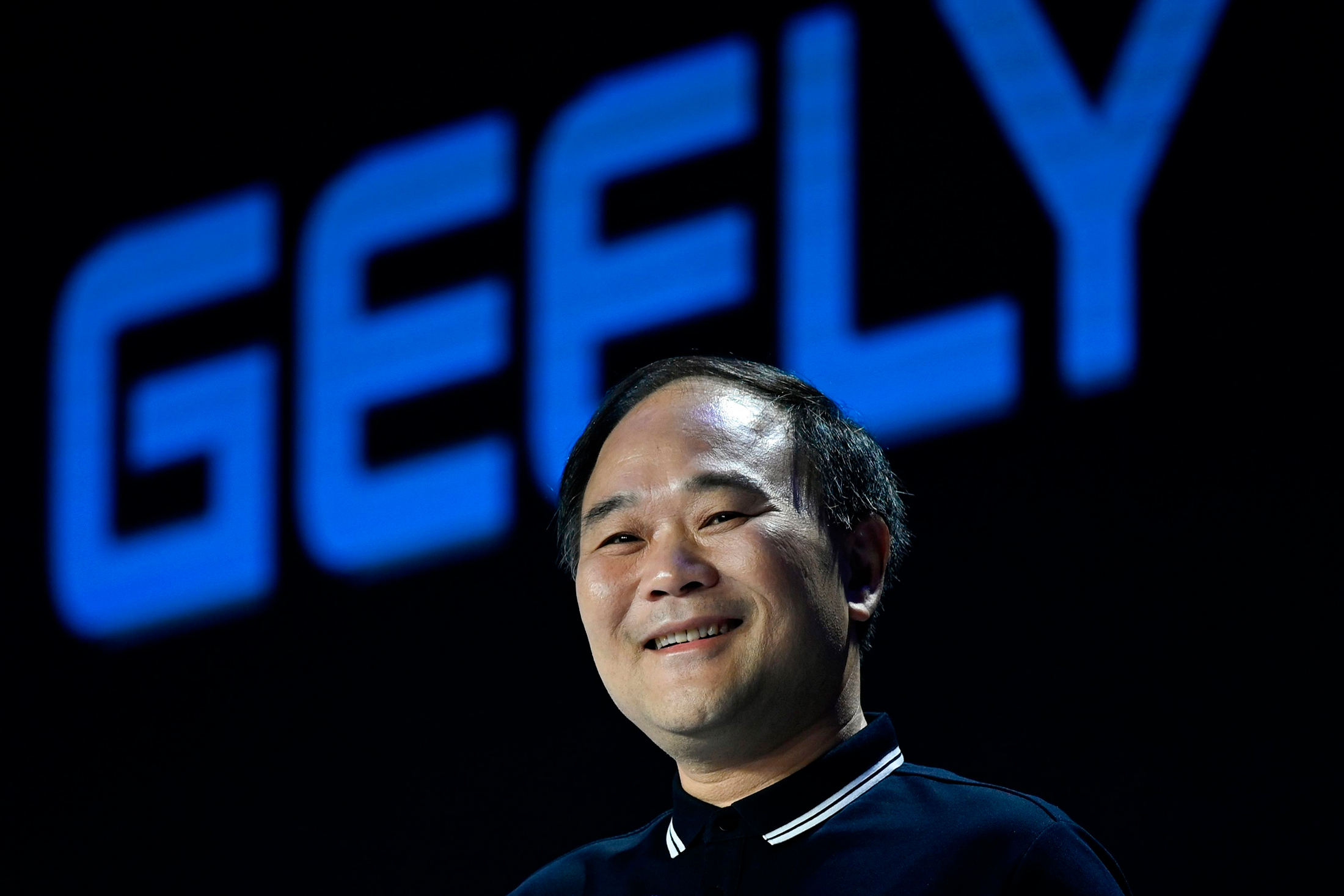

Li Shufu has a lot of ambitions. Li has spent the past decade accumulating a portfolio of foreign car brands from Volvo Car to Group Lotus. The 59-year-old billionaire also owns almost 10% of Mercedes Benz Group AG, as well as agreeing to buy a 34% stake in the Korean unit of the company.

Li wants to go into outer space. Chief Executive Officer of Musk's company, which has deployed a network of about 2,500 communications satellites that can provide internet access, is following in his footsteps. In June of this year, a Chinese rocket carried nine Geely-made satellites into space, where the company hopes they will form the basis of a network to connect with self- driving vehicles.

Tony Wang, chief executive officer of Li's satellite subsidiary, says that they want to provide a service in the field of information and communications above Earth.

A busy month for Li included the launch of the Geespace constellation, as well as his ambitions to be a leader in the field of self-drive vehicles. The first artificial-intelligence car, theRobo-01, was unveiled by Jidu on June 8 and will be sold this fall. The fund joined a funding round that invested $108 million in the Israeli company. A Li-controlled company agreed to buy a majority stake in a Chinese phone maker.

The Chinese company has partnerships with a number of tech giants. The automotive tech firm backed by Li agreed to a merger with two other companies.

With cars using increasingly sophisticated technology such as sensors to guide parking and positioning on highways, automakers are looking to do everything in-house. The benefit of keeping proprietary data safe is one of the reasons why this is a good idea. As part of China's broader efforts to prepare for the era of audiovisuals, the moves of Geely should be seen. Beijing sees a strategic interest in having a constellation it can control should such satellites gain global acceptance.

The open question is, do you really need an enhanced navigation constellation to do self- driving cars? Curcio said something. If the answer is yes, then the three companies have a huge advantage over everyone else. China wants to have its own network. China wouldn't say it's fine to rely on someone else's.

China, which has aggressively pushed the development of battery-powered vehicles locally, has traditionally been cautious around self-driving cars. Pony.ai Inc., a US-China startup backed by Toyota Motor Corp. received permission from Beijing in April to offer rides on itsrobo-taxi service in the city without having someone sitting in the driver's seat just in case. They did too. There are trials going on in other cities. More than 50 of WeRide Corp's self-driving street sweepers are going to take part in a test run in Guangzhou.

According to a McKinsey survey, consumers in China are more willing than their counterparts in the West to embrace self-driving cars. Chinese people were more willing to pay for self-driving functions. According to a McKinsey partner and leader of the China automotive practice, the industry will get a further boost as government officials reveal new rules clarifying issues such as liability in case of accidents. He says that they will put a more detailed plan in place.

A general partner with New York-based venture capital firm RedBlue Capital said that the increasing chatter around driverless cars helped explain why Li decided to buy Meizu. Li is ready for a future where the car does the driving, freeing up passengers to use the vehicle like a giant phone. Apple andGoogle are now car entertainment software companies. The company is trying to fight that by becoming a company with the ability to make a phone like experience.

Going into space is more difficult for Geely than it is for SpaceX because they won't be able to rely on economies of scale. Li will have just 168 satellites by the end of the decade. The price per satellite for the first phase of the constellation is close to 10 million dollars, Wang says, but he expects to reduce that eventually to 6 million dollars. Matthew Bloxham said that the price for a satellite was less than $500,000.

Kelly Grieco is a senior fellow with the New American Engagement Initiative in the Atlantic Council's Scowcroft Center for Strategy and Security. She says that they have a branding issue. Many companies overseas don't want to be involved with a Chinese space company for security reasons

Li is hoping that its satellites will be used by drivers outside of China. Wang says that by next year they will work with partners in the US and Europe.