Europe opened up its energy markets to foster competition in order to bring down prices for consumers.

Once rock-solid utilities are struggling to stay afloat bills have ballooned. Governments are realizing they can't leave energy security to the market. Germany is in talks to bail out Uniper, France is considering nationalizing Electricite de France, and Britain is taking over Bulb Energy.

The president of a New York-based consulting firm said that this is only the beginning of government intervention in markets.

There isn't enough energy to go around anymore and that's the root cause of each rescue. British gas and power providers sold cheap energy without considering the return of a commodities supercyle that brought high prices.

Things might get worse still. In response to the global opposition to his invasion of neighboring Ukraine, President Putin has weaponized Russian gas in order to increase Europe's dependence on it. Europe's efforts to store enough gas ahead of the winter heating season are being hampered by the fact that all major pipes are being stopped.

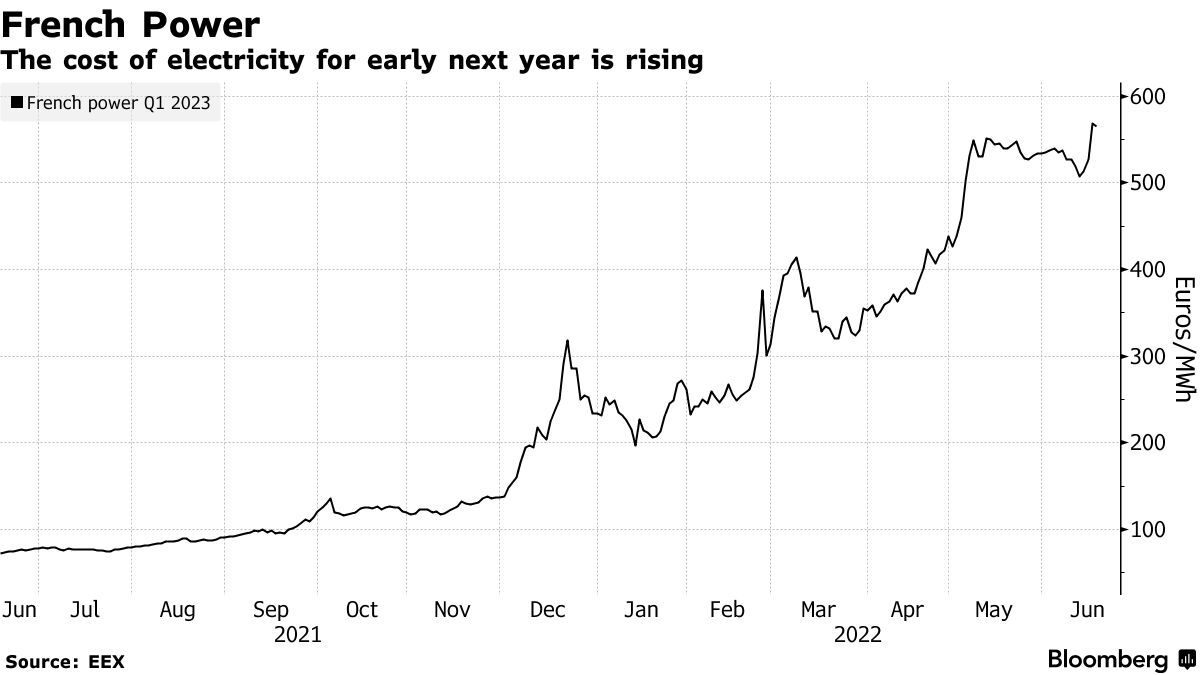

Electricity trading is signaling the crunch may last into next year as gas prices in the Netherlands are eight times higher than normal. The 5-year average price for power in Germany is six times higher than the current price.

Costs are going up not just for consumers, but also for industries that use a lot of energy.

GergelyMolnar, an energy analyst at the International Energy Agency, said that the market won't balance itself out until 2024. Financial tensions will remain until then.

Governments are stepping in because of the rising prices. Austria and Germany are paying a lot of money to store gas in their storage sites.

The German government is giving out one-time payments to households to make up for the blow from energy bills. Spending and tax cuts will be doubled to 25 billion euros to shield consumers and businesses from rising energy costs.

Italy is set to spend almost 40 billion euros subsidizing energy bills for consumers, while the UK put down some £37 billion to help consumers. Bulb will cost consumers about 2 billion dollars.

In the Czech Republic, the state-controlled utility CEZ is in talks with the government about ways to protect the economy in the event of a natural-gas cutoff from Russia. Analysts think the international support packages for consumers will reach 100 billion euros.

Governments are failing to consider the impact of price shocks on their policies because they are bailing out energy companies. The high costs faced by consumers will be added to by this oversight.

Germany now has the power to fix energy markets. Critical energy infrastructure can be seized by the government in an emergency. Habeck believes that dramatic powers were needed to counter Russia's use of energy to retaliate against Europe.

