169 million workers travel abroad for employment, according to the International Labour Organization, with companies often relying on migrant workers. Being away from their domestic jurisdiction and financial infrastructure presents a number of challenges, including how to get paid.

From the company's perspective, they may have to administer payments for workers hailing from multiple different locations.

It's difficult to manage all of this administration and ensure that the workers are paid in good time. It is a problem that German startup Kadmos is trying to solve with an end-to-end platform that helps employers remove the hassle of paying cross-border workers.

Just four months after announcing a $8.5 million seed round of funding, Kadmos today revealed it has added another 29 million to the pot via a series A round of funding.

Migrant workers need to be able to spend what they earn because they are away from home for a specific purpose. Sometimes they get paid in cash, which means they can spend the money locally, but then they may have to pay high transfer fees if they want to take the money home. Many migrant workers need to send money home to their family, which is a main reason for them working abroad, and they may be hit with large fees with cash transactions.

It is possible for a company to pay their workers through a third-party, which includes a lot of fees, but also a lot of paperwork.

Kadmos is working with shipping companies who are using an early iteration of its service to pay their workers.

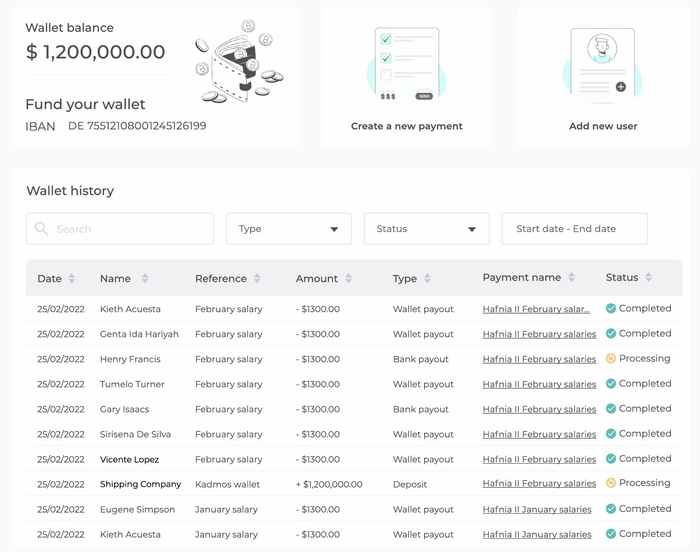

Employers can use Kadmos to make and track salary payments regardless of where the worker hails from.

Employers should use Kadmos for their employees.

An employee must be working for a company that has decided to use Kadmos in order for this to work. A link to download Kadmos is sent to the worker when they sign up through their employer's dashboard.

