The loss-making food delivery firm looks to broaden its offerings at a time when its shares are trading far below last year's debut price.

The firm said on Friday that its shareholders have approved the acquisition. The value of the company has fallen since it became a unicorn a year ago. The two firms agreed for an acquisition earlier this year and had a value of between $700 million and $750 million.

The acquisition is a sigh of relief for Blinkit, which has struggled to raise funds in the past.

Last year, the startup pivoted to instant grocery delivery. Many of its dark stores were closed and the business was scaled down in many cities. The startup will not serve in those cities if it can't deliver in 10 minutes.

Zomato has previously tried to fuel its instant grocery delivery play and grocery altogether, but failed each time.

Since the last year, quick commerce has been our top priority. In India and around the world, customers have found great value in quick delivery of groceries and other essentials. Zomato has the right to win in the long-term due to the synergistic nature of this business.

YC Continuity-backed Zepto is one of the firms that competes with Blinkit. The private market has more than twice the valuation of Zomato as compared to the public market.

The company said earlier this year that it would invest $700 million in its instant delivery service.

According to analysts at HSBC, many investors questioned Zomato's decision to acquire Blinkit and expand into the instant grocery delivery space. The analysts made a case for why the acquisition is needed.

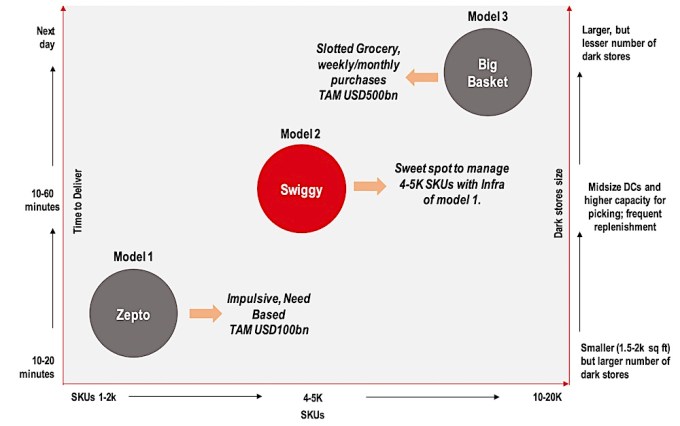

There are different delivery models for groceries. Data and image from HSBC.

Three different models of grocery delivery business exist. On the other side of the spectrum is a full kitchen offering with 25-30K SKUs, and on the other side of the spectrum is a quick-Commerce delivery of 10-15 minutes. There are two types of purchases:ctive and planned. It is thought that instinctive purchases are more need-driven and planned are more discount- and assortment- driven. There are 4-5K SKUs which cater to both ends with certain benefits and compromises for both instinctive buyers and planned buyers.

Zomato needs to attempt to build its grocery business closer to the middle of this framework and use technology to design and manage its dark stores so as to offer 4-5K SKUs with 10-60m delivery TAT. Cross-selling to Zomato's customer base is one of the top priorities for Zomato to build a successful grocery business.

The chief executive of Blinkit said in a TV interview that it was not holding merger talks with Zomato.

We covered last year.

The leadership teams at Grofers and Zomato have long been close friends and began exploring this investment earlier this year. Both the firms are also open to the idea of Zomato acquiring a majority stake in Grofers in the coming quarters, though a decision hasn’t been reached and won’t be fully explored until Zomato becomes a publicly traded company, the source told TechCrunch.

Zomato, which acquired Uber’s Indian food delivery business early last year, has told some of its major investors that it envisions a future where the Gurgaon-based firm has expanded much beyond the food delivery category, the source said, requesting anonymity as the talks are private.

Zomato has made a number of investments recently. Logistic startup Shiprocket, discovery platform Magicpin, fitness and wellbeing platform Cure Fit, adtech startup Adonmo, food robotics company Mukunda, and business-to-business startup UrbanPiper have all received funding from it. The startup had a large cash balance at the end of March.