China will unveil a bumper set of economic indicators this week that will likely set the pace for monetary and fiscalStimulus for the rest of the year as Beijing chases down itsambitious growth target.

Key data, from gross domestic product and retail sales to fiscal revenue and bank borrowing, will be closely watched to assess the damage done to Covids during April and May as restrictions were loosened. The state of the property market will be revealed by the figures.

The Chinese economy probably expanded at a slower rate.

The National Bureau of Statistics is in the United States.

Beijing expects the economy to improve in the second half of the year as business activity picks up and local governments spend more on infrastructure. China's strict Covid Zero policy will make it difficult to meet the growth target of around 5.6%. Some short-term growth may be sacrificed by the president to protect his people's health.

The June activity jump won't stop the GDP contraction.

If the full-year target can't be reached, the government would want to achieve growth in the second half of the year. The economy is expected to expand 4% for the full year, according to economists.

The annual growth target is still a long way from being hit. Further policy support should be provided.

Government finance as well as bank loan figures will be published this week by the fiscal and monetary authorities. If Beijing allows local governments to borrow more money in the second half of the year, investors will be interested.

There are growing calls for more policy support. According to a former finance minister, China has the ability to widen its budget deficit. The official from the banking and insurance regulators said at the event that policy tools will be used to fix the economy. China will need unconventional policies in the second half of the year to achieve its full-year growth target, according to a researcher from the State Council.

There are a number of important events on the Chinese economic calendar this week.

China's exports were a big driver of the economy's recovery, but not this time. Consumers around the world are shifting their demand away from goods to spend on travel and other services due to rising prices.

China's exports are expected to slow in June.

The customs general administration of China.

Even though Covid disruptions continued to ease in June, the data will show a moderation in export growth. In dollar terms, exports grew at a slower rate than in May. The 4% growth in imports was largely unchanged from the previous month.

Trade may get a boost, although a limited one, if the Biden administration rolls back some tariffs on Chinese goods. If Section 301 tariffs are removed, the maximum gain to China's export growth will be 4 percentage points.

The economy's performance in the second quarter was probably the weakest since the first three months of 2020. GDP is expected to grow 1.2% in the second quarter, down from 4.8% in the first three months of the year, according to economists. GDP is likely to have shrunk 2% in the most recent quarter.

There are indicators that will be scrutinized for signs of a rebound. Industrial production is expected to pick up as factories ramp up output and disruptions in supply chains are less severe. Industrial production is expected to have grown 4% in June, following a contraction in April and weak growth in May.

In June, China's industrial, consumer sectors are expected to rebound.

The National Bureau of Statistics is in the United States.

Fixed-asset investment probably held up in the first half of the year because of a fiscal boost from the government to support infrastructure construction, but investment in the property sector probably remained sluggish. The government made a push to boost sales of cars and home appliances in June as Covid restrictions loosened.

