There's a chance of a US recession. The emerging markets are attractive to investors. Today is what you need to know.

A US recession is possible by the end of next year according to more economists. The eight-month contractions of 1990-91 and 2001 were shorter. Inflation may prevent the Federal Reserve from reversing the downturn. The manufacturing sector in the world is slowing down.

Asian stocks may climb as trading begins Monday, providing some relief from the worries about slowing economic growth and sticky inflation. Stock and bond markets in the US will be closed for the 4th of July. In the US, this year is already one of the worst in terms of big daily declines, with the S&P 500 index falling 2% or more on 14 occasions, putting 2022.

Money managers say developing nations will be unaffected by cheap valuations, higher yields, and a resurgence of China. Since the 1990s, stocks and bonds have been in a slump, while currencies have suffered their worst losses ever. Following the resignation of the Economy Minister, Argentine assets are going to be looked at more closely.

The handover of Hong Kong to China from the British was a time of reflection for those in Taiwan. Integration with China is more difficult because of the Chinese Communist Party's suppression of dissent in Hong Kong.

The situation for Chinese dollar bonds is getting worse. A record year of offshore-bond delinquencies has been added by another developer, who said it didn't pay a $1 billion dollar note. It is a worry for investors as it is seen as a bigger threat than the crisis at China Evergrande Group.

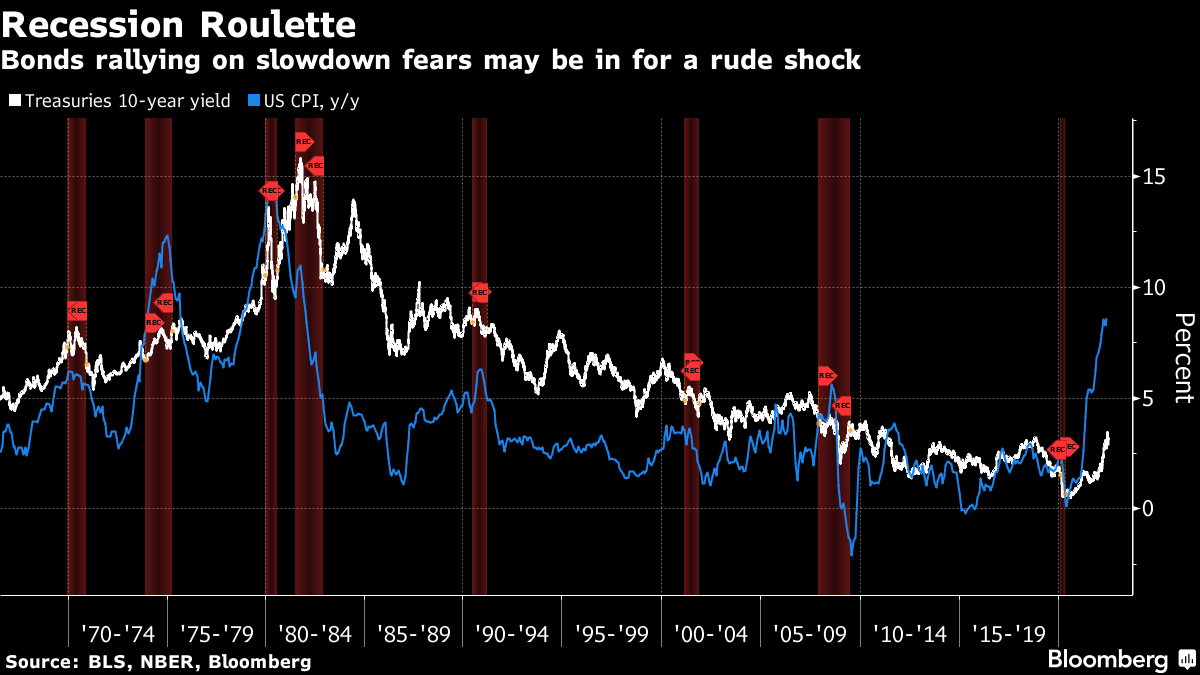

Treasuries are looking for a recession, but this may not be one. US benchmark 10-year yields dropped last week by the most since the start of March 2020, as fears gripped markets that the Federal Reserve's interest rate hikes will cause a severe US slowdown. There are growing signs that the US economy is losing steam.

For all the talk of inflation peaking, it has yet to do so, and the Fed's impact may do little to immediately counter the supply shocks that are key drivers for cost pressures. It is clear that yields did not fall during the recessions of the 1970s. After a GDP contraction, yields began to decline and continue to do so. Inflation was much higher in the 1970s than it has been in the past. It has been this way until now.

Garfield Reynolds is based in Australia.

Garfield Clinton Reynolds helped with the project.