BusinessweekJay Kurland built a practice giving legal and financial advice to jackpot winners. He’s now accused of fraud.

The lottery lawyer didn't know if the walls were closing in. The FBI had begun interviewing his wealthy clients, and things looked bad. JayKurland wasn't sure how much they blamed him for the decreasing jackpots that several winners had given him to invest.

Shortly before 9 a.m. on June 19, he hopped on the phone with his neighbor and business partner, a tanned, easy- living ex-stockbroker. One couple was singling out as being very concerned by the situation. Both the visits and the lack of payments were mentioned.

Do you think that will explode into something big? Smookler wanted to know.

Kurland said no. We made bad business moves, but it was not a crime.

A childhood friend of theirs was called by Smookler four days after that. On the phone, the two were talking. The head of the Colombo crime family and his father died in prison. He was familiar with the criminal justice system despite keeping his distance from the business. The people were coerced into investing with us.

The man didn't seem too concerned. Maybe we did immoral things. He said that it's fine. I don't know how much a lawyer gave me.

The man pressed. They are going to tell you that you made all the money.

They will be very focused on what they say. Their target is going to be a specific person.

I have been at this for 40 or more years and I have never seen a dead man in the water.

The lottery lawyer lives with his wife, Lauren, and their three kids on a nicely landscaped property in a cul-de-sac in a hamlet of 25,000. He is 6 feet 3 inches tall, with deep brown eyes and a rangy, athletic build, and he played goalie for the 40-and-over ice hockey team that won a bronze medal at the Maccabiah Games. I tried to catch him at his house a couple of times this spring.

For a long time, Kurland's life was just as boring as his suburban one. The Chai Center is an Orthodox synagogue that his kids attended. He used to mentor fourth- and fifth- graders at the predominantly low-incomeWalnut Street School. A few minutes later is the law firm of Rivkin Radler, where Kurland was a partner. He kept an oversize replica check for $248.6 million behind his desk, and a Staten Island carpenter told investigators he was reassured by the check.

The so-called Powerball Lawyer was Kurt Panouses of Indialantic, Fla. He was America's foremost lotto winner whisperer. He was booked for soft focus segments by morning shows. He represented the biggest solo lottery winner of all time, a woman who won a billion dollars in the lottery.

He began to look for innovative ways to increase his clients' money. Christopher Chierchio, who ran a Staten Island plumbing business and has been identified in the New York tabloids as a Genovese crime- criminal, was one of the side hustles he worked with.

They were accused of bilking three marquee lottery winners out of more than $100 million and were booked on multiple counts of wire fraud and money laundered. The two men were accused of extorting money. A scheme was laid out by federal prosecutors in New York that was predicated on the trust Kurland had built with clients who were unprepared for the opportunities and pitfalls of sudden wealth. After receiving investment advice, lottery winners put their money into high-interest lending businesses run by his associates. He put more of his clients' money into a scheme to buy face masks from Asia at the peak of the Pandemic and then flip them for a profit. They were accused of swindling lottery winnings to pay for boats, luxury cars, country club memberships, and many other things. One of the crew threatened to kill the family of the man who was a federal Informant.

The defendants formed a firing squad and accused each other of committing crimes. Telemachus Kasulis argued in court that the lottery lawyer had been naive and that he had been the victim of associates who made off with funds. The calls were captured by a federal wiretap and the two concluded that morality is against Kurland and that he was driven by simple greed. He predicted that Kurland would land on the front pages after committing suicide. I asked Gerald McMahon if he had ever seen a guy that was deader in the water with the evidence.

None of the accused agreed to speak for this article, though Kasulis said that the accused was looking forward to clearing his name at trial. The transcripts of wiretapped calls, interviews conducted by FBI agents and prosecutors, and recordings made by confidential informants are some of the materials used in the story. Some of the materials were public in court.

The trial of Kurland is scheduled to begin in July. The lottery lawyer's character will be assessed by the jury as they sort through the rackets. Was he a Long Island man who was tricked by his friends? Is it possible that he decided he deserved a bigger share?

I called the Chai Center's Rabbi Yakov Saacks to get a sense of the place before I went. Saacks knows Jay and Lauren as the sweetest, gentlest people. If a person is a good person, you can see that on their face most of the time. It has backfired on me before. I am correct about eight out of ten times.

A few years ago, a trio of Connecticut hedge fund managers won a $254 million Powerball prize that nobody else was happy to see them claim. A client who was friends with one of the hedge fund guys put the two of them in touch. Exposure resulted in a new professional identity.