Rescues of utilities, price caps on gas, and subsidies to protect citizens' purchasing power are some of the measures already on the table.

The European energy market used to be dominated by monopolies. As government policies became more influenced by the belief that more competition would strengthen security of supply, lower costs and address energy poverty, the European Union gradually opened up markets.

The projection didn't go according to plan. The decision to close down all of its nuclear power plants compounded Germany's dependence on Russian gas. More than 20 companies have gone out of business in the past year because of Britain's laissez faire approach to setting up an energy supplier.

France remained heavily reliant on EDF, in which it already owns 80%, and is now grappling with faulty reactor that are turning the country into a power importer. Many countries in Eastern Europe still rely on gas from Russia, giving Putin leverage over some of them.

Europe is paying a heavy price for its false sense of political security after the end of the Cold War, which left it dependent on intermittent renewable energy and a Russian gas supply. Germany had to take over and rescue a former unit of Gazprom as it owned 20% of the country's storage capacity.

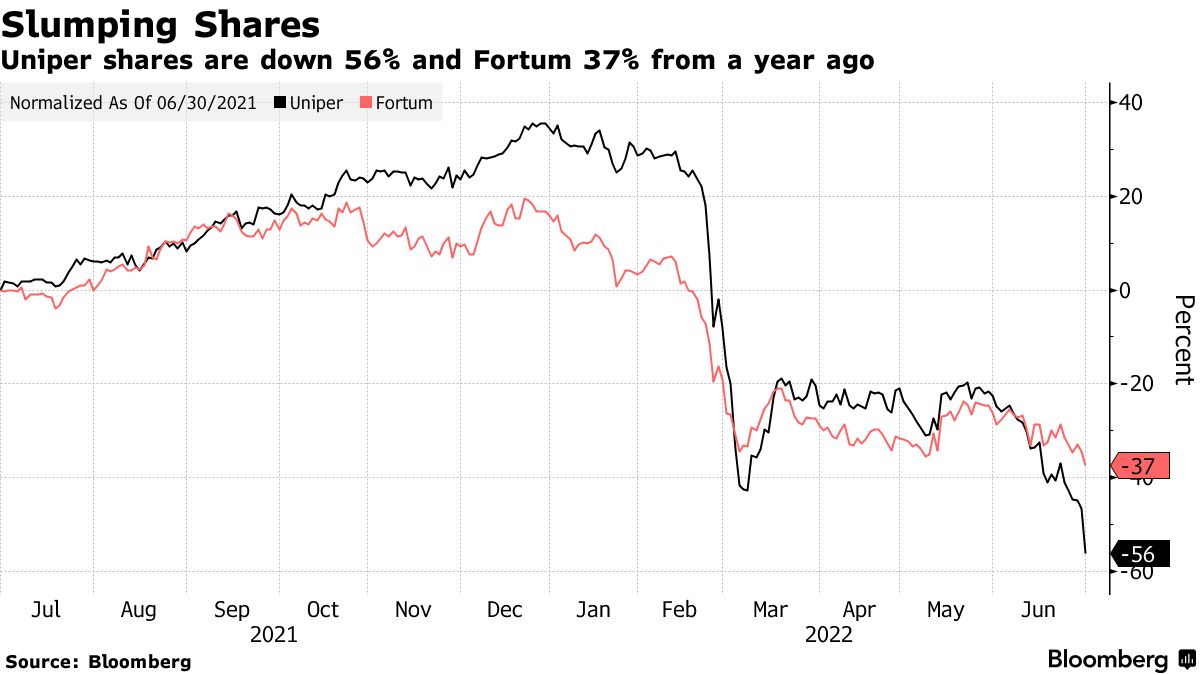

Analysts estimate that Uniper's decision to only get 40% of its Russian gas orders is costing it $30 million a day. The company said on June 29 that it is considering an increase in state-backed loans or even equity investments.

People may soon find themselves in similar situations. Replacing contracts with Russia is one way energy trading houses are forced to do so.

The chairman of the German gas industry lobby group fears a cascading effect. This should be supported by the state.

In France, the financial situation of the company has deteriorated even after the government injected 2.7 billion euros in April. A person familiar with the discussions says that Jean-Bernard Levy wants the company to be nationalized.

The company needs to be seen to be able to pursue its investment for the country's energy transition.

Governments are considering taxing energy companies on their profits. There is a cap on the price of gas used to make electricity in Spain and Portugal. During a meeting of the Group of Seven leaders in Germany last weekend, Macron called the way electricity prices are setabsurd and demanded reform of the market.

It may not come to nationalizations, but I wouldn't rule out governments taking significant stakes in some companies, especially if these prices continue for another year or two

Ania Nusbaums, Peter Laca, Lenka Ponikelska, and Todd Gillespie assisted.