As it navigates financial challenges, Vauld has suspended withdrawals, trading and deposits on its platform.

The three-year-old startup, which has raised about $27 million, said it is facing financial challenges due to the market downturn.

According to Vauld founder and chief executive Darshan Bathija, the startup is exploring restructuring options and has engaged with a number of advisers.

The startup wants to apply for a moratorium. He wrote that the startup will make specific arrangements for certain customers in order to protect their interests.

Vauld doesn't know how many users it serves.

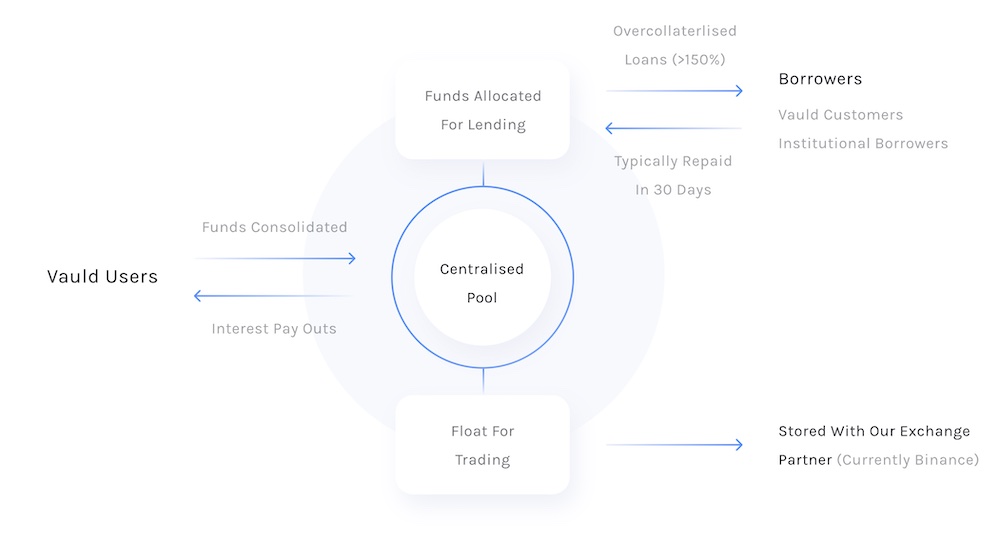

Vauld claims to offer the highest interest rates on major Cryptocurrencies. It says on its website that it offers annual yields of over 12 percent on several stable coins. Customers were able to use the platform to borrow against their token.

Vauld says on its website that it allows users to borrow up to an LTV of 66.67% against their token and instantly approve their loans. Several tech stocks have fallen in value in the last six months.

Customers of the Vauld platform know that we will not be able to process any new requests or instructions. Specific arrangements will be made for customer deposits as may be necessary for certain customers to meet margin calls.

Two weeks ago, Vauld cut its workforce in half.

It came as a surprise. On June 16, Bathija assured Vauld customers that the platform had no exposure to Celsius, another lending startup that is facing increasing financial challenges, and Three Arrows Capital, one of the high-profilecryptocurrencies that filed for a Chapter 15 bankruptcy over the weekend.

Despite the current market conditions, we are still liquid. All withdrawals were processed as usual over the last few days and this will continue in the future.

Unpopular opinion: careful when using platforms that require VC funding, they often don't have a real business model yet.

(over generalization, there are exceptions of course)https://t.co/lI1pvdPdKr

— CZ

Binance (@cz_binance) July 4, 2022

Many more Defi platforms are on the verge of collapsing, as was warned by several cryptanalysts including Changpeng Zhao. Over 50 firms have been engaged in recent weeks to evaluate funding and bailing out opportunities for some businesses, according to a recent episode of the show.

FTX's U.S.-based arm signed a deal with BlockFi that gives the exchange the option to buy the startup for up to $240 million if it does well. BlockFi was valued at $3 billion in a financing round it revealed in March 2021.