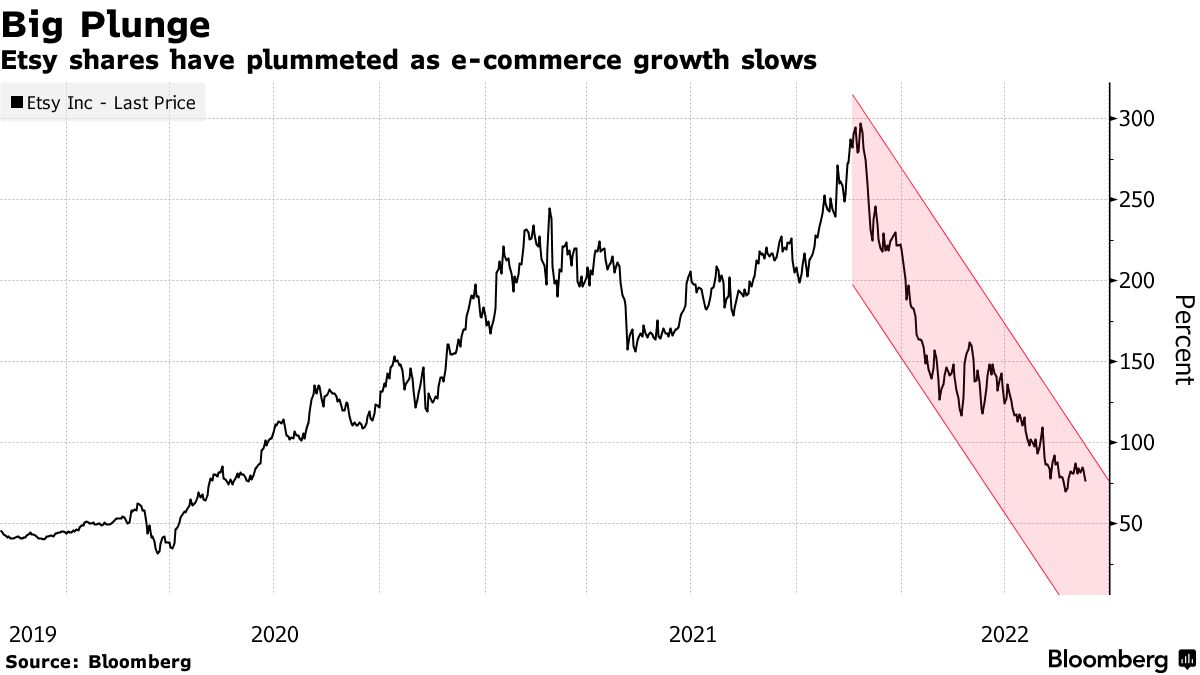

With the fastest inflation in 40 years crimping consumer budgets, the unraveling of the platform for craft sales may have further to go.

Morgan Stanley said that Wall Street's earnings estimates for the second half might still be too high and that it had slashed its price target by 50%. Ken Leon is the director of equity research at CFRA.

The stock has been one of the worst performers on the S&P 500.

There is a source for this.

He said that "Etsy is facing a behavioral shift away from shelter at home and having lots of time at home to buy personal items."

It will be the biggest yearly stock decline in its seven years as a listed company. Shoppers who were already returning to their pre-pandemic habits are reining in their purse strings because of higher prices.

After years of double-digit revenue increases, Etsy's sales growth is expected to slow in the next few years. At a time when investors are ready to punish companies that don't deliver great results, that data point alone could spark an exit.

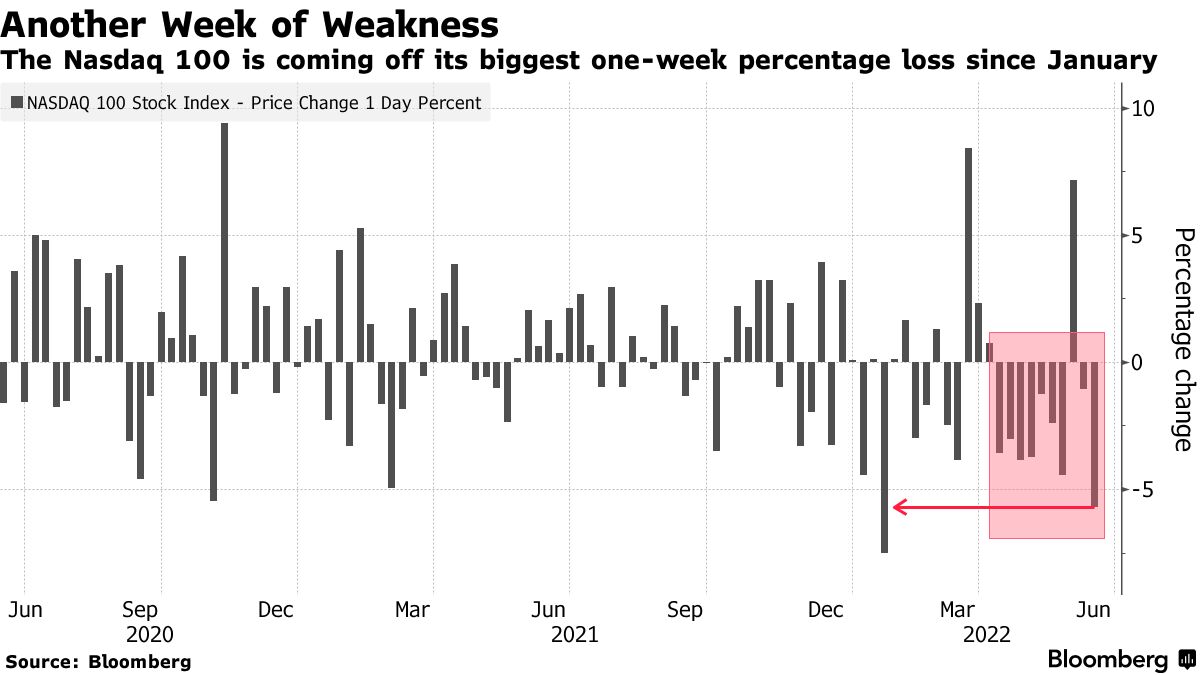

Morgan Stanley analysts led by Lauren Schenk said that earnings revisions for a large portion of their coverage may have just begun. Most stocks did not bottom out. She questioned the resilience of their growth given the weak economic environment.

The stock is cheap at 3.5 times projected sales, compared to a five-year average of 7.7 and the 2016 record low of 2, and analysts are still bullish. It may not be enough to get investors to invest.

The most recent earnings season laid bare the fading boom in e- commerce because of rising inflation and concerns of a recession that are weighing on consumers. In April, Amazon.com reported a weaker-than-expected revenue forecast that triggered a historic plunge.

The U.S.-listed shares ofshopify, Wayfair, and EBay have all plummeted in the past year.

While analysts have begun chopping away at their profit estimates and price objectives, the stock has been falling even faster: Their targets now imply an 86 rally over the next 12 months -- or another round of price target and ratings reductions.

There is no sign that the weakness in big tech is going to stop. The tech-laden index fell for the ninth week in a row last week, its biggest one-week drop since January. The index fell more than 3% on Friday after a higher-than- expected reading on inflation.

Ryan Vlastelica helped with the project.