You can sign up for the New Economy Daily newsletter and follow us on social media.

People familiar with the matter say the Saudi Central Bank placed about 50 billion riyals in time deposits with commercial banks.

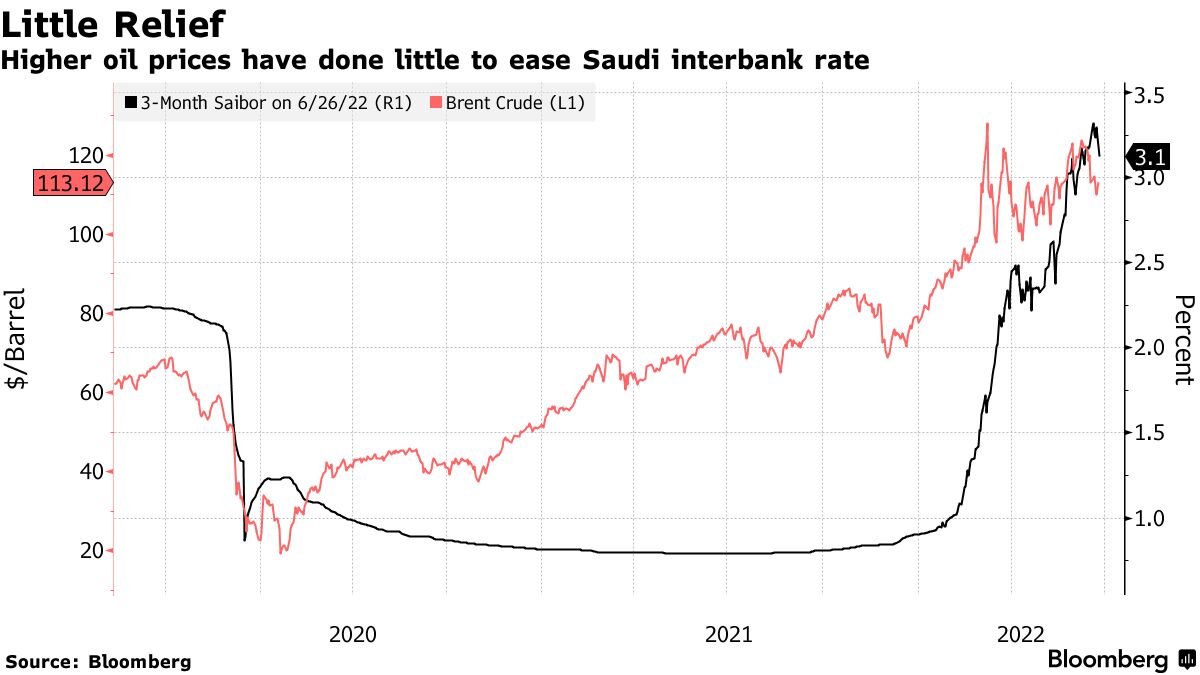

The intervention started just before the US Federal Reserve's interest-rate hike this month and consisted of money provided to banks at a discount to the three-month Saudi Interbank Offered Rate.

SAMA didn't respond to a request for comment.

The LTRO isn't the cure for funding diversity.

The price of crude collapsed below $40 a barrel in late 2008. When oil prices were crashing or the credit crunch of 2008-2009, there was little precedent for the funding stress among Saudi banks.

Saudi Arabia is on track to run its first budget surplus in about a decade after seeing revenues soar on the back of a rally in oil prices.

The first and second injections of funding from the central bank totaled around 15 billion riyals each, according to the people. They said it made at least one more placement in the last few days.

The Saibor rate fell by 17 basis points from Friday to Sunday, its biggest drop in over a month, in a sign that the central bank's injections are having an impact.

As authorities look to mobilize capital to power the kingdom's mega projects, the action reflects growing concerns about the impact on the economy. The central bank extended the duration of its repo facility to a maximum of 13 weeks to help with funding constraints.

If you sign up for our newsletter, you'll get the latest news on the region.

Saudi Arabia will keep excess oil revenues in its current account until at least early next year, as it looks to break an oil-linked boom-bust cycle that has typified the economy in the past.

The bankers were expecting the high oil prices to translate into government deposits.

Saudi Arabia has written a new handbook for how to spend oil windfall.

Bank deposits in Saudi Arabia have grown at a slower pace than credit expansion. The money market has been squeezed by the government's withholding of the oil windfall.

Saudi Arabia is set for another year of double-digit growth in consumer lending. The central bank gave over 100 billion riyals to local banks in 2020 in order to cover the costs of loan deferrals for small businesses.