The Readout is a daily newsletter from the United Kingdom.

Today's bad news. UK household incomes have been on a downward trend for the last 55 years. Simon White is worried that the UK's current-account deficit is getting worse.

“Deteriorating public finances and worsening inflation threaten to prompt a mass exodus of capital from UK shores, and a concomitant collapse in sterling.”

Lloyds gave its bank staff a raise, as didBarclays. That doesn't count as good news if you work at the Bank of England and it doesn't count as good news if you work at another bank.

We are going to check in on Emma and Andy at Wimbledon. Wait...

You need to read the stories this evening.

This winter there is a plan to avoid energy calamity. The basic idea is to pay not to produce.

A letter was sent to UK companies last week asking how much they would have to pay National Grid to reduce energy demand.

The idea of handing out cash for things not to be made is depressing, but it's just the latest news from National Grid.

He has a good idea of what winter will be like. I was given a rundown by her.

“First National Grid would appeal to everyone (homes, businesses etc) to conserve what they can. Then they trigger pre-agreed contracts with industry and business to limit energy usage. That’s what the letters revealed today achieve.

“Then it gets a bit more serious. The network operator would need to limit supplies to gas-fired power plants and fire up the coal reserve to keep the lights on. After that they can do things like lower the voltage across the network. Cuts to household supply are the very last thing they’d do. They are trying to start up a separate scheme for households to give discounts on bills if you can cut use at peak times.”

Businesses are forced to raise their prices due to energy costs.

Data was collected from businesses that are currently trading.

A new energy efficiency policy is expected to be published before the summer break. The most vulnerable people are the ones who get the most government support. The plan won't see new Treasury money and it's "fiendishly complicated" according to a government insider.

I asked the boss of the energy company if we will see power cuts. They said, "I doubt it very much." The rationale was that the UK's capacity is larger than those in Europe.

A simple on-off switch is not enough to navigate winter. It's possible that the lights never really go off because of all the plans outlined above. We might avoid the 1970s-style total black outs. The economy would get used to periods of unreliable supply. The 2020s-style greyouts.

In the last few years, the British royal family's expenditure has gone up.

The Royal Family is the source of this information.

The family's latest accounts, released today in London, show that royal outlays have risen in each of the past four years. The Prince of Wales' visit to Barbados to mark the country's transition to a republic was one of the reasons why travel expenses increased by 40%.

You should get ahead of the curve.

There is a building inside 'Londongrad'. The world of the super-rich is the subject of our In the City show.

There was a record loss. It is on track for its worst quarter in a decade and it was still in its infancy.

We are not the only ones who have this problem. US consumer spending fell for the first time this year in May.

It's not a county cricket match. The goal is to find the best wine in England.

According to a report, the public was misled by the Prime Minister in ordering the slaughter of 17 million animals.

Are you interested in spearfishing or snorkeling between zooms? You can now find a tropical business-leisure destination.

Every day there is one key story.

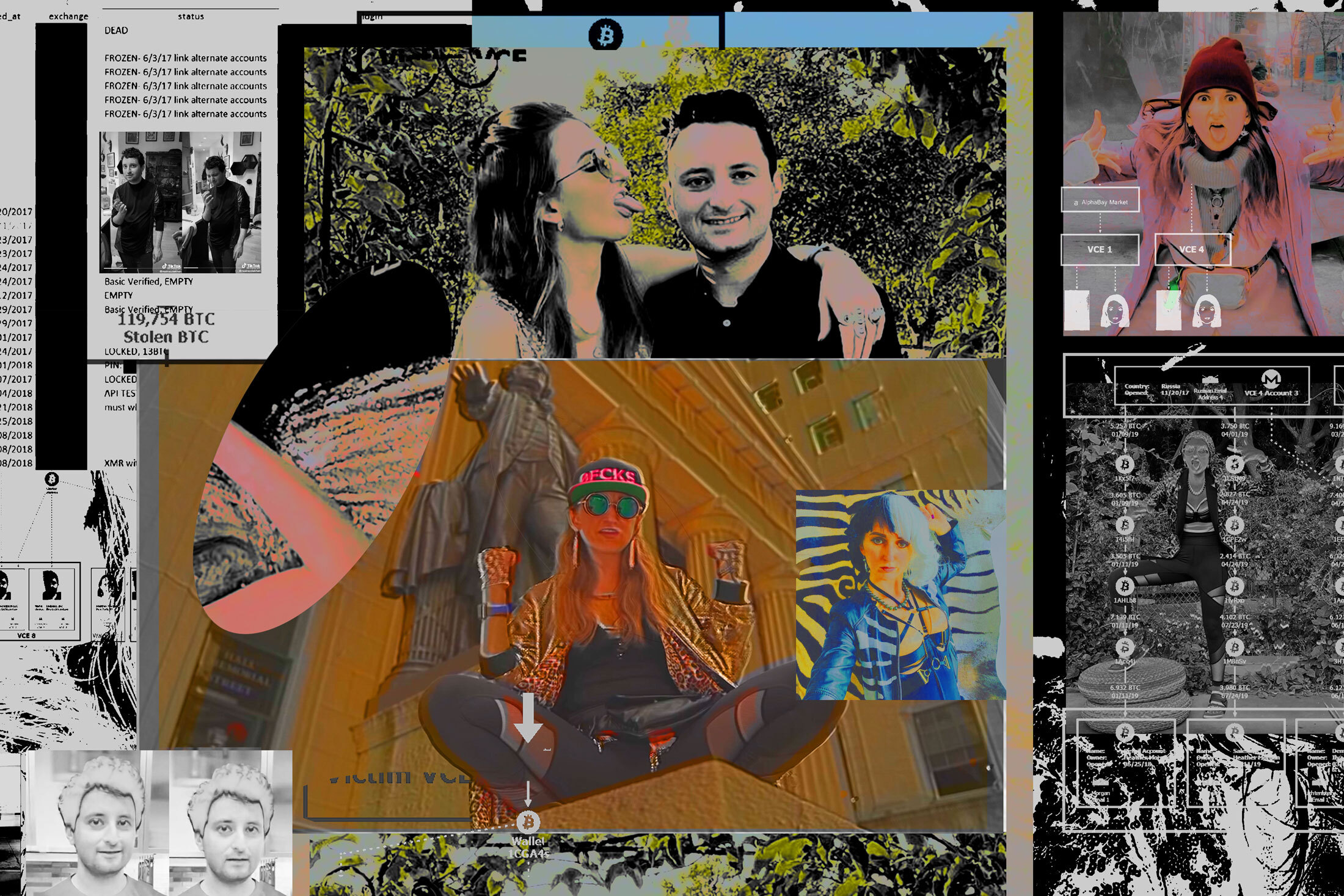

The Bitfinex server had been penetrated by the hackers. Users were buying and selling on the exchange. They looked at the commands that control the security system. They were hiding in an air duct above a bank's vault as tellers carefully moved cash in and out.

They weren't after the virtual currency. They needed private keys that allowed them to move the coins. They hit after they found the keys.

The big take is a good read.

You have an early warning system.

Bank of England data on consumer credit Manufacturing data from S&P Global. Manufacturing sentiment has been falling in recent months.

From 8 a.m. to 9 a.m., you can follow corporate news in The London Rush.

Send feedback and thoughts to readout@bloomberg.net Allegra can be followed on the social networking site. Adam Blenford edits the readout.