Buying in banking and financial services, auto, and metal stocks helped the market gain nearly a percent. The market was supported by positive global indicators.

The Nifty50 formed a small-bodied bullish candle on the daily chart, as the BSE Sensex rallied 462 points to 52,728. The week ended with a bullish candle on the weekly scale.

A small positive candle was formed on the daily chart. The Nifty is currently at the crucial overhead resistance of 15,700-15,800 band as per the concept of change in polarity.

The long-term trend for the Nifty is positive. There is a chance of one more leg of small downward correction from the highs of around 15,800-15,900 before any decisive break out on the upside, according to the market expert.

Buying interest was seen in the broader space, with the Nifty mid cap 100 and small cap 100 indices rising.

You can spot profitable trades with 15 data points.

The OI and volume data of stocks are not only the current month's data, but the three month data as well.

Resistance levels for Nifty are important.

The key support level for Nifty is 15000. The resistance levels to watch out for are 15,759 and 15,819.

The bank is called Nifty.

On June 24th, the Nifty Bank increased by 1.5 percent. The important pivot level is placed at 33,438. Key resistance levels are 33,759 and 33,912.

Data on call options.

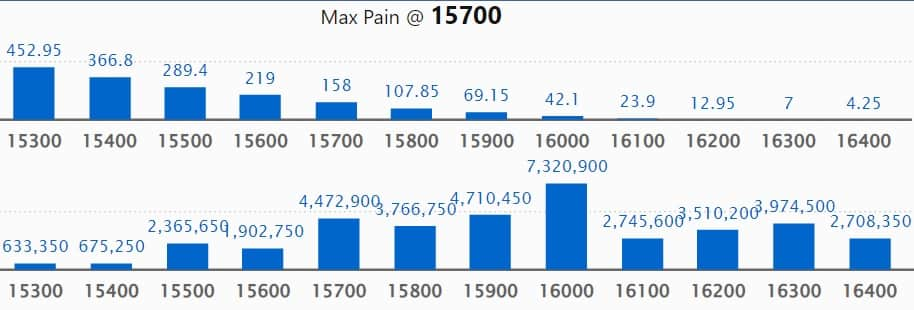

The 16,000 strike is a crucial resistance level in the June series.

There are two strikes, 16,500 and 15,900, which hold 65.2 lakh and 47.1 lakh contracts, respectively.

Call writing was seen at 15,900 strike, which added 26.42 million contracts, followed by 16,500 strike, which added 18.6 million contracts, and 16,000 strike, which added 16.45 million contracts.

The 15,500 strike shed 5.9 million contracts, followed by 15,400 strike, which shed 3.22 million contracts, and 15,600 strike, which shed almost 3 million contracts.

The option data should be put there.

The June series will be supported by the maximum put open interest of 68.6 lakh contracts.

The 14,500 strike has 65.08 lakh contracts and the 14,000 strike has 61.94 lakh contracts.

Put writing was seen at 14,500 strike, which added 23.88 million contracts, followed by 15,700 strike, which added 17.89 million contracts, and 15,400 strike.

The 14,200 strike shed 4.19 million contracts, followed by 14,100 strike which shed 1.38 million contracts, and 16,700 strike which shed 31,350 contracts.

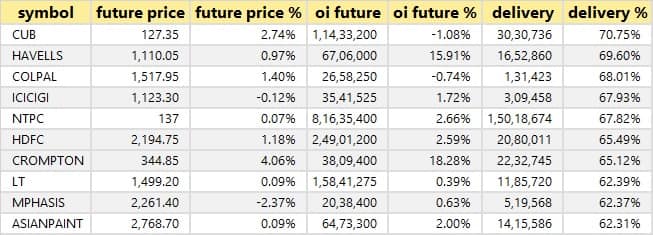

There are stocks with high delivery percentages.

A high delivery percentage indicates that investors are interested in the stock. The highest delivery was seen in Havells India.

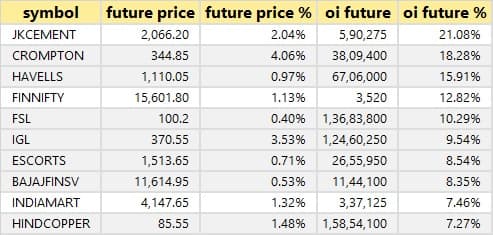

There are 106 stocks that see a build up.

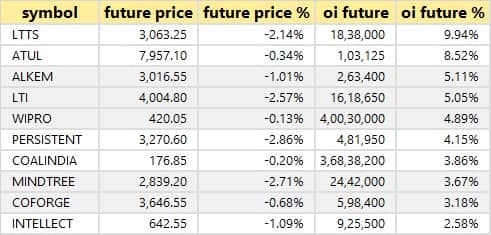

A build-up of long positions is usually indicated by an increase in open interest. Here are the top 10 stocks that had a long build-up.

