The central bank was requested to treat widely used payment instruments on par with bank accounts for customers who have undergone certain verifications.

The Payments Council of India, a unit of influential industry body IAMAI, said in a letter to the Reserve Bank of India that it will be possible for regulated banks to disburse credit to customers who have performed their comprehensive payments.

The Reserve Bank of India informed dozens of fintech startups earlier this week that it is barring the practice of loading non-bank prepaid payment instruments (PPIs) using credit lines, in a move that has caused panic among the startup community, according to a report.

Several startup's have used the license to issue cards and then give them credit lines. In order to offer credit lines to consumers, Fintechs usually partner with banks to issue cards and then tie up with non-banking financial institutions or use their own NBFC unit.

India’s central bank cracks down on fintech startups

Minimum know-your-customer details and high interest rates are things the central bank is concerned about. There seems to be a line between good players and bad players. Banks and the Reserve Bank of India have been disbursing loans to full-KYCPPI accounts for a long time.

In its letter to the Reserve Bank of India, the Payments Council of India did not name any startup, but it did represent almost all payments firms.

Over 600,000 pre-paid cards are issued to Indians every month. Most of the 10 million Indians who have access to credit are not worthy of a loan from a bank.

The Payments Council of India has asked the central bank to allow the customer from a non-revolving credit line to be disbursed into a full-KYCPPI.

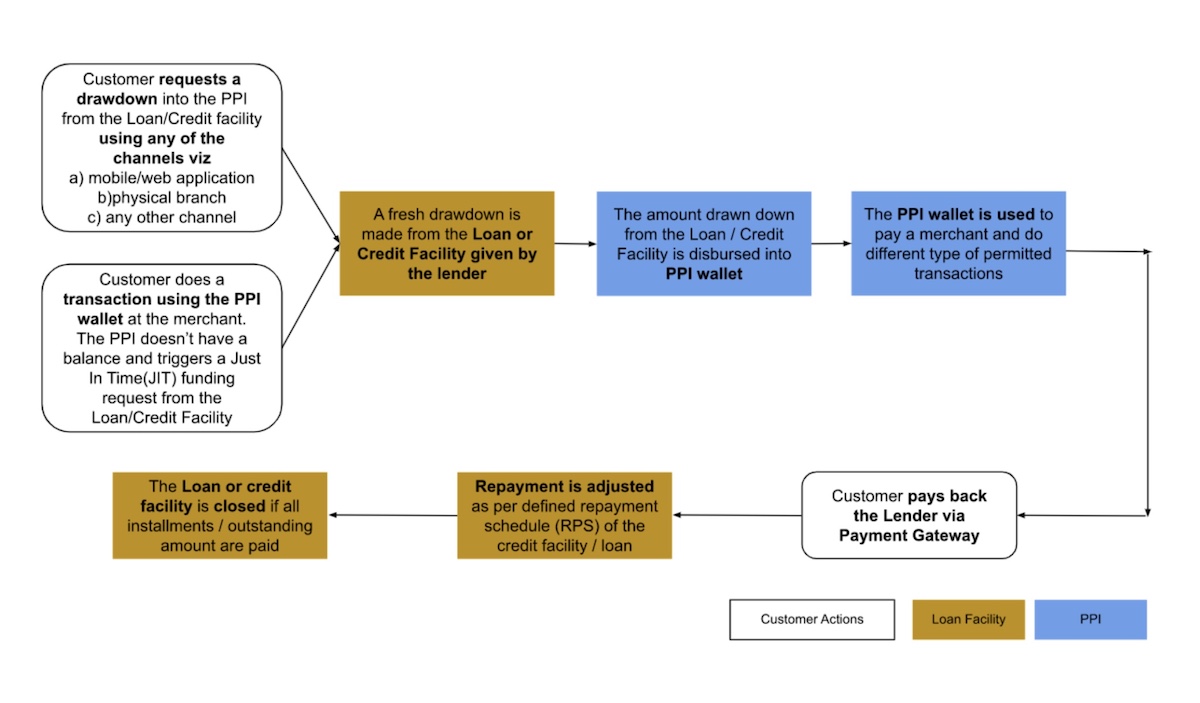

The lobby group shows the models to the central bank. The image was taken by the team at TechCrunch.

The Digital Lenders Association and the Federation of Indian Chambers of Commerce and Industry are currently working on letters to the Reserve Bank of India. Dozens of officials discussed the common grounds for what they should tell the Reserve Bank of India. The central bank needs to establish that the fintech industry at large is responsible and trying to do the right thing, according to multiple people on the call.

IAMAI did not reply to a request for comment.