The co- brand card portfolio was refreshed this spring. There are co- branded cards from IHG.

The annual fee for frequent travelers is justified even if you are not an IHG loyalist because of the fantastic perks offered by the I hg premier card and I hg premier business card. There are some conditions associated with these perks, so I wanted to learn more about how they work.

There are some unique perks offered by the IHG Premier Card.

I have received a lot of questions about the benefits on the cards. I wanted to know more about the benefits in this post.

The fourth night free on award redemptions is one of the best perks of the ihg premier card and ihg premier business card There is a lot of confusion about how this benefit works and when the cost of the fourth night will be paid back.

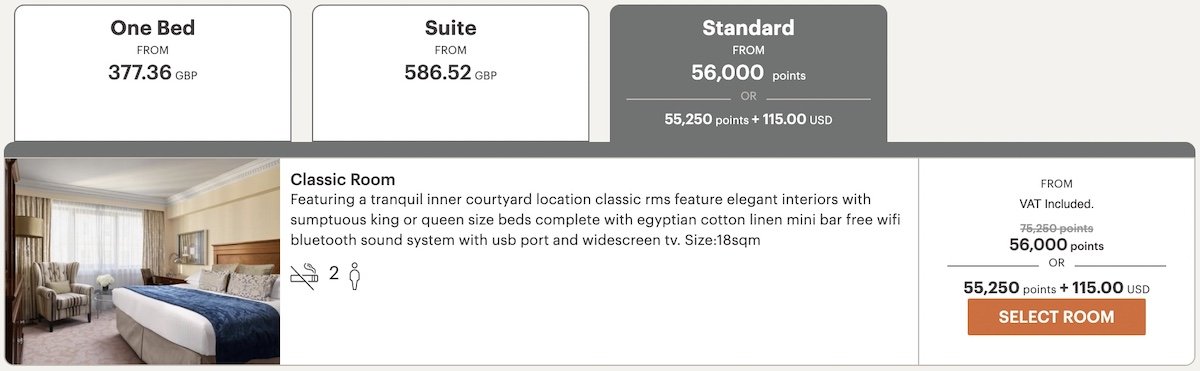

The fourth night's cost is deducted when you make your award booking. You should be able to see the price adjusted once you have the card and go to the website to make the booking. When you first see the award cost, you will see a price with a line through it, which is the original price, and then underneath that is the discounted price.

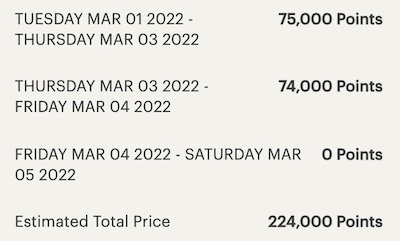

The InterContinental London Park Lane might cost an average of 75,250 points per night, but the rate can vary each night. The price is lowered to 56,000 points with the total cost being 224,000 points.

You only need to collect enough points for three nights to make a booking. If this isn't showing for you, it's probably because you haven't had the card for a while. It can be a few days before this benefit kicks in.

You can use this benefit for an unlimited number of times, and can even use it for back-to-back stays, or for multiple rooms at a hotel over the same nights. It is also valid at Six Senses properties.

You can only redeem points for four nights at one hotel at a time, so you can't stay two nights at one hotel and one night at another.

All four nights need to be booked in one go. You can only book one night with a free night certificate and three nights with points at the same time.

You can earn a lot of free night certificates. You can get free night certificates on the anniversary of your account with the I hg premier card. You can use both of these cards for back-to-back stays if you have them.

There are lots of opportunities for people who have the legacy IHG Select Card to earn a further free night certificate.

You can get a 20% discount when you purchase points with the I hg premier card. This isn't valid when IHG is giving a discount on points, which is when I would usually buy points.

There isn't a reason to buy IHG points for 20% off when they offer bonus points. The discount is automatically applied when you purchase points. I don't think this benefit is worth it.

Every four years, you can get a NEXUS fee credit on the Ihg premier card. The statement credit will be posted within 24 hours of the eligible purchase appearing on your account if you choose Global Entry or NEXUS.

The only thing that matters is that the fee is charged to your card, so you can use it for a friend or family member.

As long as you are a cardmember, you can get IHG OneRewards Platinum status for as long as you have the I hg premier card or I hg premier business card. It will post to your account automatically if you have the correct IHG One rewards number.

In practice, the status usually posts much faster than six to eight weeks.

You can get up to $50 in United TravelBank Cash when you use the IHG and IHG business cards. This is easy to understand.

Assuming you fly the airline on a regular basis, this is the equivalent of $50 worth of travel each year.

There are a lot of worthwhile cards. Platinum status, fourth night free on awards, an annual free night, and $50 in United TravelBank cash are just some of the perks of this card. The current bonuses are very good.