Macklem believes the economy can handle higher interest rates.

The governor of the Bank of Canada was in the capital city in April.

The photo was taken byJustin Tang.

The Bank of Canada raised interest rates by 100 basis points on Wednesday, just hours after Financial Post editor-in-chief Kevin Carmichael sat down with the governor. There is a transcript of their conversation.

Kevin asked if it was fair to say that the primary mission was shock and awe.

I will allow you to pick your favorite expression. Today's decision expressed concern, I think. I didn't like the way you described the situation. The decision stated that inflation is affecting all Canadians. The bigger the risk of high inflation becoming entrenched in people's expectations, the more concerned it is that the inflation stays too high.

We wanted to send a clear message to Canadians that they should expect inflation to come down and that they should build that into their expectations.

Is there a better way to think about inflation expectations. Is it necessary for people to see inflation begin to come down? Is it possible that a surprisingly aggressive move is enough to end those expectations?

Canadians need to see inflation come down. When they see that inflation is coming down, they will believe it.

Food prices have gone up due to inflation.

The photo was taken byAngela Weiss.

Canadians are aware of what is happening. There are shortages in the economy and they are aware of it. There is a shortage of workers. Goods and services are in short supply. It takes longer to arrive after you purchase something. It's hard to get a reservation at a restaurant. The airports are crowded when you want to fly. All of us are looking at evidence. Canadians know that the economy needs to cool down. We need to slow down spending and give the supply time to catch up. If Canadians thought that the Bank of Canada didn't see anything, that would make inflation expectations unmoored.

I think that by showing that we are on top of this, we are getting ahead of this, and that we can expect inflation to come back down, I think that gives Canadians confidence that they can expect inflation to come back down.

We have to understand those expectations. It will take some time for inflation to come down for Canadians. Inflation is going to go up a little further before it starts coming down, and even when it starts coming down, it is going to take a long time.

Monetary policy takes time to work through the economy. It is crucial to get out in front of it. Monetary policies work in the lag. The sooner you start, the quicker it will work and the sooner Canadians will see that it works.

It is the job of the central bank to keep inflation expectations well anchored, because they have a lot of influence on expectations. It's possible to hit your inflation target.

We have to hit the brakes on economic growth. Take the foot off the gas and you will be good to go. Are we going to have to get rates above neutral before you are done?

Today, we took a big step. Rates were raised 100 basis points. We estimate the neutral range to be between two and three percent. Interest rates will need to rise further to cool demand and allow supply to catch up and see some easing of inflationary pressures, as indicated by us. By front-loading the interest-rate increases, we are trying to avoid the need for interest rates to go up further down the road.

Soft landings are associated with front- loading tightening cycles. The (Bank of International Settlements) annual report that came out about three weeks ago has a very good chapter looking at the evidence of tightening cycles in all range of countries over a long period of time.

The Bank of Canada is located in the capital city of Canada.

The photo was taken by Chris Wattie.

It's argued that we should get our policy rate up to at least the top of the neutral range. It depends on the evolution of the economy and the evolution of inflation.

We have a goal. We don't have an interest rate target. It's important to get inflation back to the target. We will take each of those decisions based on our best judgement at the time, reflecting our assessment of the economy and outlook for inflation.

Why is the dollar no longer linked to oil prices? Today's move about trying to get some upward pressure on the dollar is related to how inflation is influenced by the dollar.

When the price of oil goes up, the Canadian dollar acts as a stabilizer in the economy. The flexible exchange rate has provided it. The Canadian dollar appreciates when the price of oil in the US goes up. What do you think about that? The price in Canadian dollars doesn't go up as much because the Canadian dollar absorbs some of the inflation.

It spreads the benefits of a higher oil price to Canada because we are an oil exporting country.

A coin from Canada.

The photo was taken by Mark Blinch.

The Canadian dollar has not appreciated against the U.S. dollar despite being strong. Against the U.S. dollar, it has been very stable. What is happening? It is never easy to explain exchange rates. When oil prices go up, we don't get the investment boom we've had in the past. There is an increase in investment, but it is not a big project. The reason for that is that we are moving to lower-carbon growth and a lot of our oil and gap are 25-year investments.

Interest rates have gone up very quickly in Canada because of the U.S. Federal Reserve's monetary policy pivot. 75 percent of our trade goes to the United States, so the U.S. dollar exchange rate is more important than the strength of the U.S. dollar. The U.S. dollar is not appreciated against most other countries. There is an explanation for why we haven't seen an appreciation of the Canadian dollar.

