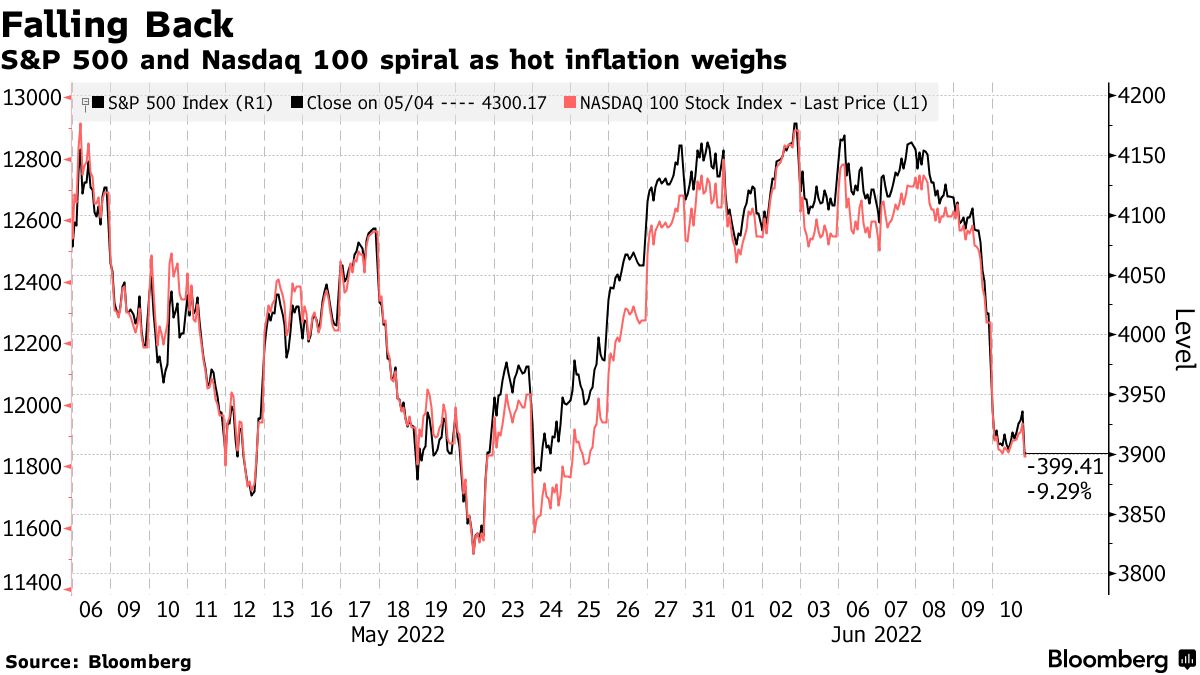

After inflation unexpectedly accelerated to a 40-year high in May, causing traders to boost bets that the Federal Reserve will hike rates even more aggressively, the US stock market closed out its worst week since January.

The S&P 500 declined for the ninth week in a row. Consumer discretionary, technology, and financials were all lower as the benchmark fell. The tech-laden index was dragged down by losses from Apple and Microsoft.

Ed Moya, senior market analyst at Oanda, said that the Fed will have to deliver more rate hikes as inflation is not ready to peak.

The stock market has had a rough three months, with the S&P 500 falling from a January record. The tech-laden index has plummeted.

The S&P 500 lost 5.1% of its value this week. Carnival Corp., Royal Caribbean Cruises, and Norwegian Cruise Line were all in the red.

Next week will see the Fed meeting and interest rate announcement. There are half-point increases through September and traders are betting on a 75-basis-point hike in the coming months.

Bill Adams said that the longer inflation stays high the faster the Fed will raise rates. Falling inflation-adjusted incomes and faster interest rate hikes are causing markets to be broadly lower.

Wells Fargo was the worst performer in banking shares on Friday after the inflation reading. The riskier assets were less risky than the broader market.

After the market closes on Monday, investors will get an earnings update from Oracle Corp. A strong US dollar is likely to affect the company's results.

The top themes for S&P 500 companies are broken out by sectors.

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| Adobe | Mizuho Adjusts Adobe Price Target | -7.6 |

| Citrix | Countdown to Stock Market Close | -1.1 |

| Microsoft | Samsung and Microsoft Bring Xbox App | -4.5 |

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| CME Group | Atlantic Equities Upgrades CME Group | 1.0 |

| JPMorgan | JPMorgan Global Growth | -4.6 |

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| PPG Industries | PPG Sees $150M in Acquisition Synergies | -6.5 |

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| Netflix | Netflix Cut to Sell at Goldman | -5.1 |

| Alphabet | CMA to Investigate Apple, Google Over Duopoly | -3.2 |

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| Devon | Mizuho Adjusts Price Target on Devon Energy | -4.9 |

| EOG Resources | EOG Resources Call Volume Normal Bullish | 1.1 |

| Exxon | Biden Gift Keeps on Giving to Big Oil | -1.8 |

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| Illumina | Illumina CFO Sam Samad to Depart | -9.0 |

| Cardinal Health | Cardinal Health to Open Distribution Center | 2.1 |

| CVS | Time for Malaysia to Consider Compulsory Voting? | 0.5 |

| Pfizer | Medical Association Endorses Pfizer Vaccine | -3.5 |

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| Con Edison | Leading Clean Energy Transition | 0.7 |

| NextEra Energy | CIBC Initiates NextEra Energy Partners at Neutral | -1.9 |

| Security | Theme | 1D Price Chg (%) |

|---|---|---|

| Estee Lauder | The Ordinary Makes Debut Into India | -3.6 |

| Costco | Marmalade Sandwiches Princes | -1.9 |

You can click here for news trends.

You can click here for S&P 500 moves.

Artificial intelligence is used to create news themes that may not be accurate. The largest increase in news readership is used to rank companies.