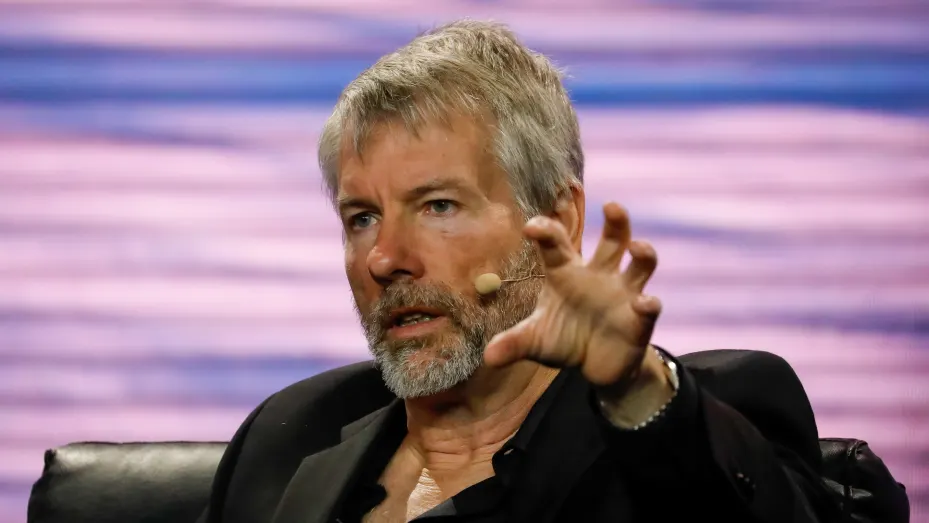

Michael Saylor lost $6 billion at the peak of the dotcom bubble.

MicroStrategy overstated its revenues and reported a loss when it actually made a profit. The stock market value of MicroStrategy was wiped out in one day.

MicroStrategy is once again facing questions over some of its accounting practices, this time in relation to a $4 billion bet onbitcoin

MicroStrategy would face a margin call if the price of the world's biggestcryptocurrencies fell below $21,000.

When contacted by CNBC, MicroStrategy was silent.

When Saylor decided to add the digital currency to MicroStrategy's balance sheet, he was the first person in the world to do so.

He believed that there was a store of value that was uncorrelated with traditional financial markets.

Digital currencies are moving in lockstep with stocks and other assets plunging due to fears of an aggressive interest rate hike from the Federal Reserve.

The price of the digital currency plunged 10% to $20,843 on Tuesday, dragging it deeper into levels not seen since December 2020. Celsius stopped withdrawals on Monday due to extreme market conditions.

Billions of dollars have been bet on thecryptocurrencies by MicroStrategy. According to a company filing, MicroStrategy held over 130,000 bitcoins at an average price of $30,700.

The value of MicroStrategy'scryptocurrencies would now be over 2 billion dollars. That equates to a huge loss of money.

A Margin call is when an investor has to commit more funds to avoid losses on a trade with borrowed cash.

The company took out a loan from Silvergate. MicroStrategy put some of the digital currency it held on its books as a security for the loan.

A request for comment was not returned.

On an earnings call in May, MicroStrategy Chief Financial Officer Phong Le said that if it were to fall below $21,000, it could face a margin call. There was a brief slip below that level.

Le said thatBitcoin needed to cut in half or more before a margin call could be made. Before it gets to 50%, we could make a bigger contribution to the package so it doesn't get there.

Saylor said the company has enough money to cover its needs. He said that the coin needed to fall to $3,500 before it could come up with more money.

MicroStrategy's shares plummeted more than 25% on Tuesday, taking its year-to- date losses to over 70%. Since the beginning of the year, the No. 1 digital coin has halved in price.

Saylor hasn't commented on the drop in the value of the currency. He posted a new profile picture on Monday showing his face with lasers coming out of his eyes, a nod to a meme signaling bullishness on the virtual currency.

Saylor wrote: "In #bitcoin we trust."

The internet could be changed with 'Web3.' What does that mean?