You can sign up for the New Economy Daily newsletter and follow us on social media.

Powell could deliver a surprise on Wednesday even after announcing 50 basis-point interest rate increases at the Federal Reserve's meeting this week and in July.

Some investors think the Fed chair will deliver a 75 basis-point move unless price pressures cool, after May's red-hot inflation print hardened expectations the Fed would keep raising borrowing costs.

Powell can reinforce that speculation by declining to take 75 basis points off the table, as he did last month, or by emphasizing the need for policy to cool surging prices.

US headline and core inflation both increased more than expected.

Bureau of labor statistics.

Friday's data shows that the US central bank has a lot of work to do to contain price pressures. Excluding food and energy, consumer prices rose 8.6% in the 12 months through May, their highest level in 40 years.

The odds of the Fed raising rates by three-quarters of a percentage point in July were seen by traders and economists as likely to happen this week.

“Powell will have a chance at the upcoming meeting to assert that inflation is still on an upward trajectory, and that the Fed will keep hiking by 50 basis points per meeting as long as that’s the case.”

--Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger. For full analysis, click here

The path of future hikes will likely be steepened by the central bank's updated projections. The median estimate shows that rates peaked at 2.8% in March.

According to a survey conducted before the consumer price data was published, the projections for this year and the next are 2.5% and 3.1%, respectively.

The Fed will be in the spotlight this week. The Bank of England is likely to hike rates the next day, and the Bank of Japan is likely to make a decision on Friday at a time when the weakness of the Japanese currency is making people angry.

Click here if you want to read about what happened last week in the global economy.

The Bank of Japan is expected to make a decision on policy on Friday. As the Fed prepares to hike US borrowing costs, Governor Haruhiko Kuroda is expected to stick with rock- bottom interest rates. Over the course of the next few days, the BOJ's position is likely to become more awkward.

On the data front, readings on China's retail spending, industrial output and investment on Wednesday should show the economy is starting to recover from the Covid-lockdown affected slump in April.

Jobless numbers from both Australia and South Korea will likely show no reason to raise rates.

The economic rebound in New Zealand has slowed as the strongest inflation in more than 30 years eats into household budgets.

India's inflation rate probably remained well above the central bank's comfort range.

Pressure is mounting on both Governor Andrew Bailey and Prime Minister Boris Johnson over the cost of living at a time when the Bank of England is poised to deliver a fifth consecutive rate hike.

With inflation at 9% and the central bank's own survey showing the worst approval rating since 1999, an intense debate is likely among officials on whether or not to accelerate tightening with a half point increase.

For the first time, the board has received a negative approval rating.

The Bank of England is part of the Ipsos group.

There are several data reports that will inform their decision, including gross domestic product on Monday that may show growth at the start of the second quarter after a decline in March, and then more evidence of a taut labor market on Tuesday.

The Swiss National Bank will make a crucial decision on the same day that the BOE makes a decision. With officials now acknowledging the threat of inflation in Switzerland, a shift towards lifting the world's lowest rate is now possible.

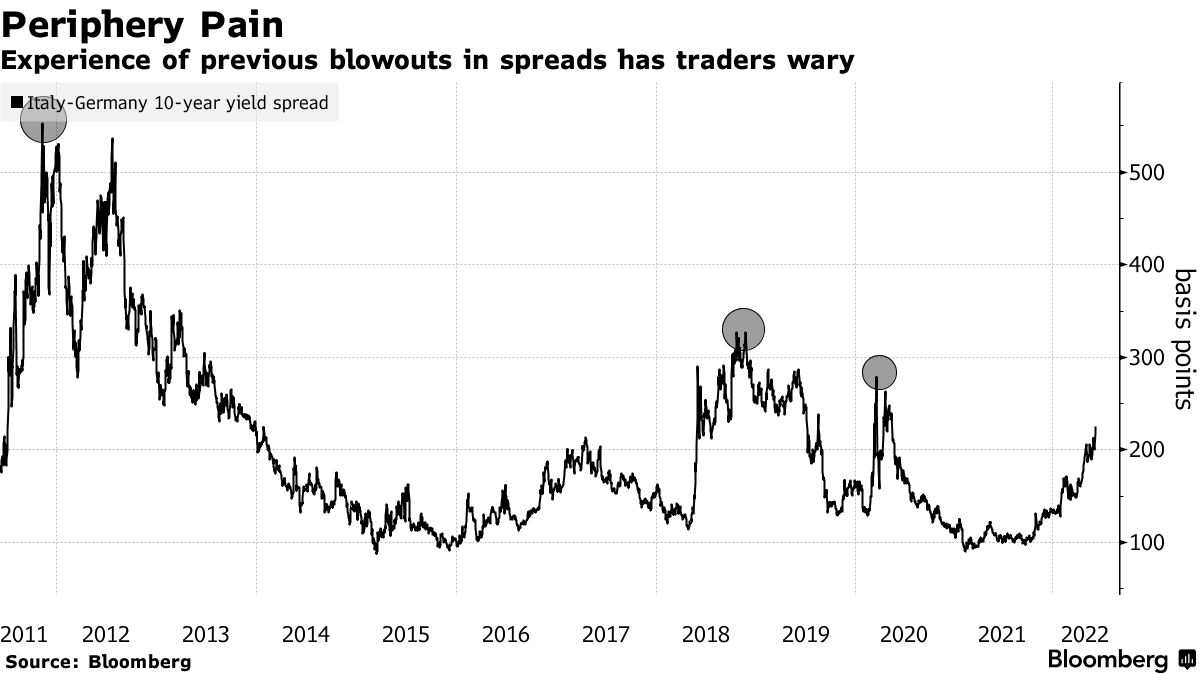

The European Central Bank last week firmed up plans to tighten monetary policy, paving the way for a half-point hike.

Several speeches by policy makers will take prominence as investors ask how that will affect weaker countries. Christine Lagarde is a member of the Executive Board of the European Central Bank.

Riksbank officials will make a decision on their future later this month, and an expected increase in Swedish inflation to 7% on Tuesday may be crucial.

Turkish data due Monday is expected to show a widening of the current-account gap as a result of a global rally in energy prices.

South Africa raised its benchmark by 50 basis points in order to keep its currency peg with the rand.

Israel's inflation is expected to accelerate further above the government's 1% to 3% target range, which has already led the central bank to hike more aggressively than expected

Should the central bank hammer out a new labor contract, this could be a busy week. There are a lot of releases dating to late April that are still growing.

The economists think year-end inflation will be 72.6%.

There is a monthly survey of economists.

Turkey is the only Group of 20 nation that has not experienced inflation this year. The most recent survey of economists puts the year-end figure at 72.6%, but early estimates show the May print topping 60%.

Brazil's consumer prices fell more than expected in May, possibly bolstering a case for an August rate pause. The central bank is expected to raise the key rate for the 11th straight meeting. It will be important to read the post-decision statement.

The year-end prices are expected to be lower.

The central bank of Brazil and the statistics agency are sources.

While the national GDP-proxy may slow from February's post-omicron bounce, the labor market in the megacity capital of Lima isn't back to pre-pandemic levels.

After a strong January-March showing, look for the April data to be consistent with forecasts that Colombia's economy may lose a step in the second quarter but still lead output among Latin America's big economies.

With help from Benjamin Harvey, Robert Jameson, Malcolm Scott, and others.