The Federal Reserve is expected to increase interest rates on Wednesday for the first time in 28 years.

In response to soaring inflation and volatile financial markets, the central bank will hike the rate that banks charge each other for overnight borrowing.

Variable-rate products such as credit cards and home equity loans are impacted.

Here is a quick look at what the Fed is likely to do.

A high bar for reverting to 25 basis point hikes is implied by the new language in the statement.

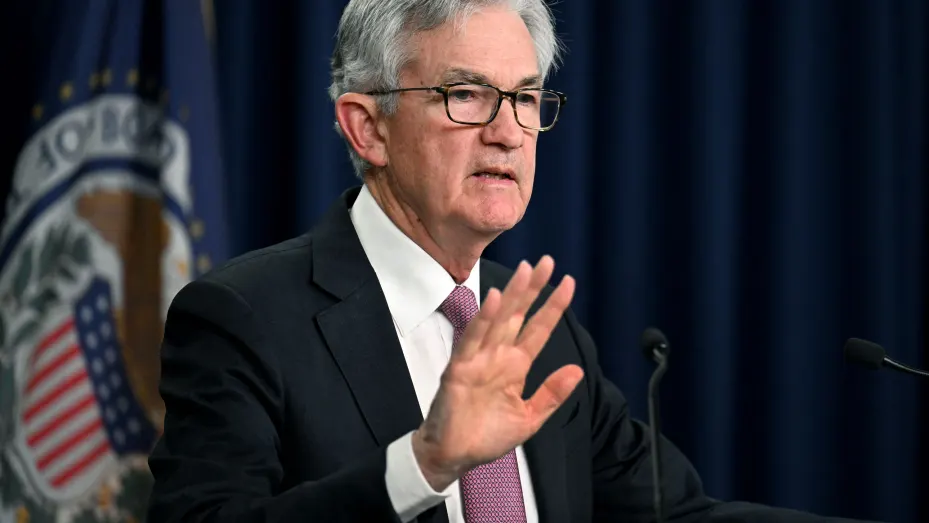

The Fed Chairman will speak to the media. The decision will be made at 2 pm. Powell will speak after that.

Powell will be asked to give an explanation of the Fed's recent change in expectations. They had been saying that the most likely course was a 50 basis point rate increase.

Powell said at his last news conference that 75 basis points was not something the committee was considering. One hundredth of a percentage point is a basis point.

Powell could give indications that multiple 75 basis point hikes are possible if inflation doesn't come down.