising interest rates. There was a sting in the tail as stocks perked up at the end of last week. There are a lot of reasons for optimism that cost pressures will dwindle. The combination of high prices and the Fed's monetary medicine is expected to cause a recession. A lot of the world is in the same boat.

Garfield Reynolds is based in Australia.

Garfield Clinton Reynolds helped with the project.