There are positive signs within the market in the wake of the controversy that overtook digital-asset lender and others in the sector.

Chris Bae is the chief executive and co-founder of EDG, a provider of structured-derivative-solutions, and he is interested in open interest and options trading.

Bae said in an interview that it doesn't suggest that there has been a dramatic decrease in liquid assets. There is a lot of data that suggests the maturity of the market has progressed and that in the options market in particular, it is business as usual. It seems that bid-ask spreads are reasonable.

The environment has been strained by a number of hacks, as well as the fires of stable coins and hedge funds. In the past few weeks, lenders have shown instability, with Celsius Network and Babel Finance freezing withdrawals. There is a less-accommodative monetary policy background, where the Federal Reserve and other global central banks are raising rates to fight price increases.

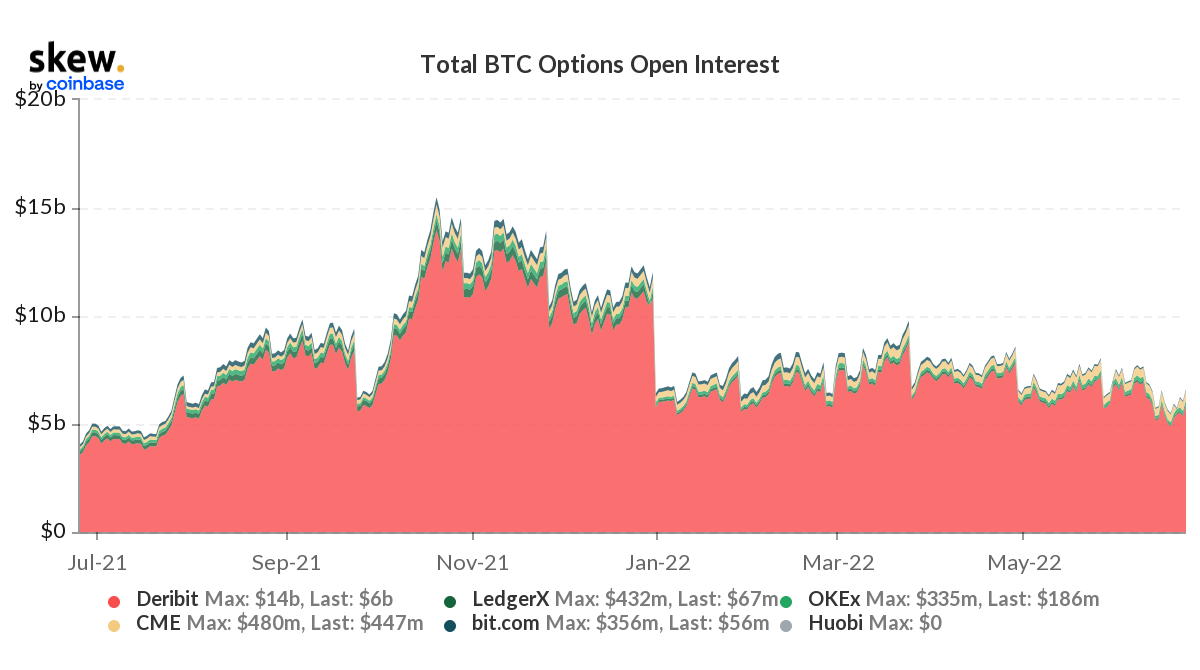

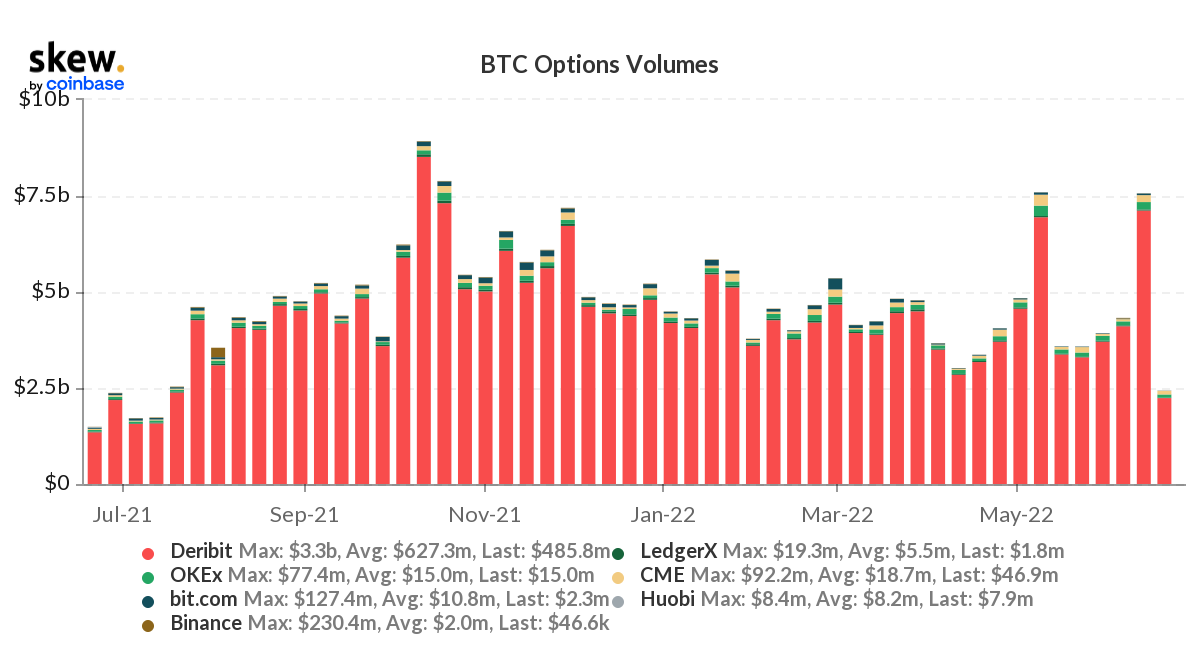

The market is different than it was a year ago. The total number of outstanding contracts has fallen from its highs. According to data from Skew, OI is down more than $7 billion from a previous record. In October, volume reached an all-time high of more than $8 billion.

Patrick Chu says that the drop in OI is a reflection of market sentiment. Interest fades during bear markets.

Two functions can be served by options. There are two things, one is hedging and the other is speculation. There is less to hedge because the amount of assets deploy shrinks. When the market goes bear, people get rekt, a reference to the word "wrecked", because they have a strong long-only bias in the coin.

More and more traditional-finance participants are showing interest in options. They're entering the market. That could explain why OI levels have not gone down.

The institutions are playing a bigger role. There was an increase in put-option buying demand in the wake of the recent bankruptcies, according to a report from the amber group. The note said that risk mitigated is worthy of consideration.

The options space has changed over the past two years, according to a trader at GSR. He says that institutions have been coming in, compared to the previous year when retail participations had a big influence. Tailor risk-management solutions or to hedge portfolios are options being used by institutions today. He says that investors can play with options on an expanded number of coins, a trend that spurs holders to want to use them for risk management.

Farrell says that miners are hedging their future production, a change from last year when they weren't buying protective options. He said that they are willing to pay a little bit to protect against the downside. It has been an interesting change.