There is a chance of a reversal of US tariffs on China. You need to know what is happening in Japan.

A new probe into industrial subsidies that may lead to more duties is one of the things that Joe Biden may announce this week. The timing may slip if Biden doesn't make a final decision. It would be his first major policy step on trade ties between the world's two biggest economies. Recent weeks have seen hints of a shift as inflation has increased, putting pressure on the US to find ways to lower prices. There is a lesson to be learned when inflation gets out of hand.

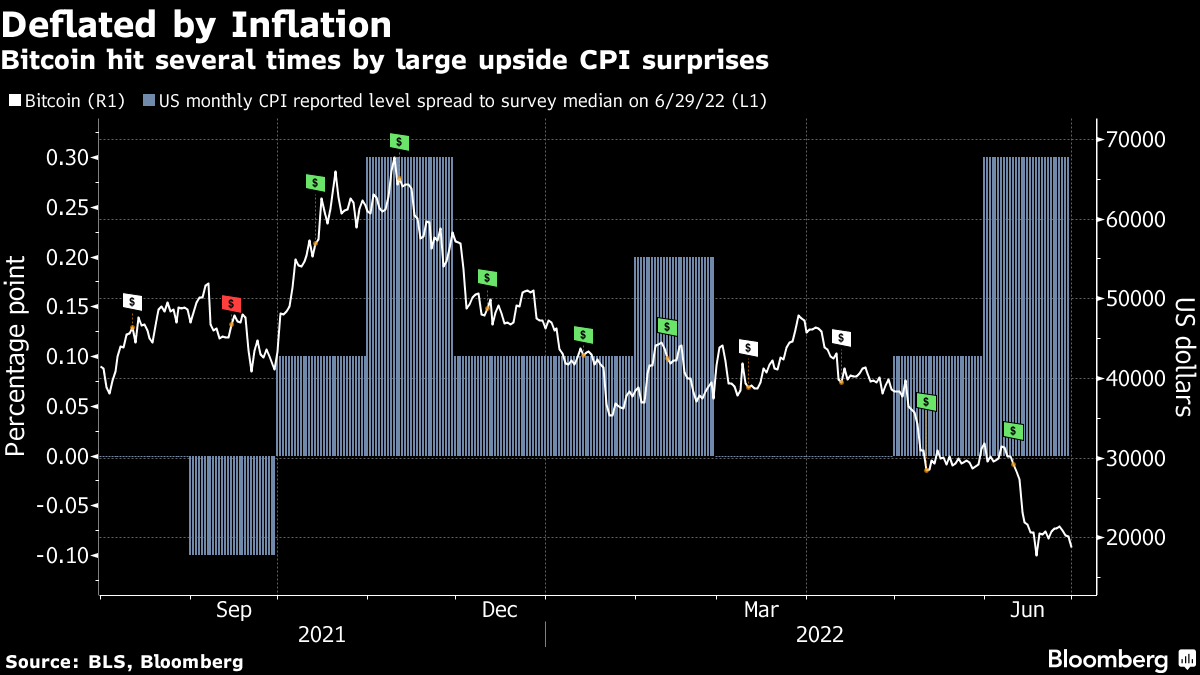

Asian stocks look set for a steady start after the Aussie dollar rallied overnight as traders weighed the possible easing of tariffs by the Biden administration. There is a lot of gloom caused by slowing economic growth and persistently high inflation. It's possible that the bear market in cryptocurrencies may be bottoming out. Many of these measures are all flashing in the same way, which is rare.

The Bank of Japan is facing difficulties due to the slump in the Japanese currency, the war in Ukraine, and a heat wave in Tokyo. Pressure is mounting on the Bank of Japan to support the currency as it is up over 70%. An upward revision of the BoJ's price outlook is likely later this month according to a former chief economist.

The belt tightening phase of the economic cycle is about to start.

Credit Suisse Group is cutting more than two dozen front line roles at the investment bank in Asia as the Swiss lender grapples with losses and a weakened outlook for the global economy. There could be more cuts in the fourth quarter.

The European Central Bank plans to change the way it invests in corporate bonds in order to penalize companies that cause more pollution. It is the first time a central bank penalizes corporate issuers. There is a growing sense of anxiety that time is running out to address the threat posed by global warming after the United Nations Intergovernmental Panel on Climate Change estimated that the planet might be on track to warm by more than 3C.

The idea of a good hedge against inflation was one of the many narratives that accompanied the rise of the digital currency. Digital gold gained some value because of the limit on the number of coins that can be mined. After inflation burst higher last year, that theme initially played out just fine, but that changed as the Federal Reserve moved towards hiking interest rates. Over the past few months, there have been upside inflation surprises and that has led to a decline in the price of the digital currency. There is a nervous edge to trading as stable coins are getting more attention. There is a chance that another hot inflation reading later this month will cause a big drop in the value of the currency.

Garfield Reynolds is based in Australia.

Garfield Clinton Reynolds helped with the project.

Watch Live TVListen to Live Radio