The business was founded on the idea that lottery winners are terrible at managing their wealth. There are articles aboutlottery winners who lost it all. A few years ago, a Vice reporter was listed as one of the ways they were ripped off. He said that many of the winners are not sophisticated enough to see it. He said he was a legal adviser and a financial consigliere. He would advise winners on how to maintain anonymity, negotiate tax bills, park money in trusts, and invest wisely in general. One typical client was charged a $100,000 retainer and $15,000 per month for the rest of the year.

In 2015, the lottery specialty of Kurland was well established. He was still attached to the same firm where he'd worked since graduating from law school. He was a finance guy with a client list that included NBA stars, and he was a competitive sport-fishing guy with a golf cart. From Kurland's point of view, Smookler's lifestyle looked attractive.

It's not clear if Smookler's life was all that glamorous, but he definitely promoted it that way. He published self-aggrandizing if vague insights on golfing, racehorse breeding, and political networking. When I contacted Sini, he said he had never heard of him. Suffolk County Executive Steven Bellone is a good friend of Smookler, according to Bellone's spokesman. A spokesman for O'Neal told me that he didn't invest money with Smookler, since the photo of him in a sweaty T-shirt backing down the big man on a basketball court was featured on the blog.

Smookler was associated with a firm in 2015. Belfort told me that he might have paid Smookler a few dollars to pick up golf balls in his backyard when he was younger. Records from the regulatory body show that since 2003 Smookler had settled hundreds of thousands of dollars in disputes with clients who claimed he and the firm mis managed their investments. The president of brookville was barred from working in the securities industry after it was fined 1.5 million dollars for fraud. The former president didn't reply to requests for comment on the events.

He was still pursuing new business opportunities despite semi-retirement from finance. He met with his friends over drinks. He knew that the lottery clients offered him access to tens of millions of dollars. One of the businesses they were starting was called Cheddar Capital. Following the 2008 financial collapse, they wanted to join an industry. Banks tightened their lending requirements after the crash to make it harder for businesses with bad credit or checkered legal situations to get loans. Cheddar would offer a form of loan called a merchant cash advance, an instrument that commanded interest rates as high as 400% and was typically paid back in chunks. The use of a confession of judgment is a punishing legal tool that lets a lender deploy a marshal to seize the signer's assets on the thinnest of pretexts. IsKurland interested in joining?

The man did. He started looking for other investors after buying a 20% stake in Cheddar Capital. Blyer, also known as DrBFixin, was his brother-in-law.

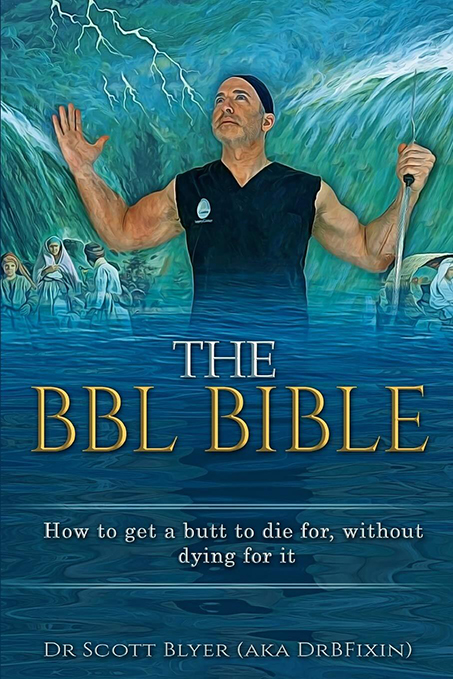

Blyer was a master of internet PR, posting bawdy skits and graphic before-and-after surgery pics for his 250,000 followers on social media. He self-published a book, The BBL Bible: How to Get a Butt to Die for, without dying for it. There is a photo illustration of Blyer in sleeveless black scrubs and flanked by Old Testament-y randos in white robes. The lobby at his practice off the Long Island Expressway has a similar mélange of questionable taste and borderline-insane charm with a stripper pole and wall décor.

Both Blyer andKurland are close. The couple lived with her parents and Blyer before they got married. Blyer told prosecutors that when he was a lottery lawyer, he started to feel better about his chances. Blyer said, "Kurland started to exhibit genuine entrepreneurial tendencies, talking about further profiting from his multi millionaire clientele."

