The Social Security checks would be boosted.

The proposal's tax hikes were denounced by Republicans.

Raising the retirement age is one of the things the GOP favors.

There is a Social Security benefits cliff that will cause retirees to see their checks reduced.

The program has enough money to send out monthly checks to elderly and disabled Americans for 13 years, according to the latest federal report. The program needs a 20% reduction in benefits to be sustainable.

In the coming decades it will be vital for Congress to take steps to put Social Security and Medicare on solid financial footing.

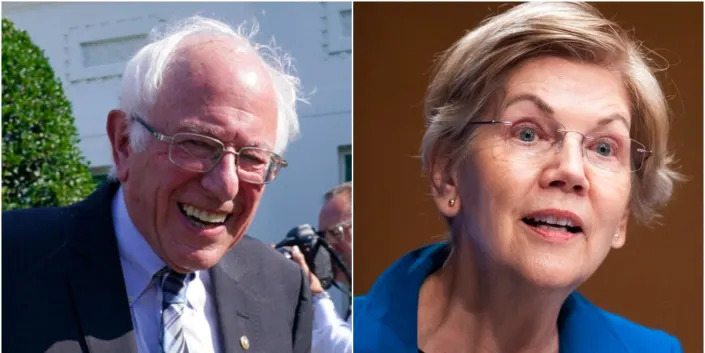

Senator Elizabeth Warren is one of the democrats who are putting together a plan to change that.

They proposed a bill that would increase the benefit by $2,400 per year and fully fund the program through 2036.

The Democrats want to raise the earnings cap to pay for it. Americans are only taxed on their first $150,000 in income to pay for Social Security.

All income above $250,000 would be subject to the Social Security payroll tax under the Social Security Expansion Act.

The idea of raising the income threshold is already supported by key centrist Joe Manchin. The payroll tax cap should be raised to $400,000 to put Social Security on a more sustainable fiscal path according to a Democrat from West Virginia.

The Republicans indicated that they wouldn't vote for the plan because it wasn't popular. They prefer other fixes instead of raising taxes to fund safety net benefits.

Lindsey Graham, the ranking member of the Budget Committee, suggested in a Thursday Congressional hearing that the program's retirement age would probably need to be raised. The TRUST Act is a bipartisan bill that was proposed by Romney. Legislation may end up cutting some benefits.

The bill has no chance of getting a single Republican vote.

Business Insider has an article on it.