The Middle East is home to the first investment by the Founders Fund. One of the largest Series A rounds in the region was led by Sequoia Capital India.

Fifth Wall is a large VC firm that backs real estate and proptech startups. Existing investors from the seed round of the company, as well as new investors, such as Chimera Capital, invested in the company.

Every traditional industry has been disrupted by software, from high volume businesses with low ticket items to medium volume businesses with medium ticket items. The category where real estate falls under is not exempt. Opendoor, Place, HomeLight, and QuintoAndar are just a few of the startups that have made it easier to own and rent homes.

The global commercial sales volumes have exceeded the 2020 total by more than half. Huspy was launched in 2020 in order to tap into the home-buying opportunity in the Middle East.

There are a lot of property transactions in the Middle East. The mortgage process can take up to eight weeks to complete, and customers engage over five real estate agents before closing the purchase of a home.

When searching for a house, there is a lack of visibility and an ugly transaction process. Many people end up paying too much for the mortgage and not closing the house they wanted. The problem we sort out was this one.

After working for Beco Capital, a venture capital firm, he saw an opportunity in the real estate space. Most of the Middle East's unicorns are invested by the firm.

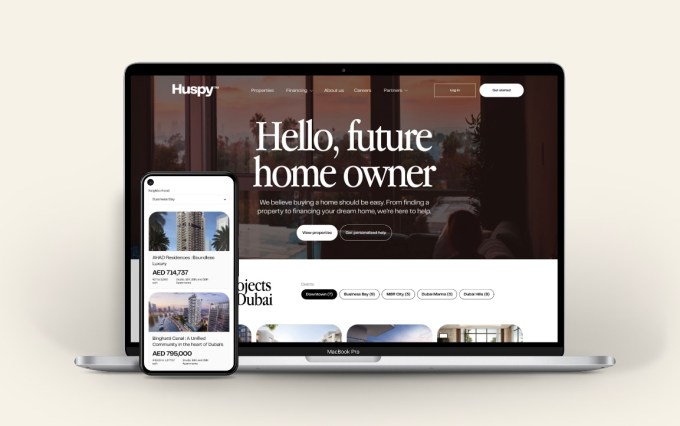

Huspy wants to make it easier for users to find real estate products. Digital solutions for buyers, property agents, and mortgage brokers can be found on the platform.

Users can lock in their loans and get quotes in minutes with the company's home finance product. Huspy closes transactions for customers more quickly than other platforms. Home Matters was acquired in January to increase growth.

Huspy launched a property marketplace earlier this year. Huspy closes the transaction for users when they see a list of properties they can visit and pay for. Huspy begins at the top of the funnel, streamlines the process, and completes transactions on users' behalf.

You have the chance to see a lot of what is happening. The chief executive said that proptech was important to him. A typical customer journey takes them to the portal, which has 25 to 30% fake listings. Every listing that we have on a platform is checked.

Huspy has partnerships with banks and agencies. The proptech platform can be used to list credible properties on the market. Huspy has a distribution network in the real estate market that makes it easier to convert customers.

Every time an agency calls, they pick up customers on our platform because our conversion is much higher.

Huspy claims to process $2 billion in gross merchandise volume in a single year. Banks are charged 1% per mortgage transaction and real estate agencies are charged 2% per transaction.

They are the Huspy team.

Huspy has better unit economics than other proptech platforms in the region, according to Antoun. He said the new funding would help Huspy expand into two markets with a total addressable market of over $12 billion. Even as it invests in technology to cater to future demand, the company plans to move into other parts of Europe.

The lead investor in the oversubscribed round is the managing director of Sequoia Capital.

He said that the company has become the leader in mortgage broking in the U.S. with healthy unit economics. Huspy has a deep focus on having the best team in the region and that meshes well with us.

Opendoor raises $300M on a $3.8B valuation for its home marketplace

Real estate platform Loft raises $425M at a $2.2B valuation in one of Brazil’s largest venture rounds