The business reporter is in New York.

Image source, Getty Images

Image source, Getty ImagesBusinesses around the world raised prices at a rapid pace last year. The United States was hit the hardest.

Prices jumped at an annual rate of 4.7% last year, more than any other country in the Group of Seven advanced economies. Inflation in the UK was 2.5%.

When inflation in the US hit 8.6% in May, the country remained ahead of the pack.

Many of the forces that drove inflation last year were not unique to the US.

The US did not fare as well as it could have. There is high demand.

Spending the US government approved to shield households and businesses from the economic impact of the Pandemic was the driving force.

The aid helped people keep buying.

Goods like furniture, cars and electronics saw a surge of orders.

Businesses raised prices because of high demand.

According to a recent study by the Federal Reserve Bank of San Francisco, 3 percentage points of the rise in inflation until the end of 2021 could be attributed to the fact that there were more relief packages available.

Oscar Jorda, senior policy adviser at the bank and one of the people who worked on the study, warned against reading too much into the percentages, but said the overall picture is clear.

He said in an interview in May that the programmes were a lot of money for consumers at a time when industry was not ready to respond to an increase in demand. They "signedified a big push of inflation".

Harvard economist Larry Summers, a long-time Democratic policy adviser, and some Republicans raised the risks that the packages would cause inflation.

The head of the Federal Reserve, America's central bank, argued that price increases would betransitory and fade as Covid issues abated.

Even as inflation expectations in the US began to shift, the Fed was slow to respond to the price increases.

The Fed was slow to respond to the change in expectations.

Despite wage gains lagging, rising prices were not seen as a cost of living crisis last year.

As savings get spent, that causes a political problem for US President Joe Biden, who is blamed for the price increases.

Image source, Reuters

Image source, ReutersMr Biden pointed the finger at the war in Ukraine, which has hit oil supplies and exports of commodities, driving up prices and spreading pain around the world.

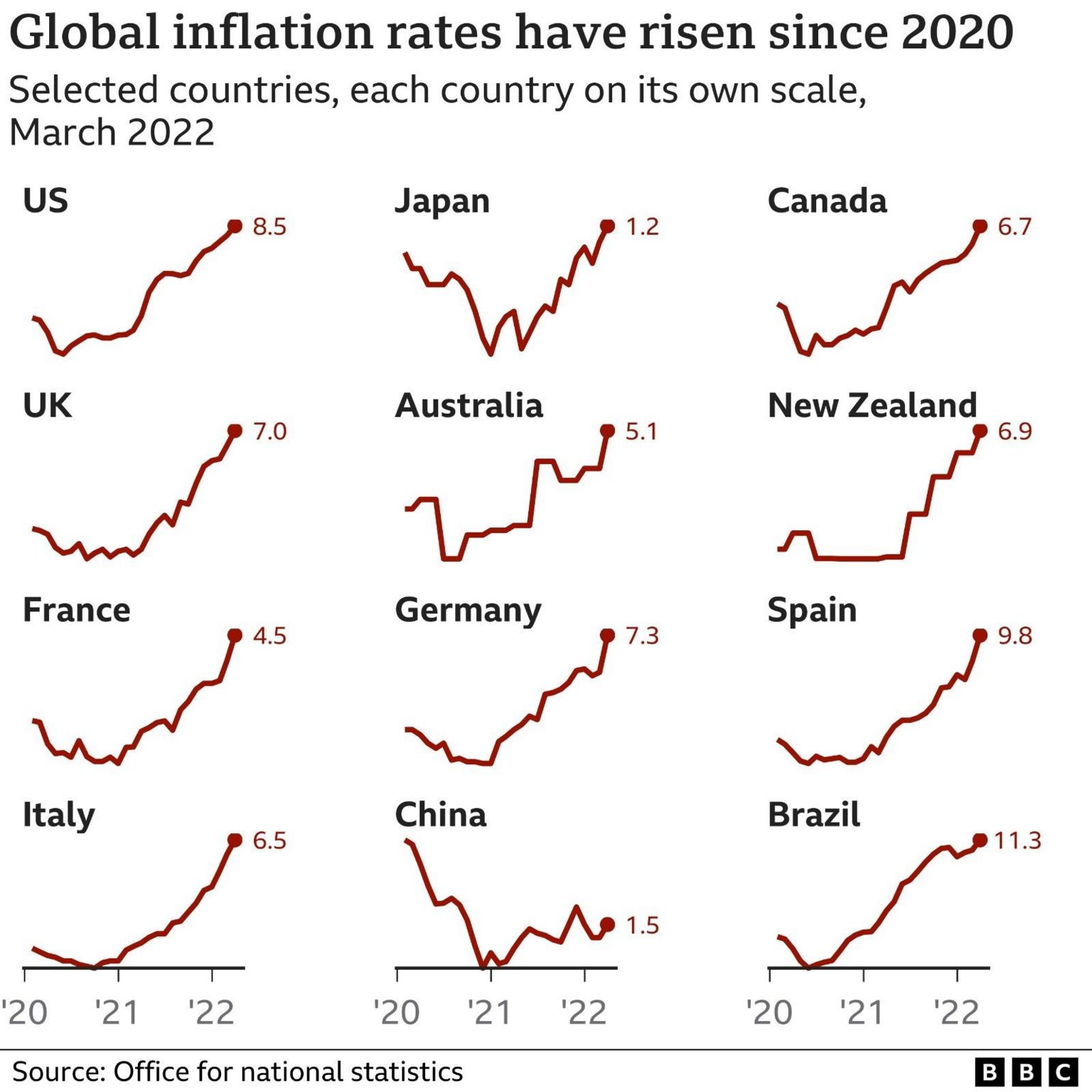

The Euro area's prices rose at an annual rate of 8.1% in May, led by countries that are close to Russia and rely on oil and gas.

After a price cap that had limited energy bills was raised, the UK's inflation hit 7.8% in April, just behind the US among advanced economies.

The UK government's consumer price figures show an even faster increase of 9%.

Japan, which has struggled to keep its inflation rates above zero, is seeing prices rise in April.

Inflation is expected to peak this year at 5.5% for advanced economies and 8.5% for all of the 38 countries in the Organisation for Economic Co-operation and Development.

The Federal Reserve, Bank of England and others have taken steps to address the problem.

Making borrowing more expensive helps reduce demand from households and businesses.

He said that a return to the 2% target is unlikely and that he hopes this can happen without causing a recession. The big question is that.

Image source, Getty Images

Image source, Getty ImagesRate rises may only add to economic uncertainty in smaller countries, which are vulnerable to sudden shifts in money flows and exchange rate fluctuations, which are often triggered by rate rises.

Politicians in the world's biggest economies are trying to find ways to keep the cost of living in check.

The windfall tax on oil and gas companies was used to fund the aid package.

Some countries in Europe, such as Spain and Portugal, have instituted price caps on gas, the kind of response that economists generally advise against, since caps tend to keep demand high.

Outside of the grocery store, the most immediate point of pain, Mr. Biden has released unprecedented amounts of oil from national inventories to try to lower petrol prices.

The power of politicians and central banks is limited because of the war in Ukraine.

They can invest in different energy transition policies in the long run, according to Mr Jorda. There isn't much that can be done in the short term.