One of the clearest signs that authorities are easing back on the tech industry is that they are talking about a revival of the initial public offering of Ant Group Co.

One of the people, who asked not to be named, said that the China Securities Regulatory Commission has established a team to review the share sale plans of the company. A long-awaited license that would clear the way for an IPO and make the company regulated like a bank is close to being issued.

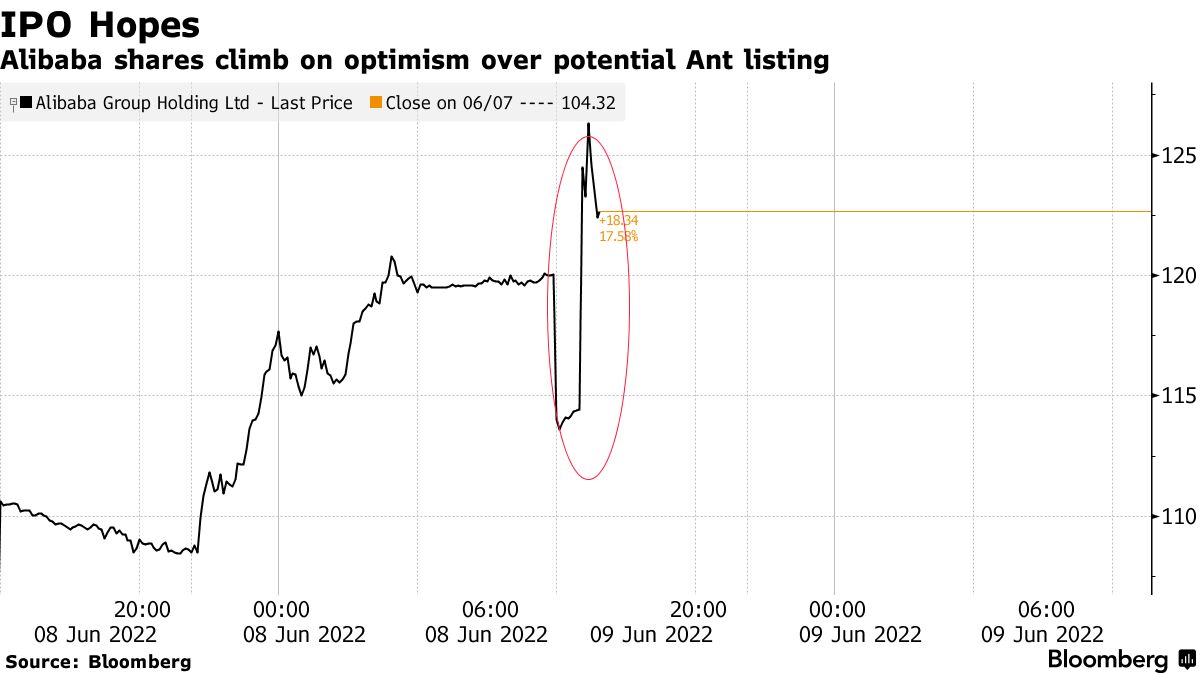

Evidence of progress on both fronts is likely to reinforce investor optimism that the worst is over for the private sector in China. A report that authorities are preparing to wrap up a probe into Didi Global Inc. and restore the company's main apps to mobile stores has propelled Chinese tech stocks to new heights.

| Click here to read this story in Chinese language. |

|---|

| For a guide to reading Bloomberg Chinese news, click here. |

It would send a powerful signal that policy makers are following through on pledges to support the industry if the curbs on Didi were relaxed. The Communist Party's evolving stance towards the private sector has become one of the most closely watched developments in global markets in recent years.

A report on the potential revival of IPOs in China helped propel gains in US- listed Chinese shares.

Jack Ma's company, "Ant," refused to comment. Requests for comment from the CSRC and the central bank were not responded to. The Chinese premier said last month that the government supports domestic and offshore listings.

The crushing of Ant's $35 billion IPO in November 2020 sent shock waves across the financial world. Some of China's fastest-growing companies, as well as more than $1 trillion of market value, were wiped out by the start of a broader crackdown.

Ma, China's most famousentrepreneur, has mostly disappeared from public view since giving a speech that criticized regulators. Many of his peers have given up their formal corporate roles and increased their donations to charity in order to align with the vision of the president.

A return to the heady days of 2020 is not likely because investors are likely to welcome any signs that the tech crackdown is easing. The company is worth less than it used to, according to some early backers. Fidelity Investments lowered its valuation estimate for the firm to about $78 billion in June of last year from $235 billion just before the IPO was halted.

The Chinese company could have set a new record.

There is a source for this.

One of the people familiar with the situation said that China's securities regulators are looking at the plans for a Shanghai listing. The company expects to conduct a dual-listing in Hong Kong.

The Chairman of the Hong Kong stock exchange has been appointed as an independent director. The move was approved by regulators in Beijing. One of the people said that authorities have been speeding up decisions on the restructuring proposal.

Since the Wall Street Journal reported that China is close to wrapping up probes into Didi and two other firms, investors have interpreted the move as a sign that some of the most beaten-down tech stocks are finally due for a reprieve.

From this year's low in March, the Hang Seng Tech Index has advanced 36% in Hong Kong, while the Golden Dragon China Index of US-listed shares has increased by over 50%. The index is down from its peak.

Regulators ordered the company to set up a financial holding company for its wealth management, lending and credit scoring businesses in order to be more closely regulated after derailing the IPO.

The people said that authorities are preparing to issue a financial holding company license, but it is not clear how quickly a final decision will be made.

As a result of the restructuring, the capital base of the company has been increased to over five billion dollars and it has moved to build a network of services that it once could not direct traffic from its payment app to.

The "Jiebei" and "Huabei" brands are no longer part of the consumer loans made with banks. The world's largest money-market fund lost 15% of its assets in the first quarter.

The assistance was given by Lulu Yilun Chen and others.

(Updates with share reaction in fifth paragraph.)