Most of the time, everyone on Wall Street got it right. The Fed, as well as a group of global central banks, did the same thing.

In December of last year, strategists at the world's top investment firms predicted that the S&P 500 would increase in value. The yield on the 10-year Treasury was expected to hit 2% by the end of the year, according to economists. Goldman Sachs Group Inc. lent credibility to the claims that the digital currency was on the verge of hitting $100,000.

A confluence of shocks has ended one of the most powerful bull markets and sent safe-haven government bonds and other assets into a tailspin. The S&P 500 is down 23%, the 10-year rates are at 3% and the value of the currency has fallen.

The multi-year phenomenon of "there is no alternative" in equities is gone, as the market has quickly turned from buying to selling. The Russia-Ukraine war contributed to the highest consumer prices in four decades. Ultra-low interest rates and monetaryStimulus have evaporated as the Fed and its counterparts have sought to quell inflation

James Athey is an investment director at abrdn in London. It's not attractive with 8% inflation.

Stock traders are looking for places to hide.

The turbulence that was coming from inflation wasn't seen by Powell. He expected the price gains to decline by the end of the year. Bond markets are showing signs of a recession because of the Fed's rate hikes.

The Fed was expecting rates to be floored near zero last year. The needle is now pointing to 3.5% by the end of the decade.

Despite the sharp declines, market experts are still confident that stocks will recover by the end of the year.

The S&P 500 needs a 45% rally in the next six months to reach John Stoltzfus's projection. The index needs to rally at least 30% to be met by a number of other companies. The S&P 500 is expected to gain 22% from Friday's level in the latest survey.

It is anyone's guess when Russia's war in Ukraine will end or when China's Covid policies will ease, lifting price pressures in addition to the Fed's policy tightening.

According to Max Kettner, chief multi-asset strategist at HSBC Global Research, equities haven't fully priced in a recession. There is more weakness for risk assets in store over the summer.

During the period of the global financial crisis, the S&P 500 fell by over 50%.

Morgan Stanley's Michael Wilson, one of the few bearish voices in December, said the market's more than 20% drop doesn't fully reflect the risks to corporate earnings.

All one can do is put cash under the mattress with gold and US Treasuries sinking as well.