The decision was made because we haven't seen as much appreciation of the Canadian dollar. We take that into account.

The big central banks are being criticized for overdoing it when it comes to inflation. The economy is going to suffer more than it needs to because you are pushing forward too aggressively.

Soft landings are usually the result of front- loaded tightening cycles. There are more gradual tightening cycles that end up having to take rates even higher in larger slowdowns. We are front loading our response. Our goal is to get inflation back to target with a soft landing, and a front-load policy response gives us the best chance of that.

Our objective is to get inflation back to target with a soft landing

Is it too much for us to do it? The rate went up by 100 basis points, but the level is 2.5 per cent. The interest rate is not high. Look at where we started. We got off to a good start. The economy has moved rapidly into excess demand, and that is reflected in the fact that we have raised rates quickly since March, in four steps.

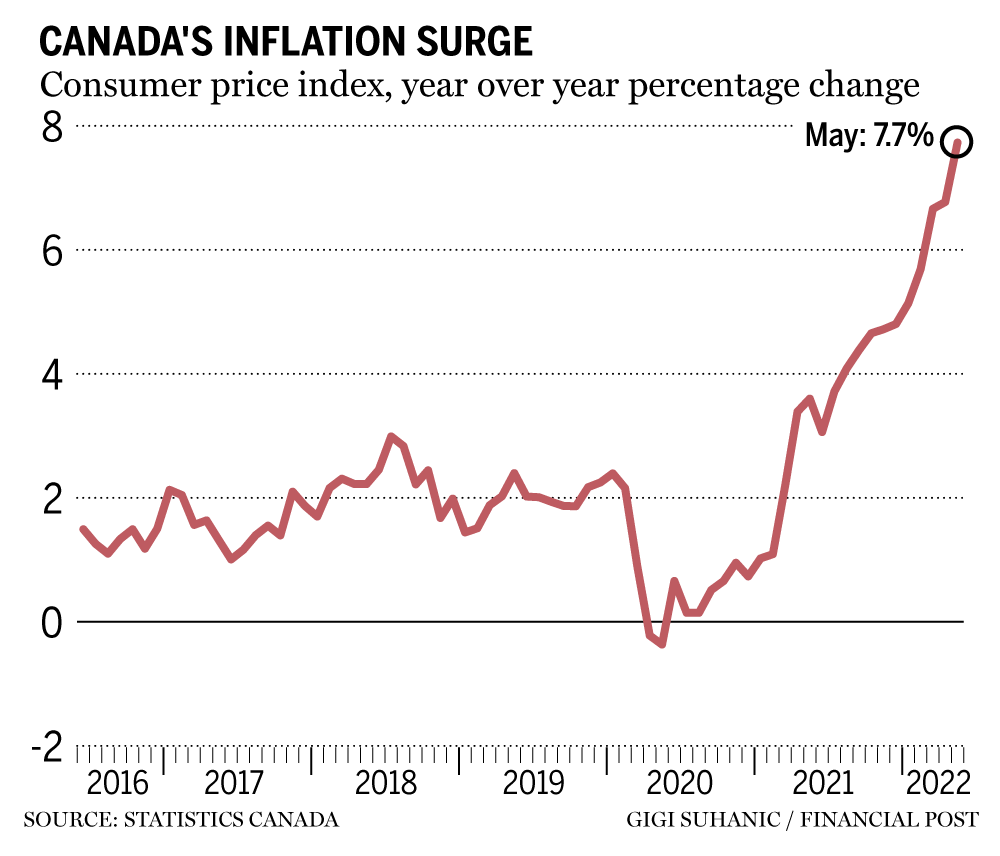

The rate of inflation has gone up from 2% to 4%. Almost three quarters, a little over 70 per cent, 72 per cent, of the components of the consumer price index are rising more than three per cent, more than half are rising more than five per cent

Higher goods prices have been passed through to a wide range of goods. There are labour shortages and higher food prices in restaurants. The economy is in over demand. Higher interest rates are needed. Higher interest rates can be handled by it. Moderate spending is needed to take the steam out of inflation.

Monetarists argue that if central banks had a closer look at money supply, we wouldn't be in this mess. Money supply is considered when the council makes its decisions. What do you think about the idea that money had something to tell us?

