Both Ayushi Shah and Nikhil Inamdar work for the British Broadcasting Corporation.

One of the fastest growing genres in digital space is easy to understand financial content.

The Pandemic hit Mumbai two years ago and Shivam decided to teach himself how to manage money.

It was the young financial content creators that spoke his language when he searched through books and instructions.

The videos are easy to comprehend. They cover a wide range of topics.

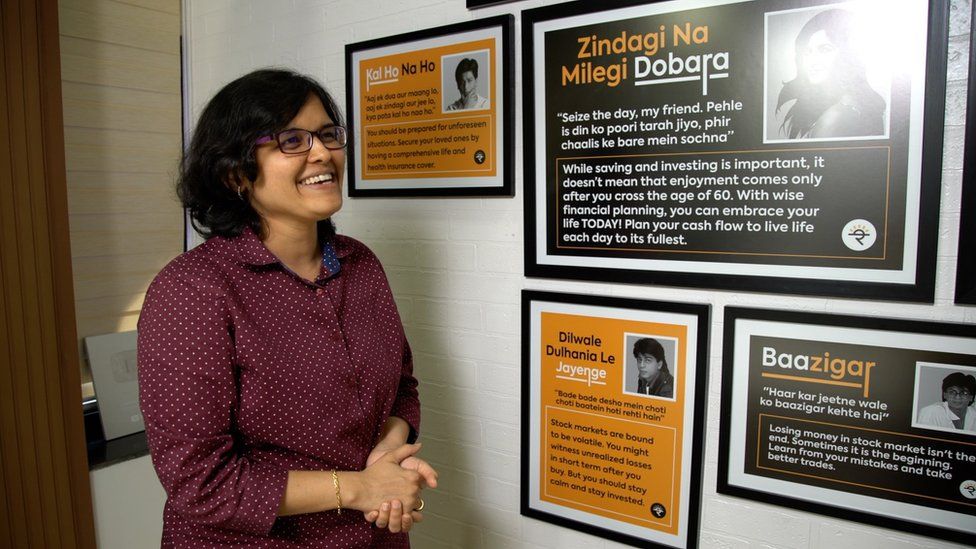

One of the creators he followed was Rachana Ranade, whose impish, easy, breezy manner of breaking down complex financial jargon into easily comprehensible content has earned her 3.5 million subscribers.

Ms Ranade showed us a wall-to-wall graphic that showed her rise as a YouTuber.

In just five months, she had reached 100,000 subscribers after uploading her first video. Since then, her growth has been rapid.

Bollywood celebrities or cricketing icons usually get mobbed for autographs and selfies.

One of the walls of her office cabin features quotes from movies. Financial concepts that are hard to comprehend are explained by these quotes. There's a song from Kal Ho Na Ho that talks about the importance of life insurance.

Ms Ranade says "finance that's simplified"

Image source, Getty Images

Image source, Getty ImagesIt's what India's young investors are looking for. Millions of them opened trading accounts to participate in the market bull run aided by investing services offered by online brokerages at the click of a button

Three out of 10 Indians are financially literate. They want to learn how to make money in the stock market, or how to start their own business, in the midst of a booming economy.

Financial content is one of the fastest-growing genres in the digital space.

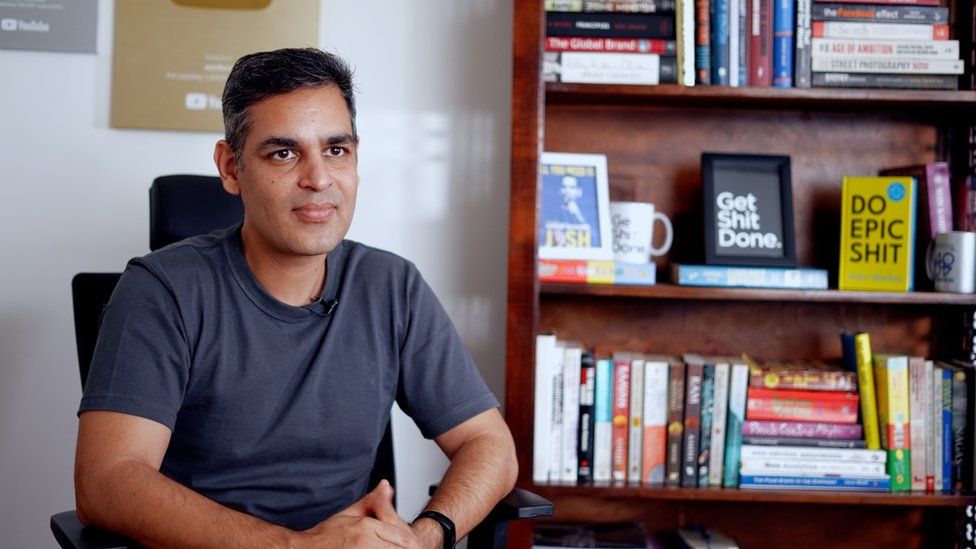

"For the Gen-Z and millennials, YouTube is a university now in India," says Ankur Warikoo, an entrepreneurial-turned-financial-influencer, whose videos focus on personal finance, entrepreneurship and productivity hacks

He got a publishing contract last year after his first book became a hit.

Mr Warikoo says his content creation journey began a decade ago. The Pandemic was a real turning point for finance content creators.

A lot of creators are offering high-quality content. Mr Warikoo said there was an audience with time and money and a market that was supportive. You wouldn't be able to put your point across if it was a bear run.

It was a mix of enabling factors, such as cheap data, growing internet penetration and the shift among India's Gen-Z andmillennial population from TV and print to digital video, that led to this success. "Especially with a topic like money, which is something that we all want to understand but have very rarely been given an opportunity to," he says.

It is not an assertion that is completely off the mark.

India has had more business channels that broadcast real-time financial market content than people want. They all cater to a small group of traders and institutional investors, not the first time market entrants.

The market gap has been filled by many of the YouTubers. They are getting a lot of money from advertisers through partnerships.

A single branded video can be worth as much as $20,000 for a top-tier influencer.

While experts applaud the trend of democratising financial education, they warn against it.

Digital content creators are in a regulatory grey zone. Ms Ranade and Mr Warikoo do not give stock tips, but many other people do.

I trust people who have been through a few market cycles when it comes to investing. While this digital phenomenon has overtaken us, everything has gone up, says a former editor at a business channel who now runs a fact-checking website.

Billions of dollars of foreign money have been pulled out of India's equity markets after a two year bull run. Mr Ethiraj says that it will be the first real test of how enduring or ephemeral the success of India's money millionaires is.