The $4.5 million seed round has been completed with the addition of an additional $2.1 million. The startup, which provides multiple products for the cross-border commerce space in Africa, raised this new financing from a group of international investors.

This investment is the first of its kind in Africa. The firm co-led the round with GlobalVentures, a VC focused on the Middle East and North Africa. "I think the fact that AMEX is now investing in the continent, especially after investing in companies like Stripe, is really powerful," said Jessica Anuna to TechCrunch.

Greycroft, Seedcamp, Plug and Play and Berrywood Capital doubled down on their initial investments.

The e- commerce market in Africa is worth over $25 billion and is growing. Payment issues are faced by merchants and consumers in Africa when they pay for products online.

There is a suite of business and consumer facing products connected. Merchants outside Africa can collect payments from six countries in Africa and get paid in G20 currencies like dollars, pounds or euros. Small merchants in these countries can pay in their local currency. Suppliers get payments in their dominant currency in three days. Merchants who don't have storefronts can use Payment Links to share links with their customers.

The company is growing in merchant acquisitions and transaction volume. More than 210,000 transactions have been processed by Klasha, 10 times the number from last October. Merchants pay a fee to use the platform for analyzing data.

The image is titled "Klahsha."

Users in Africa were able to use the consumer product to create virtual cards and send and receive money. Anuna said that the company would update the app to help retailers accept payments from Africans.

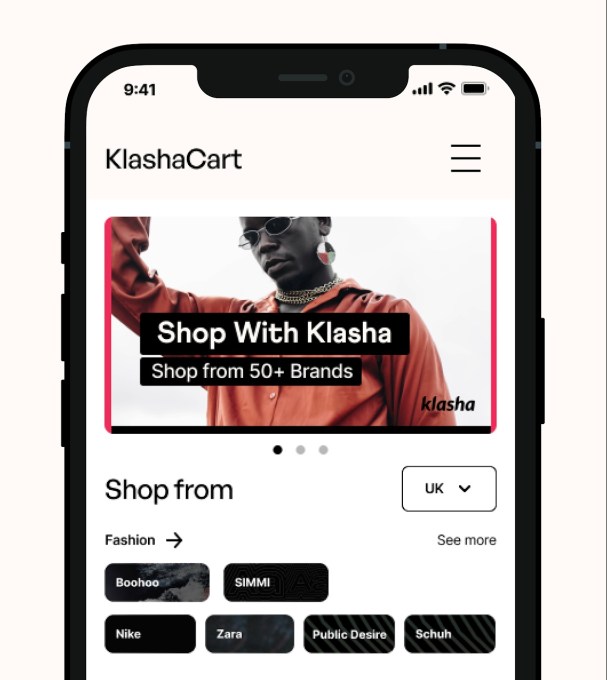

Anuna said the biggest product development was the app that allows these consumers to shop from selected stores like Boohoo.com, pay using their Klasha wallet, and get delivered to their door.

Cross border commerce from Africa to the rest of the world needs to be streamlined. Give the rest of the world access to Africans who want and need these goods.

Consumers in Nigeria will be able to shop from different retailers using naira and have their items delivered within 14 days via the app. In the next couple of months, the platform will be live in Africa. Its consumer base has grown by 4x in the past year.

The cart is named "KlashaCart."

There is more room for growth for the company, according to a partner at Global Venture. According to her, there is a significant opportunity to provide a better experience for more than 500 million digital buyers anticipated on the continent by 2025, in an e- commerce market that makes up to 5% of Africa's retail space.

"We look forward to seeing the company's innovative solutions help open up commerce for African consumers and facilitate cross-border payments." It's possible to drive spending by making payments simpler in emerging markets and allow merchants to scale.

Backed by Greycroft, Klasha gets $2.4M to improve cross-border commerce in Africa