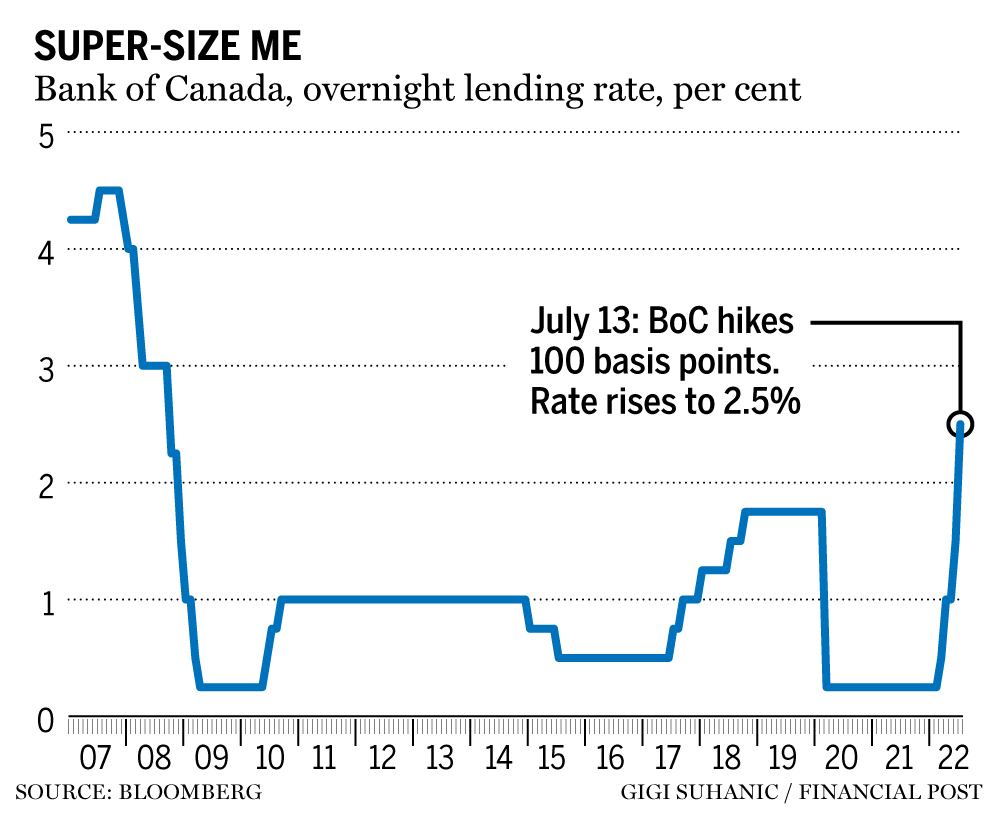

Rates are going up by leaps and bounds in Canada.

The governor and deputy governor of the Bank of Canada appeared before a committee.

The photo was taken by Sean Kilpatrick.

The Bank of Canada hiked its overnight interest rate on July 13 in order to control inflation, which has been high for decades.

The policy rate was raised by a percentage point and the interest rate was raised by a percentage point. The governing council probably felt reassured after the United States Federal Reserve Bank made a similarly vigorous hike of 75 basis points last month.

Inflation hit a record high of 7.7 per cent in May, thanks to higher prices in almost every category. After the U.S. released inflation data for June, many economists predicted price pressures could be peaking.

With inflation showing few signs of cooling and prices in Canada following what happens south of the border, more hikes are likely.

There is an expert reaction to what this increase means.

The Governing Council decided to front-load the path to higher interest rates by raising the policy rate by 100 basis points. They think they're getting ahead of inflation risk when they're not. When Canada needs to counter inflation in a more restrictive way, they have done nothing. The Reserve Bank of New Zealand and the Bank of Korea had front-loading when they began hiking.

Today's actions can be described as front-loading the response, when a more accurate depiction portrays the BoC in constant catch-up mode to inflationary pressures. Canadians now face heightened economic anxiety because rates are going up by leaps and bounds when earlier and more gradual rate hikes could have stopped some of the inflation risk in the bud and avoided today's big changes.

The Bank of Canada is going to raise rates. Despite the fact that there are some signs that the economy is slowing, central bankers are still tying their hands with forward guidance. Between now and the September meeting there isn't much data. Further policy tightening is on the way.

The hike in the policy rate was meant to front-load the path to higher interest rates rather than reach a higher final destination. While the Bank said that it continues to judge that interest rates will need to rise further, it provided no update on where it expects the policy rate to end up.

The BoC is expected to follow up today's decision with a 75 bp hike in September. With rates considered to be above neutral, adjustments are likely to be more fine tuning.

The economic backdrop is also affected by this big step up in rates. The BoC is under pressure because of the unemployment rate, wages and inflation. The Bank has to accept the risk that the economy will tip into recession in order to prevent high inflation expectations.

The fear of an unmooring in inflation expectations was obvious throughout the release, with officials noting that more consumers and businesses are expecting inflation to be higher for longer, raising the risk that elevated inflation becomes entrenched in price- and wage-setting.

It is not likely that an economy-wide recession will occur in 2022. The economic indicators of the job market, businesses, and consumers point to a healthy economy even though certain industries, such as the housing market, will likely go into decline. There is a tradeoff to restoring price stability.

The email is bbbharti@postmedia.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.