Gen Z is getting some economic medicine that has older generations recalling 2008 and 2001 and Uprise is here to help.

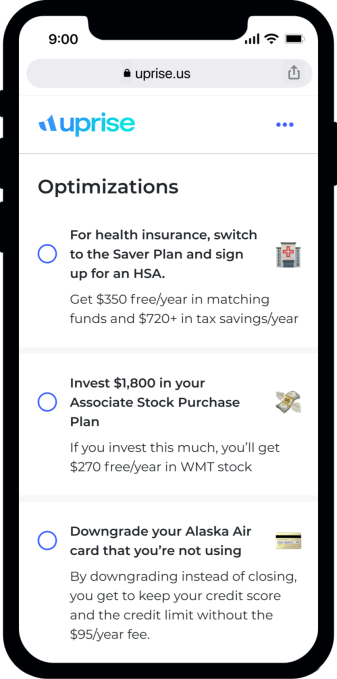

Financial recommendations for Gen Z were made by Uprise.

The company was founded by Jessica Chen Riolfi and Chris Goodmacher. They were seeing younger people invest in certain stocks and lose money. With Uprise, they want to give users a tool that arms them with best practices and techniques so they can invest with more specific goals in mind.

Chen Riolfi knows what's going on. Previously she was the leader of products at a startup. She passed on her mother's knowledge about finances to her daughter. Uprise was built to give her mother's knowledge to the people.

She said that they could only solve a small portion of your finances. People kept asking what I was missing. I don't know how to manage my money. I am wondering if I am doing this correctly. It's something that all of us can relate to. There is a desire to make sure that everything is in tip top shape.

Uprise isn't the only one targeting Gen Z's finances. Over the course of the past two years, we have covered a lot of different startup approaches to this. They consider their competitors to be like LearnVest and Harness Wealth.

Harness Wealth raises $15 million to democratize the power of family offices

This company considers itself like a family office, too, but what is unique about Uprise is that it takes in a user's full financial picture, as well as some of those overlooked aspects, like employer benefits.

If you're told that you have too much money in your checking account, you might want to put it into a savings account. You can take advantage of a company match by increasing your 401(k) contribution.

Chen Riolfi said that they were able to find 1.5 million dollars per plan to add to the customers lifetime net worth. There is a lot of money left on the table that is not being used.

The approach has been well received by people. After starting Uprise, Chen Riolfi and Goodmacher, who was the second employee at payroll and benefits startup Justworks, saw their waitlist balloon by over 3000 people.

The company received over one million dollars in pre-seed funding from institutional investors and a group of individual investors.

Uprise has $50 million in assets so far. The company is pre-revenue and will always have a free component to it, but plans are to make money by building a premium tier that offers additional features, like the ability to zoom with your financial advisor, and monetize some of the financial products recommended by financial advisors.

Chen Riolfi said that the new funding will be used to accelerate the company's hiring of new talent and to begin building integration so that recommendations can be implemented in one click.

She said that there was a lot more to learn as they made sure that they could hit the mark. We want our product to have value. It is going to take a long time to help people implement the recommendations.

10 fintech investors discuss what they’re looking for and how to pitch them in Q1 2022