Image source, Reuters

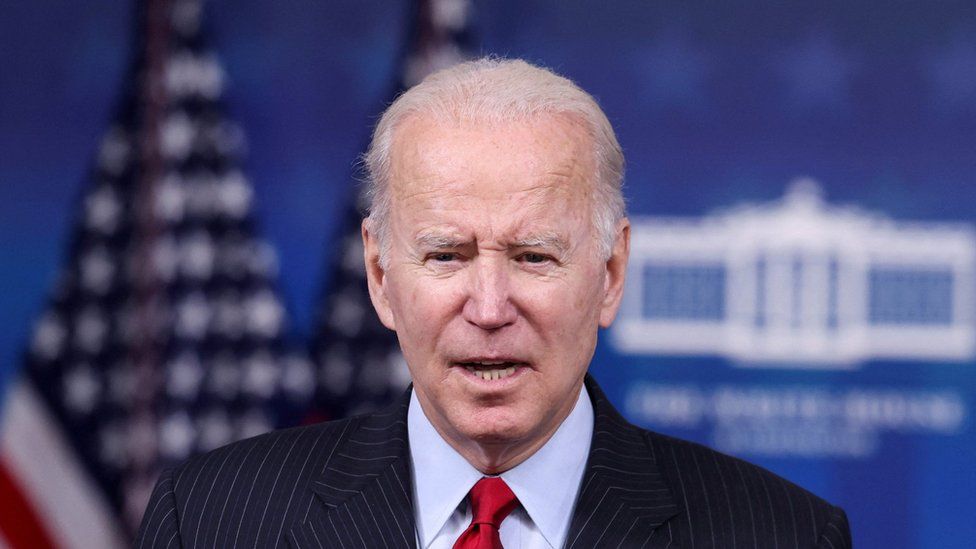

Image source, ReutersUS President Joe Biden has called for a three-month suspension of America's national gasoline tax.

The price of a gallon of gas has gone up from a year ago.

Mr Biden is under pressure to respond to the upcoming congressional elections.

Household petrol and diesel costs would not be affected by the levy being removed.

The political support for the gas tax holiday is uncertain, with members of Mr Biden's own party concerned that the move would benefit oil and gas firms.

The White House said policymakers should do what they can to ease the strain on families.

The administration said that a gas tax holiday alone wouldn't relieve the run up in costs.

The war in Ukraine is putting costs on American families and Congress should do what it can to give working families some breathing room.

The US imposes a tax on gasoline and diesel that is used to pay for highway infrastructure.

The elimination of the tax through September would cost the government $10 billion.

The effort from countries around the world addresses the soaring energy costs.

Since last year, oil prices have risen as demand outstrips supplies constrained by cuts made after the Pandemic hit in 2020 and caused demand to crater.

Western countries have stopped buying oil from Russia due to the war in Ukraine.

"Pausing the federal gas tax will certainly provide near-term relief for US drivers, but it won't solve the root of the issue - the imbalance in supply and demand for petroleum products."

Image source, Getty Images

Image source, Getty ImagesLonger-term policies are necessary to increase US energy production.

The vice president has already taken steps such as releasing oil from national reserves and lifting taxes on solar panels.

State governments often impose their own taxes higher than the federal government's, which is why Mr Biden is urging them to suspend the national gasoline tax.

The charges have been suspended in New York.

In the last few weeks, the president has intensified his criticism of the oil and gas industry.

The UK's recent announcement of a windfall tax on energy company profits has little political traction in the US.