You can sign up for the New Economy Daily newsletter and follow us on social media.

If the inflation outlook doesn't improve, the European Central Bank should raise interest rates by 125 basis points.

An initial July hike should be 50 basis points and an even larger move should be considered at the Sept. 8 meeting to pro-actively steer the economy toward calmer waters.

He said that a 0.75 percentage point increase may be necessary when the situation doesn't improve. If there is no clear rate steps, inflation will solidify.

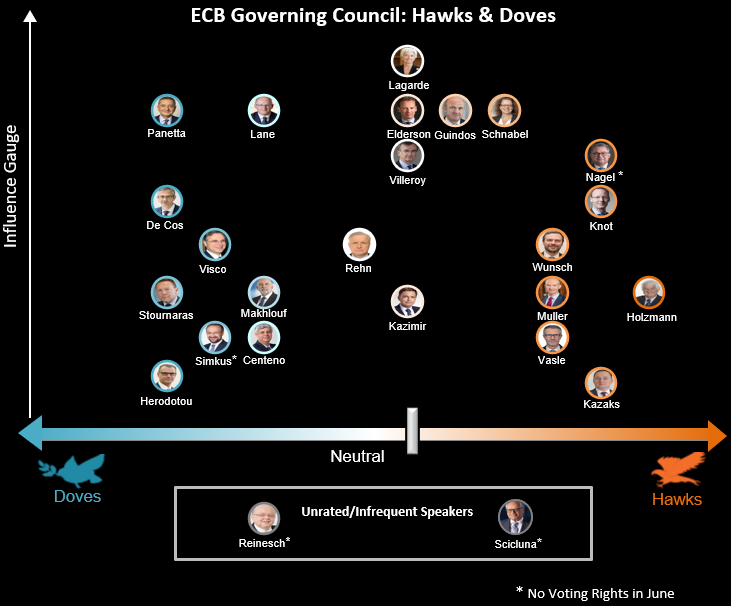

The European Central Bank indicated an initial rate increase of 25 basis points this month and another hike in September. Christine Lagarde said that the size of the second move will be dependent on inflation developments.

Policy makers have been pushing for a July increase. The three quarter point call is a departure from the plans for gradual policy normalization. The US Federal Reserve has hiked rates by at least that amount.

The return to the euro area's 2% inflation target will be dependent on what measures are taken and how long it takes.