There was a place where Cheddar came in. Blyer told his brother-in-law he was looking for ways to avoid paying taxes when he paid for surgeries in cash. Blyer should invest over $100,000 in Cheddar. Blyer put the money on the kitchen counter and deposited it in boxes. The investment was marked down as an advertising expense. Blyer was back with more money. Blyer is scheduled to testify at the trial.

It's not clear what the company did, but they were serving up Cheddar to his clients. The Staten Island carpenter who won the $246 million Powerball was looking for representation. The man and his wife drove to the office. The couple were nervous, but they agreed to every piece of advice he gave, from taking their post-tax winnings in a lump sum to hiring a bank and accountant.

The company sent Kurland $63,000 after he persuaded him to deposit $5 million into the business. In the month of January, the two men got $63,000. An additional $7 million was invested in cash advance companies run out of the same office as Cheddar. The companies' accounts were allegedly used for personal expenses such as a Range Rover and a shopping spree at Dick's. As far as he knew, Mangal had no reason to worry about his investments. He didn't know if he received payments or if he had a stake in the company. None of the formerKurland clients responded to interview requests for this story.

According to prosecutors, the pattern was that Kurland steered mega millionaires to merchant cash advance companies, he got a cut, and he and his associates helped themselves to the money. It happened with a couple who won a $150 million lottery and put in $5 million. It happened with the Mega Millions winner from South Carolina. He started spending more time at the store.

It was time again by the summer. Kurland told DrBFixin that he and his partners had expanded their lending business because of a man named Greg Altieri. Blyer said that he was asked if he wanted to double down on his advertising spending. He deposited another $300,000 into his bank account.

The jewelry deal had begun without a hitch. Another Long Island boy named Altieri was married with two children. He sold to clients like J.C. Penney and Kay jewelers. From the outside, his business looked modest. He told investigators that he had been bilked by a person who claimed to be an oil heir and that he had begun looking for seven-figure investments. Some guys in the lending business caught his attention.

The jeweler explained that he was buying pieces at "clearout" prices and flipping them for a 30% to 70% profit. There were people in the room. Some of his winners were told about the chance. The billionaire from South Carolina and the healthy rainbow people agreed to put in almost 20 million dollars.

Instead of investing in jewelry, or anything at all, Altieri was using new capital to pay back his earlier investors, a group of retired cops and firefighters. The scheme fell apart. With payments from Altieri drying up, Kurland assured his clients not to worry and moved to protect his brother-in-law, returning Blyer's latest $300,000 in cash. Blyer told the feds that it wasn't a good time to invest with him. He said thatKurland looked terrible and wasn't sleeping.

They began pressuring Altieri for cash when they pressed the other two. In March 2020 he began to record their calls after he was told that he was cooperating with the government. When the law can't arrest me, I'll have everyone with a bullet in their head," he said. He was told a few days later that he would be tortured. The village is no longer standing. The game is done. I have ruined my life. He was hoping that the lawyer would die in the accident. The man said his son's teeth would be torn out.

It didn't help them, as Altieri was charged with defrauding investors of close to $200 million. He was sentenced six months later. There was no money left.

He needed a miracle to make his lottery winners whole again. He thought it came to him from Chierchio, the reputed Genovese family soldier. He had had mixed results with the legal system. He was sentenced to two years in prison after being convicted of paying a labor official bribes. He was acquitted in a bid-rigging case related to a plumbing job. He told the Staten Island Advance that his name was smeared and that his clients stayed away. He said he was completely innocent. I needed God's help. He was found guilty of tax fraud.

Chierchio found a new opportunity when the Pandemic struck. Governments were looking for contractors to give PPE in large quantities. In March 2020, California signed an $800 million agreement to buy 400 million masks and 200 million face shields from Bear Mountain, a company run by Troy King. Chierchio got to know King and he was looking for work. He called a business associate in Miami, looking to raise $20 million to buy the PPE, and the associate introduced him to some guys who worked with lottery winners.

Chierchio wasn't known byKurland. He asked his South Carolina winner if she would be interested in working with him. She wanted to put her money to use, but didn't know that the jewelry money was gone. She requested that the money she earned be donated to charity. The government said that Kurland took out another $19.5 million without her knowledge and funneled it to Chierchio.

Bear Mountain was unable to fulfill its contract with the state. King has not been accused of any crimes. It's not known how many masks Chierchio sold or where he got them. Vietnam and Bill Gates's factory were mentioned on phone calls as possible sources. Chierchio was accused of keeping for himself most of the money California paid him. It doesn't seem to have been invested at all for the second investment from his client. Chierchio is thought to have kept $15.5 million for himself and divided it between his Miami associate's daughter and an entity he controls. None of the money went to the winner or to charity.

