Insiders are starting to question aspects of the investing form as the ESG industry faces attacks from a growing chorus of detractors.

The industry is struggling in terms of impact and returns, according to James Whittington, head of responsible investment at Dimensional Fund Advisors.

He said in an interview that any promise that you can beat the market by your insight and evaluating ESG risks probably isn't going to stack up. Whittington said his team found no compelling evidence that investors targeting environmental, social and governance goals are altering companies' cost of capital or achieving change through stewardship.

Whittington's comments add to the debate that is hitting ESG from all sides. The head of responsible investment at HSBC was suspended after he questioned the focus on climate change. In the US, Republicans have identified ESG as a target in their culture wars, while Musk has called it a scam.

Chris Hohn, a renowned hedge fund activist, recently characterized ESG engagement as little more than a waste of time.

A common theory among sustainable investors is that they will change the cost of capital for companies, rewarding outperformers, punishing lagging and creating a strong financial incentive for all to improve against ESG metrics.

The theory makes sense, but there is no hard evidence to back it up.

Hedge funds get thumbs down from the stock market.

A study published in March found that the focus on de-carbonization might be driving a higher cost of capital in oil and gas developments.

The question is how well ESG drives returns. A company that ignores environmental, social and governance factors will be less profitable in the long run. Whittington considers Esg a secondary consideration that can be added to profit-driven strategies.

Whittington believes that the best way to manage risks is to use information in market prices. He said that ESG is about giving clients funds that align with their values.

Which clean-energy funds are the best?

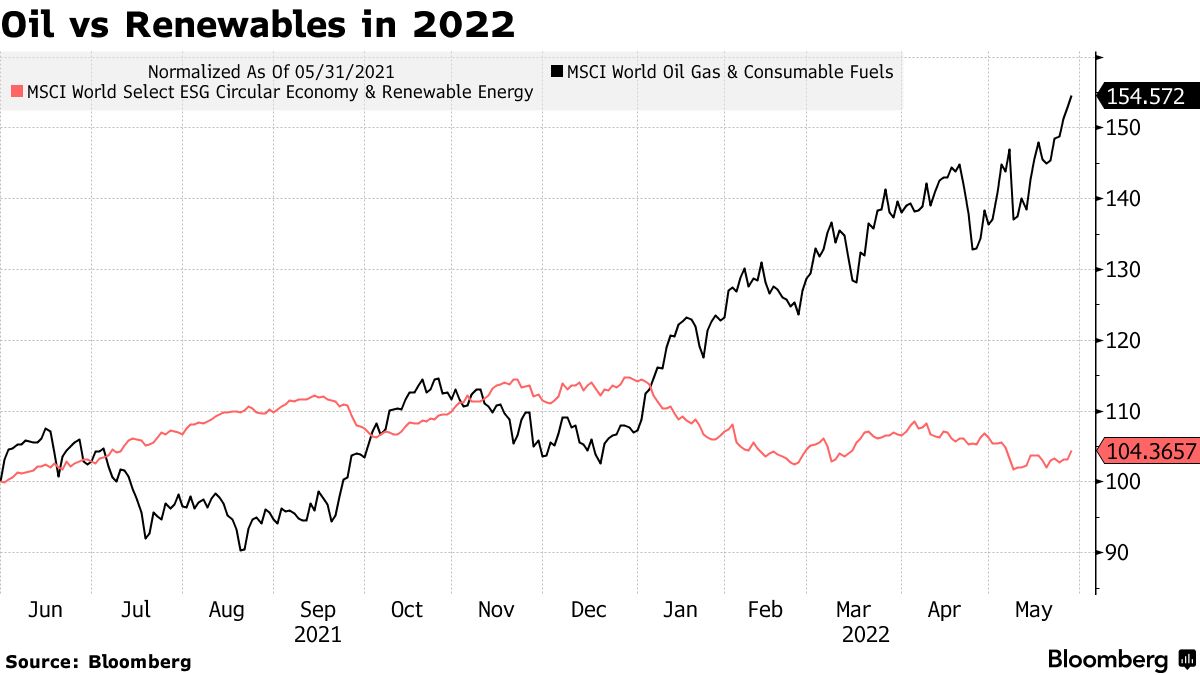

A recent study by the European Securities and Markets Authority found that ESG funds perform better than conventional products. The equity funds have had a bad start. The average loss in Europe is almost double the decline in the Stoxx Europe 600 Price Index.

The International Energy Agency said in March that global CO2 levels rebounded to their highest level in history last year. The ESG industry has a value of over 40 trillion.

The link between fighting climate change and ESG investing is unclear, and the US Securities and Exchange Commission proposed new restrictions to crack down on greenwashing last week.

Whittington says that ESG is too focused on what is going wrong in emerging markets.

The growth of economies in emerging markets can do a lot of good.

With help from Sheryl Tong Lee.