The stock selloff is still going on. 18% of its workforce is going to be sacked. China is the leader in reducing pollution. Today is what you need to know.

The Federal Reserve's stance to fight high inflation will cause the US to be in a recession. The S&P closed lower for a fifth day in a row and futures for Australia and Japan were also down. The bear market could be long and painful due to the fact that the Japanese currency slid past its 1998 low against the dollar.

The Chief Executive of Hong Kong conceded that her government could have done more to prevent the deaths of elderly people. The city had an under-vaccinated population. She apologized to her family in an interview with the television station. New schoolbooks will teach students that Hong Kong was never a British colony, and bar and nightclub-goers have to show a negative Covid test result to enter premises.

The US, UK and EU imposed a number of sanctions on Russia in order to pressure it to pull its troops out of Ukraine. More than 1000 companies have said they are curtailing operations in Russia. The full story on the effects of sanctions can be found here.

The company said it will lay off 18% of its workforce, or 1,200 workers, in another sign of the downturn in the market. Even though its shares have plummeted since it went public more than a year ago, the company still wanted to show an optimistic outlook. Cryptocurrencies are close to a bottom than the U.S. equity market, according to the founder and CEO of the company. The Celsius crisis is causing fresh angst across the digital asset universe.

In the seven years since, China has reduced air pollution as much as the US has done. According to the University of Chicago's Energy Policy Institute, the amount of harmful particulates in the air in China has fallen by 40% over the last three years. Air quality in South and Southeast Asia and Central Africa is getting worse. The lowdown on the 10 most polluted countries in the world can be found here.

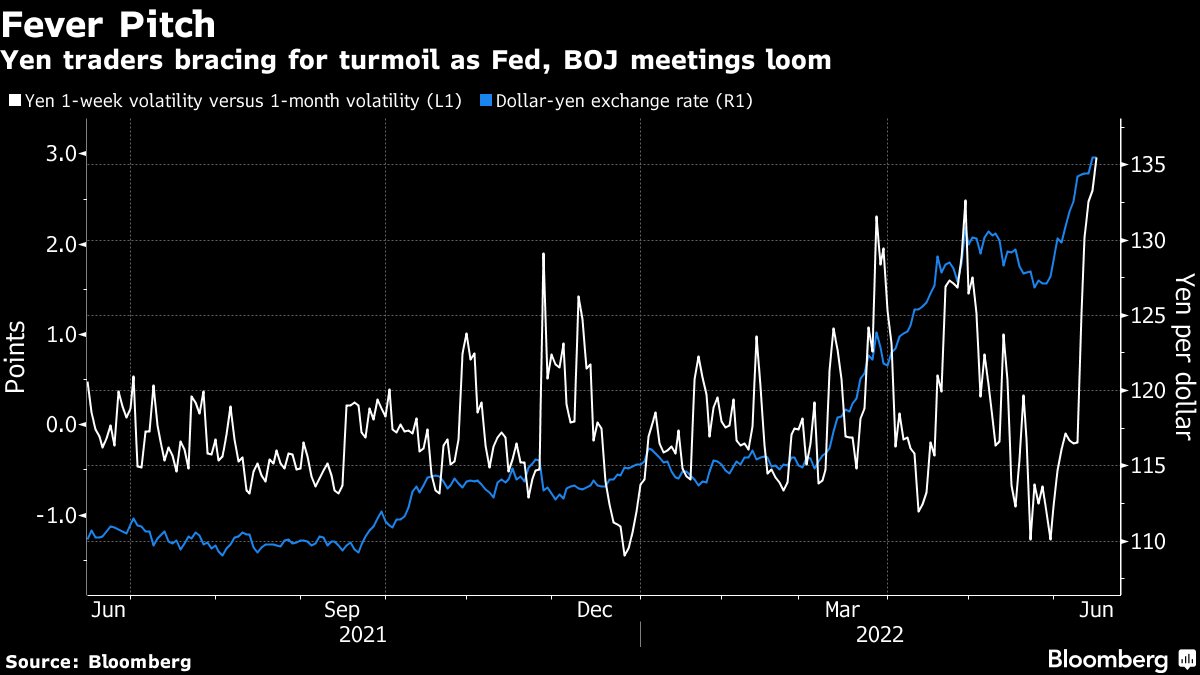

The central bank meetings in the US and Japan could cause the Japanese currency to go much higher. There is a lot of focus on the Federal Reserve meeting and a possible interest rate hike. The Bank of Japan's insistence on sticking with ultra-loose policy settings is a big deal.

The governor of the Bank of Japan needs to acknowledge that yield-curve control is becoming counter productive and will need to be retired. The overnight reading of the renminbi spiked as it usually does around Fed meetings. The one-week volatility gauge has risen to its highest level since 2020 on a nominal basis.

Garfield Reynolds is based in Australia.

Garfield Clinton Reynolds helped with the project.