EU leaders want a partial ban on Russian oil. The Labor Party won a majority. The Pacific was dealt a blow by China. Here is what you need to know.

European Union leaders agreed to pursue a partial ban on Russian oil, paving the way for a sixth package of sanctions to punish Russia for the invasion of Ukraine. The sanctions would forbid the purchase of crude oil and petroleum products from Russia delivered to member states by sea, but include a temporary exemption until a solution is found to satisfy the energy needs of Hungary and other landlocked nations. More Russian oil is on board tanker ships heading to China and India.

Australian Prime Minister Anthony Albanese's Labor Party secured a parliamentary majority after days of ballots getting counted in tightlycontested seats, giving his government the heft to push through bills on issues ranging from climate change to anti-corruption measures. Measures to boost the economy's productive capacity that will be crucial to reining in deficits and lifting living standards have yet to be shown. In case you missed it, here is the story of how Albanese went from public housing kid to prime minister, and what the future holds for Australia when it comes to climate change.

Australia's ABC News reported that China's plan to sign a sweeping trade and security deal with 10 Pacific Island countries was dealt a blow because some of them expressed concern. There were signs that Pacific nations were uneasy with China's expansion in the region. Chinese Foreign Minister Wang Yi is on a 10-day trip to the region in what has been seen as a sign of Beijing's intensifying competition with the US and Australia for influence there. Here you can find out which Pacific nations had reservations. The US wants to form its own club in the region.

A new source of green power is emerging under the ocean. Japan has successfully tested a prototype generator in one of the world's strongest ocean currents that could provide a constant, steady form of renewable energy. Deep ocean generators can run 24 hours a day. There are obstacles to overcome. You can get the full story here.

President Joe Biden will hold a rare Oval Office meeting with the Federal Reserve Chair on Tuesday, as investors remain cautious about whether central banks can raise rates to rein in inflation without derailing growth. In Japan, Australia and Hong Kong, futures were down. As investors begin to see value in fixed-income assets, bonds in almost every corner of the $63 trillion global debt market are bouncing back. Bulls say the selloff is over.

The majority of 540 people who took part in the survey said that China's Covid-zero strategy will stay in place for the rest of the year. However, optimism is running high that the tariffs will be removed and that Beijing will end its restrictions on technology firms. Here is what you told us.

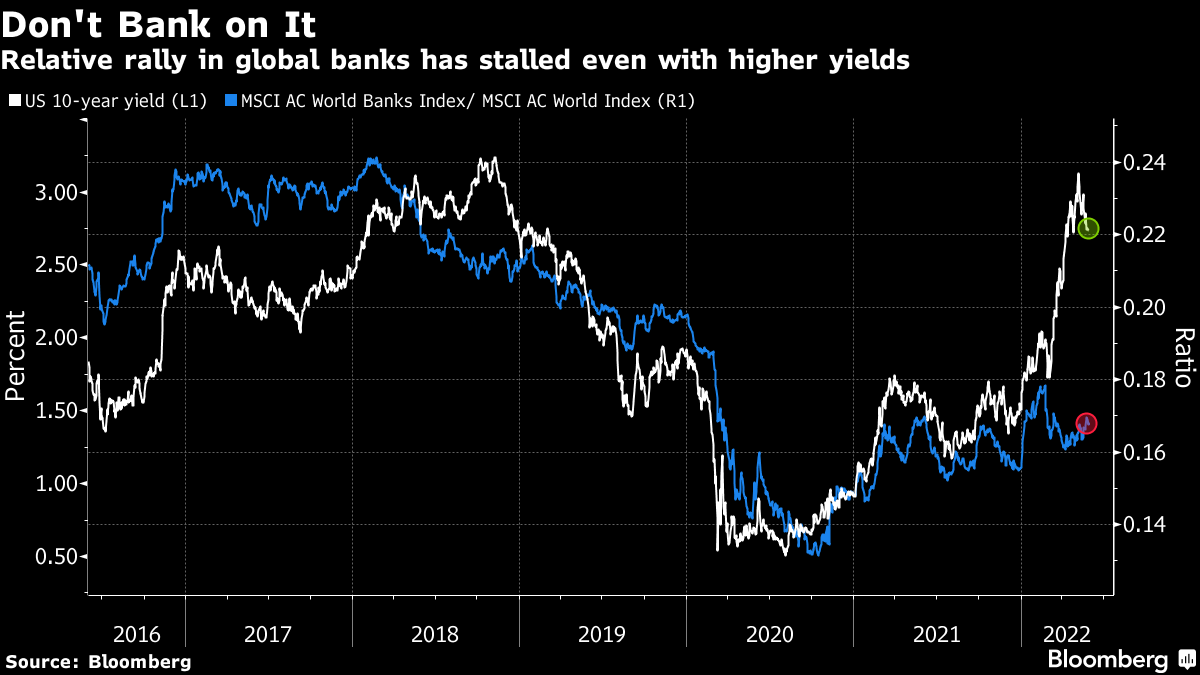

The value sector has failed to deliver the bang for the buck this year that should have come with higher bond yields. The relative performance of an MSCI gauge of the world's banking stocks broke away from its tight relationship with 10-year Treasury yields, having closely tracked them for at least a year. Banks peaked relative to the broader market the day before Russia invaded Ukraine, suggesting that fears about growth are behind the move.

It would be bad news for bank earnings if there was a fall in loan demand. More investors seem to be warming to the idea that bond yields have peaked, removing a catalyst for bank stocks to close the gap. That suggests a couple of months of choppy trading for the shares, until investors get a better sense of the global economic outlook.

Cormac is a deputy managing editor in the Markets team.

With assistance from Cormac Mullen.