With the PPE money gone and Altieri about to be charged, Kurland was impressing upon his colleagues the seriousness of their situation. He said that every dollar should be used to pay off debt before anyone got a dollar. He made a gesture at them. He said that he had no idea that they took it. I'm not a financial adviser. This isn't what I'm supposed to be doing

The two men spoke to Kurland and tended to soothe and parry. They ranged from the beginning of grief to the end. There was a denial that we were normal guys. There was a possibility of a $1 million fine for signing up. Chierchio had a different approach to life. He said that he and you didn't hit the lotto for a billion dollars.

The two of them accepted that prosecution was inevitable. On one call, Smookler said that the lottery winners were painted as naive victims, that they were the mastermind lawyer, and that they were the behind-the-scenes guys. You have billionaires, famous lawyers, mobsters, and you have a case there.

They were charged along with other people. Between the theft of merchant cash advance investments, the disappearance of Ponzi money, and the PPE that wasn't, the men were accused of stealing about $80 million of lottery winnings. The government denied him release because of his violent threats.

Dominos began to fall as the trial neared. The first person to plead guilty was Smookler, who defrauded the lottery winners of $45 million. Smookler won a fishing competition in the Virgin Islands with a catch of 39 pounds of mahi-mahi. The man had run out of money and was being represented by a lawyer. Chierchio was with them weeks before the trial. Three people are waiting for sentencing.

The illustrations were created by Maxime.

There is something about the lottery lawyer affair that makes it seem like it could be a real thing. I went to Long Island this spring to check out some of the homes owned by the alleged co-conspirators. I tried to get him to tell me his side of the story but couldn't.

I rang the doorbell after walking past the SUV in the driveway. Lauren came to the door after the dog barked at me through the window. She was pleasant but not happy. She said her husband was at work. She wouldn't say who employed him now, but she fired him after he was arrested. How were things going? She looked at me and said it was the dumbest question she had ever heard. I wrote a message forKurland on the back of a piece of paper.

I saw a red car behind me as I drove back. Friday the 13th-style hockey mask was fixed to the passenger's head. I chuckled and made eye contact with the driver, but he just looked ahead and didn't notice I was in on the joke. I became less happy as the car followed me. Careening onto the expressway, I lost the driver and my chance to become a character in the lottery lawyer's tale.

The men implicated in the case thought of themselves as supporting characters in the other person's plot. It wasn't "Joe Pesci" or "the guy from The Sopranos" who tried to take down his grandpa, but the feds, according to a wiretapped call. Russo's grandfather died while awaiting trial on a federal racketeering case. At other times, he compared Altieri to the drug dealer played by EdwardNorton in 25th Hour.

One day, after I left a message on his home phone, his wife called me back and asked if I could help her get in touch with the journalist portrayed in the film. She told me she couldn't talk without her lawyer's consent, but she was sure she had a good story to sell. She said, "This is as big as The Tinder Swindler and Anna."

I talked to Smookler on his cell phone. He spoke in a casual and confiding manner. He told me he couldn't do an interview before the trial because he was supposed to testify. The story is going to cost a lot.

One of these guys isn't the same as the other. He is not accused of being a member of the Mafia and he is not accused of threatening children. The government is desperate to claim that Mr.Kurland spent money on cars, clothing, and taxes because he was a well-known attorney with a profitable practice.

The motion was accompanied by more than 100 pages of excerpted phone conversations that were supposed to show that his client was tricked by his business partners. Kasulis claimed that the two men were scheming to keep the money missing. On May 20, 2020, he told Chierchio that he wanted to get a $100 million line of credit out of his client. I don't want to give him a dollar. After a week, he sounded like a parody of a 1920s mobster. I treated him like a bird. I was talking to him like a predator.

Kasulis said that factors beyond his control were to blame. He fell prey to a Ponzi scheme because his clients lost money in the merchant cash advance business. Kasulis argued that Kurland had steered his clients into businesses he had taken a stake in because of his belief in them.

It should serve as a cautionary tale for future lottery winners if it is determined that he was a crook. You should put your winnings under your mattress if you have won a lot of money. You could always call the lawyer of your choice. It's possible to pitch the story to Hulu if it all ends in failure.

The mathematician whose hack upended defi won't give back his millions.