The company has raised $800 million at a steep valuation drop.

There have been rumors for at least a month that Sweden-based Klarna, best known as a " buy now, pay later" service provider, was looking to raise new funds. According to initial reports, this valuation would be in the region of $15 billion, which is a decline from its $48.6 billion valuation a year ago. The size of the valuation is pretty much the same as it was earlier this month.

The new investment has lowered the value of the company by 85%, to a point where it is now worth less than it was a year ago.

A number of new and existing investors were included in the round, including Canada Pension Plan Investment Board.

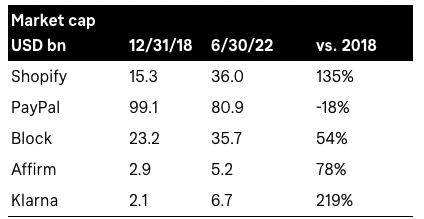

In its press release, Klarna highlights the "worst stock downturn in 50 years", while it also tries to paint a prettier picture by showing how its valuation compares to last year. It's no wonder that Klarna looks decent with this dataset.

Since the beginning of the year, Klarna's valuations have been compared.

The implication is that while the valuation may have fallen off a cliff, it is still performing well on the grand scheme of things.

While many companies have gone through a correction following crazy times, it is worth looking at Klarna's valuations from each of the last four years to see if they have changed. After hitting a value of $5.5 billion in the first year, the company hit a value of $10.6 billion in the second year, and then hit a value of $32 billion in the third year.

Even though it has dipped from its previous valuation, it is still considerably down on its valuation in 2020. Things are better than they were last year.

There is a chance that there is something to Klarna. Its valuation is a reflection of what its investors think, and it is not the only company to see such a valuation crash. After its market cap peaked last year, Affirm has plummeted in value, but it is still worth the same amount as Klarna.

The valuation of the company is due to investors voting in a different way than they did before, according to Michael Moritz.

The business of Klarna, its position in various markets, and its popularity with consumers and merchants are all stronger than they have been at any point in the past. The stock of Klarna and other first-rate companies will receive attention after investors emerge from their bunkers.

So are we in a startup recession or what?