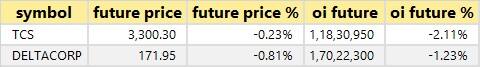

Two stocks see a lot of selling.

A decrease in open interest and a decrease in price is a sign of a long unwinding. The open interest future percentage was used to calculate long unwinding.

19 stocks have a build up.

A build-up of short positions is usually caused by an increase in open interest and a decrease in price. Here are the top 10 stocks that had a short build-up.

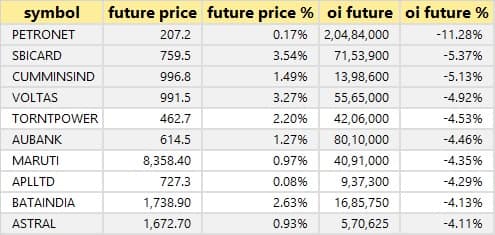

73 stocks are short-covered.

A decrease in open interest is usually a sign of a short-covering. Here are the top 10 stocks in which short-covering was seen.

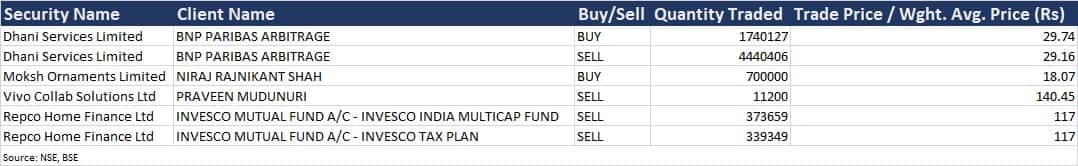

There are a lot of bulk deals.

3,39,349 equity shares of Repco Home Finance were sold by the tax plan of the fund.

Click here for more deals.

There are investors meetings on June 27.

The company's officials will meet several mutual funds.

Mirae Asset Management will meet officials of Gland pharma.

The company's officials will meet with Laburnum Capital.

The company's officials will meet Hillfort Capital.

The company's officials are going to meet the AMC.

The company's officials will meet with the investment firm.

The officials of the company will be in Singapore.

The company's officials will meet a number of companies.

There are stocks in news.

Zomato informed exchanges that the board had approved the acquisition of up to 33,018 equity shares of quick commerce company Blink Commerce. The purchase price is Rs 13,46,986.01. It said that the acquisition is in line with its strategy.

The pharma company acquired a portfolio of branded and generic products. The portfolio was acquired for $5 million in cash and up to 45 million dollars in contingent payments.

Bhama Krishnamurthy was appointed as the part-time chairperson of the bank. The appointment must be approved by the Reserve Bank of India.

The CFO of the company has left to pursue opportunities outside the company.

Welspun Corp has secured various orders of over 47,000 metric ton. They will be executed from India and the US. An order for the supply of pipes and bends for a project in Australia is included.

The proposal to buy back the equity shares of the company will be considered by the board on June 29th.

ICRA has upgraded the long-term rating on the bank facilities of the company to A2 from A3 and the short-term rating to A2 from A3

The Reserve Bank of India has approved the re- appointment of Rajiv Anand as the deputy managing director of the bank. For the next three years, the re-appointment will take place.

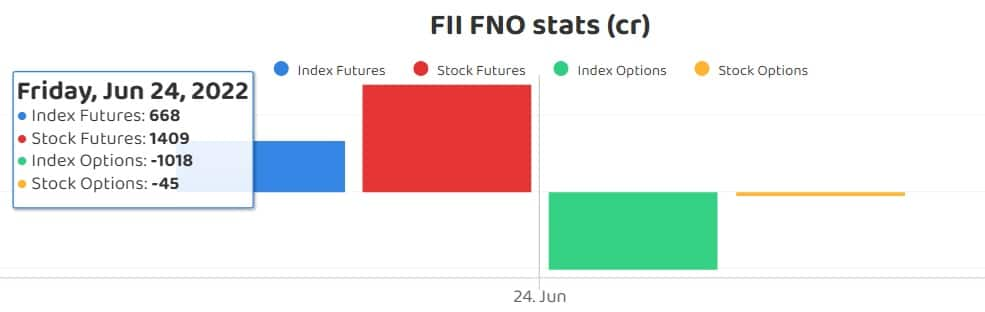

There is fund flow.

DII and fii data are included.

Foreign institutional investors sold a net amount of shares to the tune of Rs 2,353.77crore while domestic institutional investors bought a net amount of shares to the tune of Rs 2,213.44crore.

There are stocks under F&O ban on the stock exchange.

Delta Corp, Indiabulls Housing Finance, RBL Bank, and Sun TV Network are all under the ban. Companies that have crossed 95 percent of the market-wide position limit are included in the ban period.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.