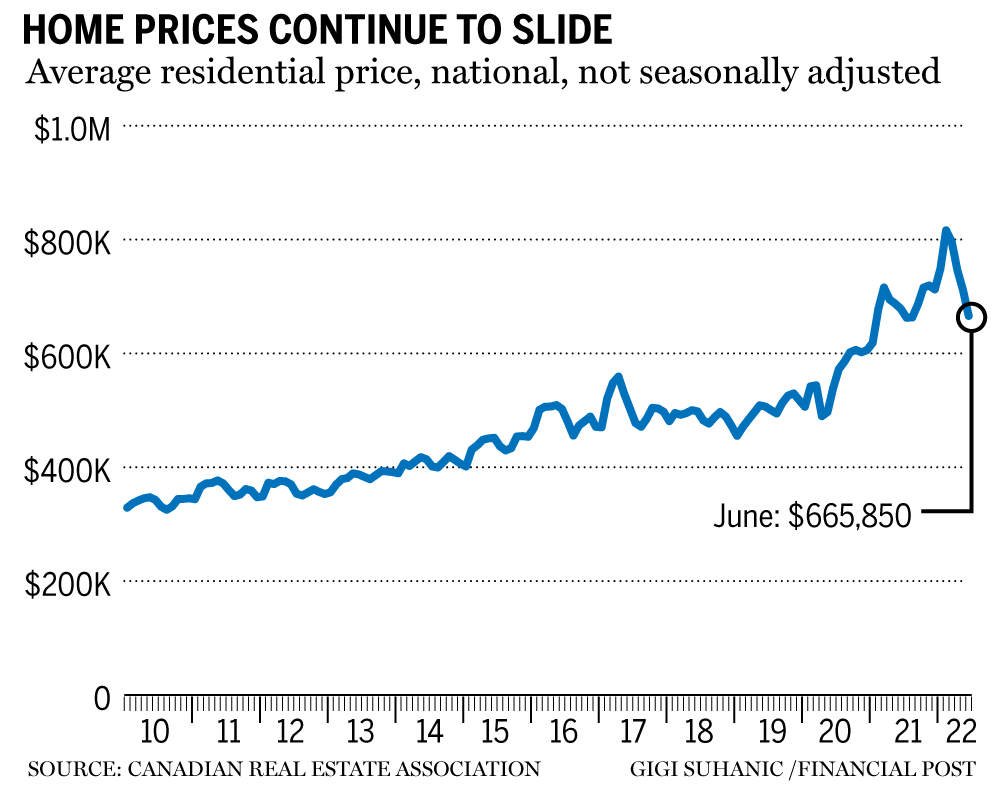

The average price was six per cent lower in May than it was in June.

There is a sign on a house.

The photo was taken by the Postmedia.

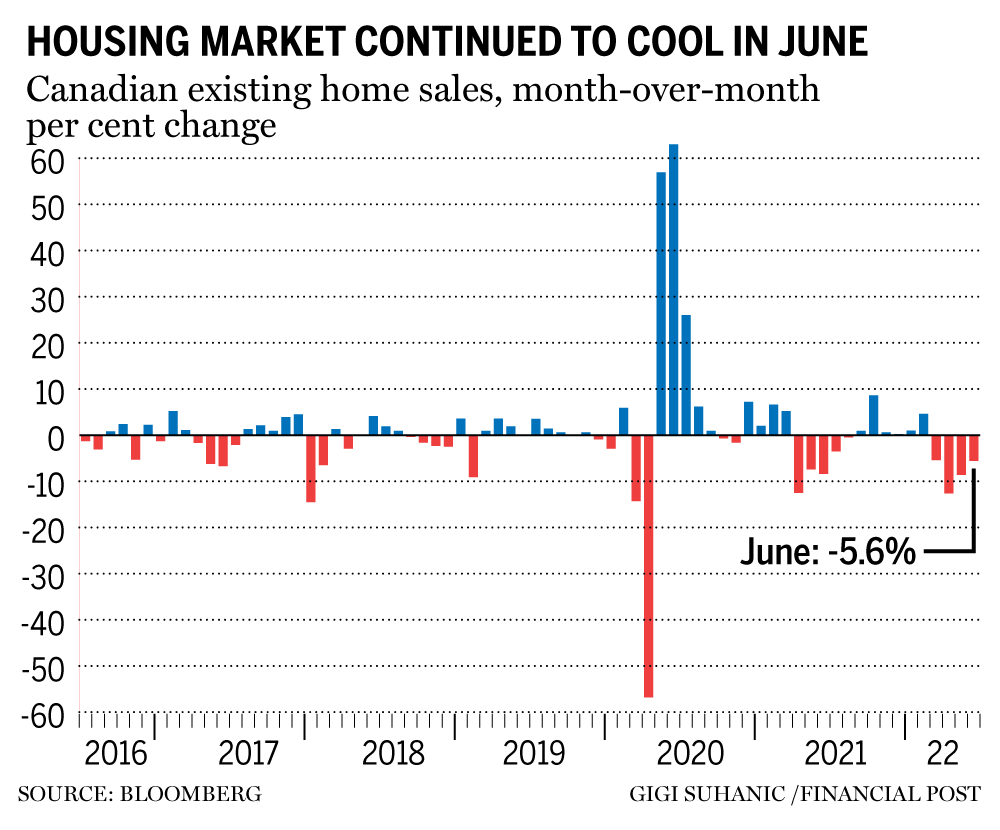

As rising rates put more people on the sidelines, home sales and prices are falling.

According to data from the Canadian Real Estate Association, the actual, non-seasonally adjusted average price was $665,850 in June, slipping 2% from a year earlier and sliding six per cent from May.

The number of homes changing hands fell from a record in June to a new low in June. The drops seen in April and May were larger than the declines seen in June.

The chair of the Canadian Real Estate Association said in a press release that sales activity continues to slow in the face of rising interest rates. The supply issue has not gone away despite the fact that the cost of borrowing is the main factor affecting housing markets. Some people may choose to wait on the sidelines as the dust settles in the wake of recent rate hikes, but others will still be active in the market.

The rate hike cycle of the Bank of Canada has had a negative effect on the housing market. The central bank raised its policy rate on July 13 in a surprise move. The banks quickly raised their own prime rates.

The email address is shughes@postmedia.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.