There is an idea and a dream. The only thing you would need is time in the markets. Good luck if it is all you have.

While the plight of profitless companies is well known, the extent to which such firms have come to choke the equity landscape is only beginning to be comprehended. Over the last five decades, the percentage of US firms trading publicly with zero earnings has more than tripled, according to new research.

Until recently, they were the epitome of the stock-market ball, built not on factories or resources, but ideas, and hoping something will catch on and make them the next Facebook or Google. When times are good, all of that is fine. When the market appetites switch from hot intellectual property to cold hard cash, intangible-laden companies become a luxury no one can afford.

University of Minnesota.

The number of US public firms with negative net earnings reached a record at the end of 2020, accounting for 62% of the group, compared with 18% in 1970. Most of the initial public offerings that came to market in the last year didn't make a profit. In 1980, that figure was 24%.

It's not just in technology. Unprofitable companies have flourished all over the world. Manufacturing is the heart of the economy. More than half of US publicly listed manufacturers didn't make a profit in 2020. Their numbers include some of the most well-known names in the industry.

The proliferation of money-losing public firms is being driven not just by tolerance among investors, but an overt preference for a certain kind of loss-making firm, the author suggests. Businesses are being encouraged to sell stock years before they are profitable because of a belief that a formula or idea will eventually attract a network of users that will one day prove extremely valuable.

The study measures the characteristics of intangible assets and plots them against loss-making firms. It shows a high correlation between the two, suggesting that most of the companies went public on the assumption their intangible assets will one day pay off.

Dan Su is a PhD graduate from the University of Minnesota and the author of the paper. Monetary policy is important for these companies because they cannot make profits until many years later.

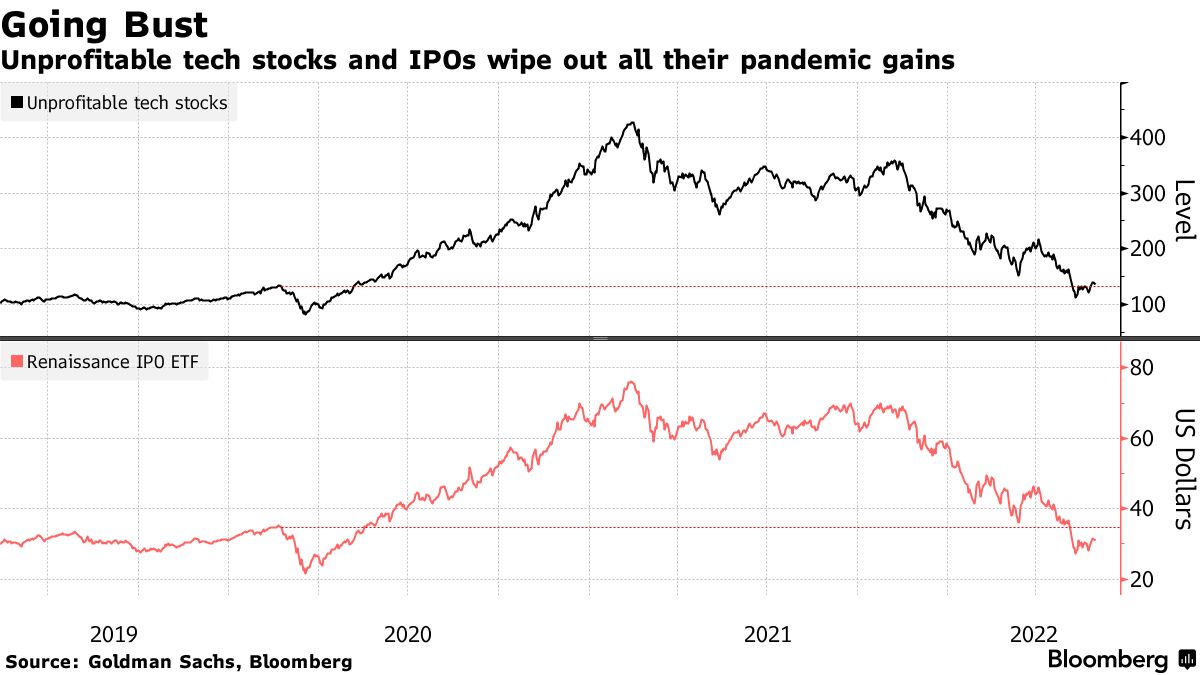

The investors were quickly to leave. The top 100 unprofitable companies in the US gained more than 130% in the three years prior to their peak in February 2021, according to data compiled by Su. Since that high, those firms have plunged, while the Russell 1000 has gained. The returns were minus 42% and minus 15% from the peak.

The scale to one day dominate existing industries was promised by the rapid growth at a time when private equity was willing to bankroll unprofitable companies. The money to fund them was dirt cheap.

The S&P 500 companies have a value in assets.

There is a company called "PwC." It is called "PwC." The company is called "PwC."

Peter Garnry is the head of equity strategy at Saxo Bank A/S.

There has been a lot of change since. In a letter obtained by CNBC, Benchmark warned that the process of shifting perceptions on valuations could be painful.

The pain is already visible as the tide goes out on easy-money liquidity that kept profitless companies aloft. Cash-rich companies are what investors are looking for these days.

The volume of US IPOs has fallen this year.

Agence France-Presse.

Higher rates suggest the demise of unprofitable companies as a result of low interest rates. Tech firms have lost money as the Federal Reserve fights inflation.

There are fewer ways to take profitless companies public. The market for IPOs fell in the first quarter compared with a year ago. Fund-raising is less than it has been in the past in both the US and globally.

There are some good news. According to Garnry at Saxo Bank, business models and ways of exploiting digital technologies have improved since the dotcom bubble.

He said that there will be companies that will have an interesting business model in the long run.

Su believes that conditions are different from two decades ago. Nine of 10 industries have seen an increase in the intangible economy. It might be more than just an easy money phenomenon.

He said that we are likely to see more firms with negative net earnings in the future. We will see more firms like Amazon andTesla with huge profits in the future. This shouldn't be seen as a bubble.