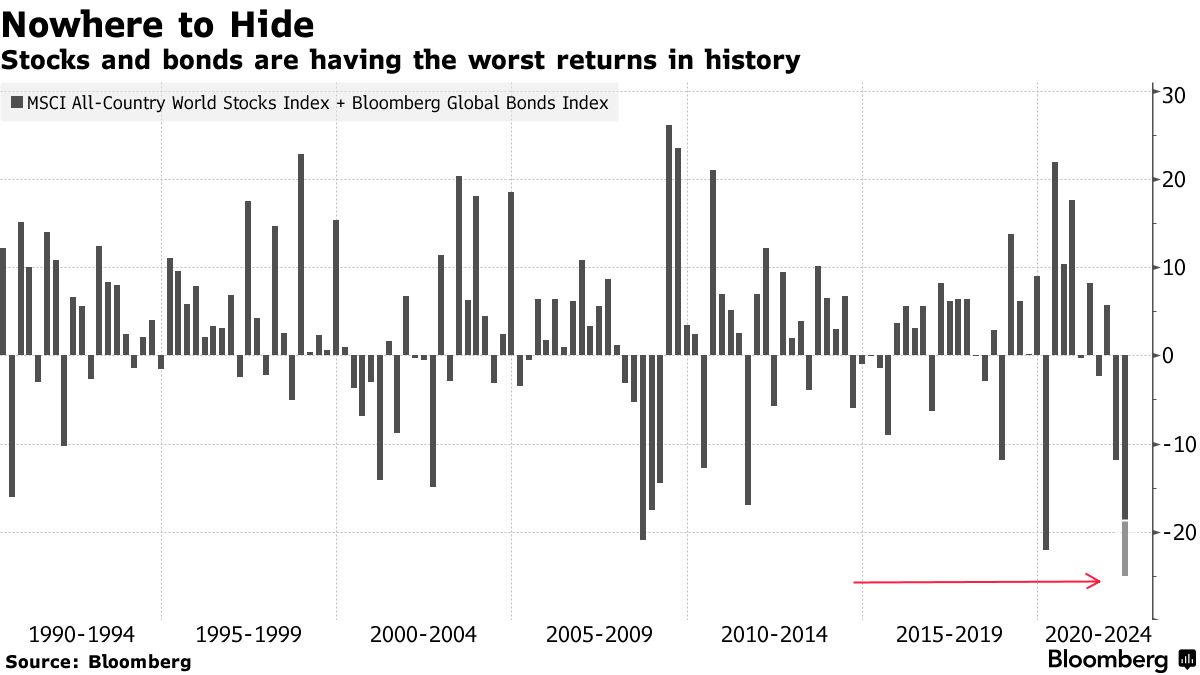

The worst quarter for bonds and stocks has never been experienced. Credit markets have taken a big hit.

The pool of the safest corporate debt in the world has lost more than $900 billion so far this year, making it the worst first half of a year on record. Default- swaps insuring the debt of Europe's high-grade firms are sitting at the highest since April 2020.

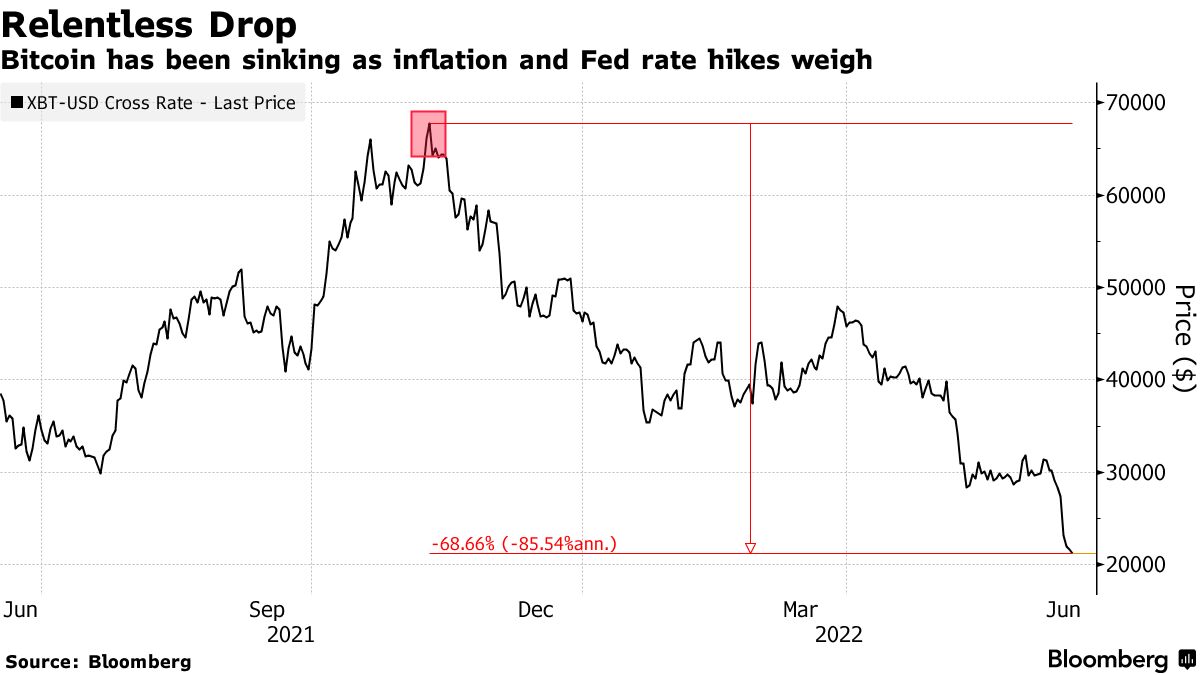

There has been a lot of swings in cryptocurrencies.

The market for digital assets has been in a downward spiral for a long time.

Since it hit a high of over $70,000 in November, the value of the digital currency has plummeted. An independent store of value and arguments similar to gold have gone quiet since the world's largestcryptocurrencies was likened to gold. There have been layoffs, freezes of withdrawals, and liquidity problems in the digital currency industry.

It's not easy to get things right in this market. There have been big rallies and big losses. This year'strigger has been obvious, according to HSBC's Kettner.

He said that investors were obsessed with the idea of "transitory inflation" last year. Inflation has not turned out to be temporary nor has it peaked. The last few days have been rough.

John Cheng, Hannah Benjamin, Tanzeel Akhtar, and Ksenia Galouchko assisted.