Priti Gupta and Ben Morris are based in Mumbai.

Image source, Getty Images

Image source, Getty ImagesWhen Raj took out a loan for $110, he thought it would solve his financial problems, but it has made his life worse.

A man was lured into a digital loan scam.

Raj was attracted to the loan approval process. The only thing he had to do was download an app to his phone and provide a copy of his identity card.

He got some money, but only half of what he asked for. The company demanded that he repay three times the amount of the loan.

He used loans from other finance apps to pay off his debts. Raj owed thousands of dollars across 33 different apps.

He was too scared to go to the police because he was being threatened over repayments.

The people running the apps gained access to his phone and his pictures, and threatened to send nude pictures of his wife to everyone on his phone, if they didn't stop.

Image source, Raj

Image source, RajHe sold all of his wife's jewelry in order to pay off the scam artists.

I don't think they will allow me to leave. I don't know if I'll survive my life. Raj gets threating calls and messages every day.

This type of mobile phone scamming is not new in India. There were 600 illegal lending apps identified by the Reserve Bank of India.

Maharashtra state had the highest number of complaints regarding lending apps.

"These apps promise hassle-free loans, quick money, and people are lured into them, not realizing that their phones get hacked, their data gets stolen and their privacy is comprised," says Mr Yashasvi Yadav, special inspector general of police.

He says it is a scam because so many people in India are not eligible for bank loans.

Image source, Getty Images

Image source, Getty ImagesThe apps are usually run in China but the scam artists are usually in India.

Tracking their bank accounts and phone numbers has caught many scam artists.

One scam artist said it was easy to get away with it.

People like us who work for apps are hard to trace as we use fake papers to get a mobile number.

We work from all over India. Most of the time, we don't have a place to work from. The only thing I need is a computer and a phone. I have more than 10 numbers to use for threatening customers.

This particular scam artist told us that they are trained to find "gullible and needy" people, who are only given half of what they are asked for. The scam artist will demand three times the amount is paid back.

Pressure is applied if the victim doesn't pay.

The first thing to do is to be aggressive. Then say something bad. The person is going to be blackmailed as we have loanees phone details.

Many don't go to authorities because they are afraid.

Image source, Getty Images

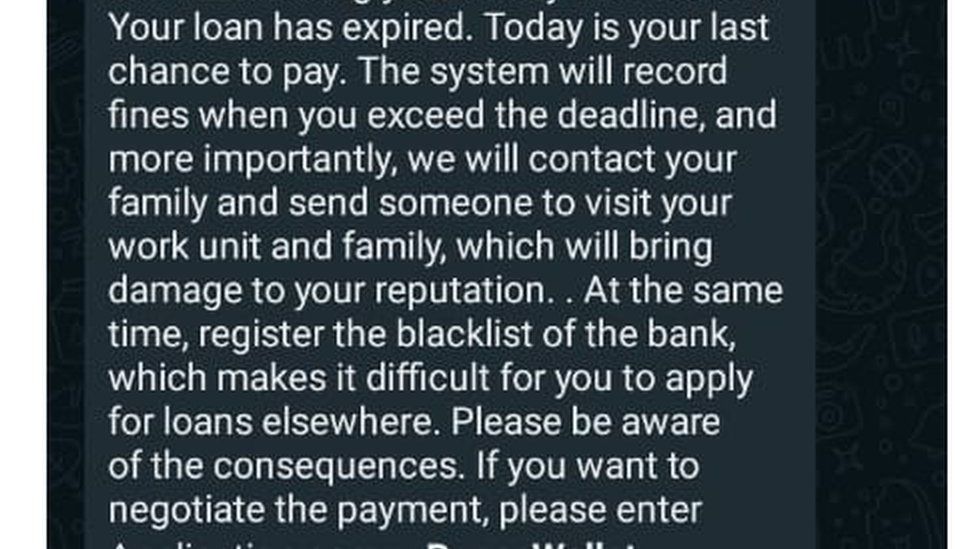

Image source, Getty ImagesMessages sent to victims include threats to tell family and work colleagues about the victim's debts, according to the Beeb. There are threats to make and distribute porn videos that use the victim's image.

The government has taken action against loan scam operators. The Play app store was urged to review the apps in May of last year.

Almost all Indians with a phone will have the operating software called Android and the app service called Play, which is a part of the equation.

The scam artists use simple text messages to advertise.

The government has been asked to come up with new legislation by the Reserve Bank of India. There is a central agency at the Reserve Bank of India.

The government is expected to give a response soon.

New rules won't come in time for some.

His family says that he committed suicide due to the threats and harassment he was receiving from loan scam artists.

Dattatreya said that his brother had just downloaded the app.

After that, agents began calling his work colleagues and telling them that he had bad debts. They sent nude photographs of him to 50 of his colleagues.

Even after he filed a police complaint, the harassment continued.

He says that the man's life had become a living hell.

The police are looking into the matter.