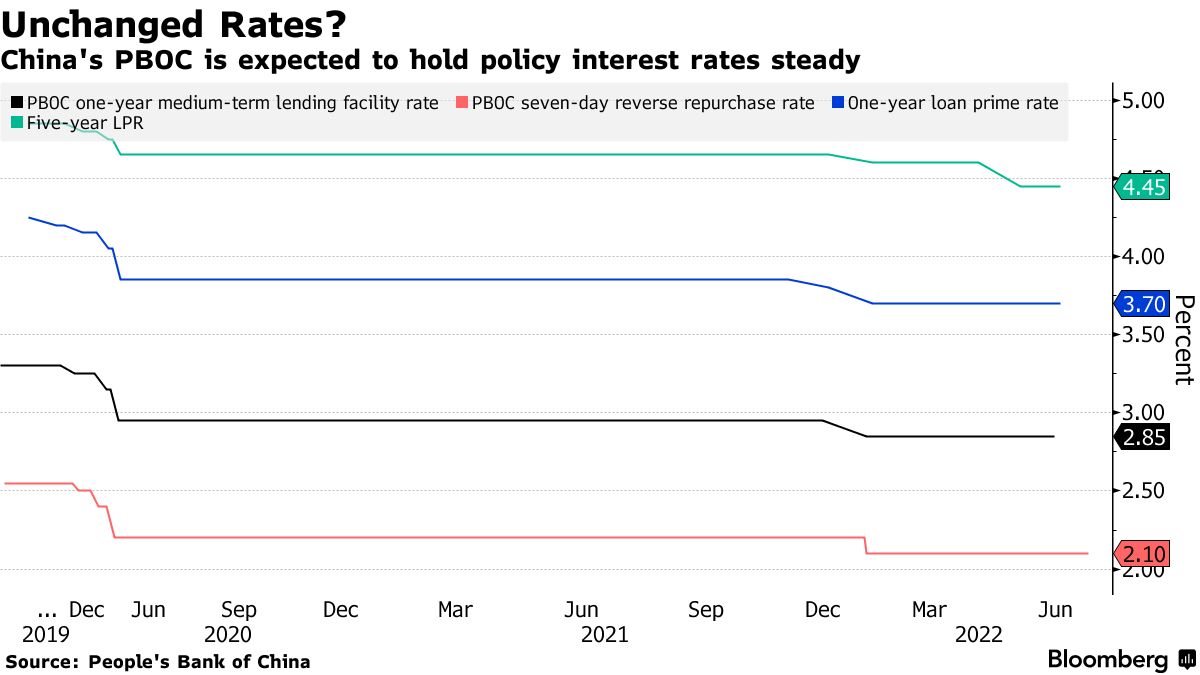

The rate on one-year policy loans could be cut by the PBOC in order to give more monetary support to the economy. Governor Yi Gang recently signaled that monetaryStimulus will likely focus on boosting credit rather than lowering interest rates in the rest of the year due to concern about inflation and rate hikes by the U.S. Federal Reserve.

Domestic inflation doesn't pose an immediate threat to the PBOC. Consumer prices may rise above 3% in the second half of the year because of surging pork prices, raising the bar for any high-profile monetary easing such as policy rate cuts or a reduction in the reserve requirement ratio for banks.

The 2.5% increase in consumer prices last month was the fastest rate in two years and beat the expectations of economists. Pork prices grew from the previous month and fell from a year earlier, but the contraction was less than in the previous 16 months.

The PBOC is expected to roll over medium-term loans this week. The PBOC slashed daily open-market operations last week and any withdrawal of liquidity through the MLF will send a strong signal that it is back to normal. The MLF loans will mature in a number of billions of dollars.

The release of credit data this week will show a continued rebound in financing activities in June, which is usually a bumper month as banks ramp up lending at the end of the quarter. The People's Bank of China encouraged banks to lend more and increase their loan quota. The surge in local government special bond issuance was a factor in the gain.

China's new loans are expected to increase in June.

The people's bank of china

According to the median estimate of economists, aggregate financing is expected to rise to 4.2 trillion yuan in June and exceed 3.8 trillion in June last year. In May, new loans were estimated to be 1.9 trillion. The outlook for monetary policy and lending data are expected to be discussed by the PBOC.

Fiscal income and spending for the first half of the year will be released by the Ministry of Finance.

Income from land sales and tax revenues have fallen due to the downturn in the housing market. Government spending went up as costs on Covid testing went up.

While local governments are struggling to make ends meet, Beijing is pushing them to accelerate debt sales. By the end of last month, most of the special local bonds have been issued.

The finance ministry may allow local governments to sell more bonds in the second half of the year. Over the past few weeks, there have been 1.1 trillion yuan in new support for infrastructure announced.

JohnLiu, Lin Zhu, YujingLiu, Xiao Zibang, Wenjin Lv, Tomoko Sato, and Fran Wang assisted.

(Updates with recent forecasts, comments from officials, state newspaper on policy support.)