Everything we look at. Money growth is looked at by us. Credit growth is looked at by us. Money growth is a good predictor at times, but not always, and it is not a good predictor at other times. Money growth can be an indicator of spending, but the inflationary impact of that spending depends on the state of the economy. Extra spending is not inflationary if the economy is weak and needs it to fill a hole. A hole is being filled in. Inflation is prevented from going down by that.

If your economy moves into excess demand, it will cause demand to run ahead of supply, which will cause inflation to go up. Sometimes money is a good predictor of inflation, but other times it isn't. Money growth in Canada went up a lot and now inflation is high, you can draw a graph and see that. After the global financial crisis, the Bank of England had large quantitative easing programs, but there was no surge in inflation.

One hundred dollars in Canadian currency.

The photo was taken byBrent Lewin.

I think the lesson is that you want to keep an eye on money, but you have to look at where the demand is for the goods and services that people want. Inflation is going to happen if supply can't keep up with demand.

Demand has moved ahead of supply in recent months. The labour market is very tight and that is the reason why we are seeing inflationary pressures.

I spent the first year of my career at the Bank of Canada and then joined a research group with other economists. Poloz was the former Bank of Canada governor. It was a few years after the bank dropped money targeting that Gerald Bouey famously said, "We didn't abandon M1, M1 abandoned us" The Bank of Canada was focused on finding a new monetary aggregate. It was very similar to the Holy Grail. We could re- anchor policy on a new monetary aggregate if we could find a stable relationship between money growth, spending, and inflation.

At the end of the year when I ran a lot of regressions, the conclusion was that if you over fitted these regressions, you could find a stable relationship. We couldn't find a stable relationship between money and income after you did a sample of predictions. Inflation targeting was born out of that. If the relationship isn't stable we're just going to get ourselves in more trouble. There are going to be more mistakes. Let us concentrate on our goal. Targeting inflation is what we should be focused on.

Money is something we're going to watch, but it's not always that reliable an indicator and you want to look at it in the context of a lot of other indicators The success of inflation targeting indicates the decision was made.

I'm going to ask one more question. I want to know if you thought the central bank did a good job of explaining why your inflation forecasts were off. The monetary policy report has a box. There is nothing else there. What are the two things you have learned that could change your thinking?

I would like to reflect on my two years as governor.

It was my first press conference as governor. The last two years have been very quiet. We have been through one of the most severe recessions in history. The fastest recovery we have ever had has been by us. The vaccines have never been developed before. The price of oil went from negative to positive. We have never seen impaired global supply chains before. Russia has invadedUkraine.

Our decisions have always been based on the best information we have at the time. They have always been in line with our mandate.

Everyone has had this experience. We have had some large forecast errors due to the economy being very volatile. There are a couple of things that come out of this exercise that are important. We made a lot of big forecast errors. We need to be held responsible for that. Canadians need to know that. Because inflation is too high, we need to understand our own inflation forecast errors. We need to understand where we missed and how to get it back down.

Two-thirds of the miss comes from international factors, the biggest being a sharp rise in the price of oil. Oil was about 50 dollars a year ago. We assumed it would stay around 50 dollars. It has been the best predictor of oil prices. That is what we do most of the time. It was more than double from that.

Other commodity prices have increased as well. Global supply chains got seriously impaired and that caused the prices of many goods to go up. About two-thirds of the miss is accounted for by all those things.

The shipping containers are uploaded from the ship.

The photo was taken by Lucy Nicholson.

About a quarter of the miss is due to the recovery and excess demand and the faster-than- expected recovery. If we knew everything we know today, we probably would have started raising interest rates earlier. We didn't know There was a lot of excess supply a year ago. Last summer, the unemployment rate was seven and a half percent. We were in the middle of the epidemic. There was a new round of public health restrictions when Omicron hit us in January. We didn't expect Russia to invadeUkraine. We thought that the global supply chain issues would work themselves out more. Some of them have worked harder, but new ones came along. Supply chain disruptions have been more persistent than they have been in the past. We were surprised by those things.

In October of last year, we ended our Quantitative Easing after the economy got traction. January saw the removal of exceptional forward guidance. We made it very clear to Canadians that they should expect a rising path for interest rates. We tried to get ahead of this by front-load our response, keeping inflation expectations well anchored and cooling demand.

What have we learned from this? Domestic inflationary pressures will become more prominent if you are in excess demand. That is what we are talking about.

Kevin Carmichael can be reached via email at kcarmichael@postmedia.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.