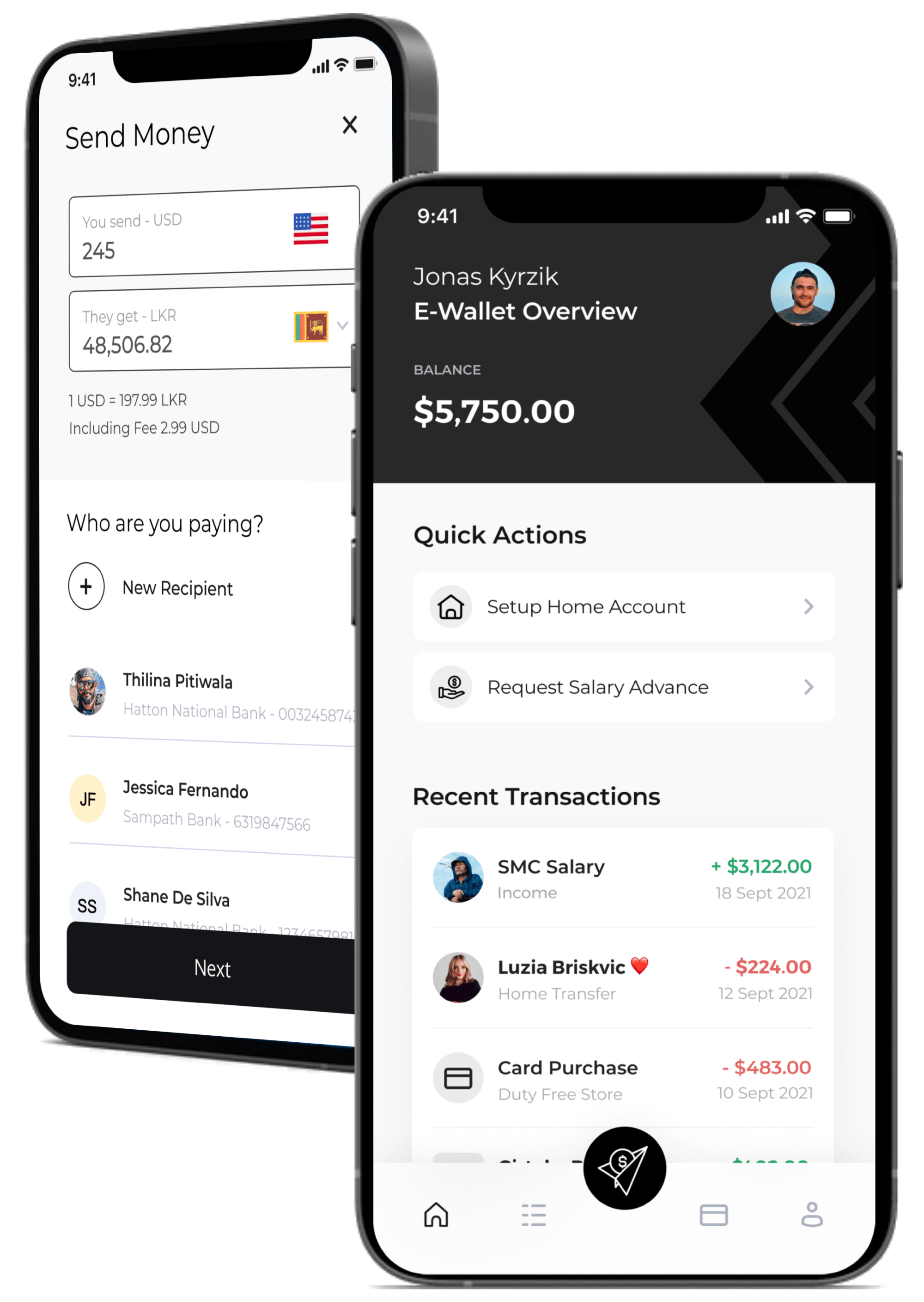

Kadmos provides a mobile app that holds workers' salaries in U.S. dollars or euros, and also allows them to send money home instantly, with predictable set fees. Kadmos gives workers with their own card that is linked to their digital wallet.

Kadmos is a mobile application.

It's Instinctively that limiting payments to euros or dollars is a little restrictive given that migrant workers will likely be coming from any number of countries in the world. The shipping industry mostly pays in the two currency.

The current industry needs are mostly for the US dollar and euro. Seafarers can hold their salary in a stable currency.

Workers will have to transfer money frequently, either when they spend it or send it home. Kadmos charges a sub-1% mark up, which compares favorably to the typical 1.5% that traditional banks charge. If they use their card in a country with a different currency, they will be charged at the Kadmos rate.

Kadmos might be able to offer workers options to get paid in other currency if the company expands into other industries.

These possibilities are being looked into by the team.

Kadmos is an example of the modern financial movement. It has many of the benefits of a challenger bank such as Monzo, in addition to cross-border payment features similar to the likes of Wise. Kadmos is built to solve a very specific problem according to Justus Schmueser.

The approach can be categorized as B2B2C. Obtaining a few different employers who use Kadmos to pay their employees can lead to thousands of new end- users for the Kadmos app.

Kadmos is in a good position because it solved two problems at once, helping migrant workers get paid, and easing many of the costs and administrative burdens for employers.

The goal is to make the payment process easier for companies, and at the same time make the process of receiving and spending money easier for the workers. Kadamos focuses on using technology to provide a solution to the restrictions placed on the financial freedom of cross-border employees.