The Covid-19 was locked down in Shanghai on May 29.

There are more economic relief policies in China. The EU does not agree on revised Russia sanctions. The May draws to a close. Here is what you need to know.

The S&P 500 is down more than 10% so far this year, and investors are wondering if the worst is over. The lure of tech and growth shares fell as interest rates rose, making it 888-282-0465 888-282-0465 888-282-0465 888-282-0465 888-282-0465 888-282-0465. Where are we now? On less-hawkish remarks from Fed officials, the S&P was up 2.5% last week. Analysts say that the stock market may have yet to hit a low. In Japan, Australia and Hong Kong futures are up.

All manufacturers were allowed to resume operations from June as authorities rolled out scores of policies to revive an economy impacted by Covid lockdowns. The financial hub will speed up approvals for property projects and supply new residential developments according to a plan issued by the Shanghai municipal government. Beijing says its outbreak is under control, while Hong Kong has relaxed the flight-suspension mechanism for carriers that bring in a certain number of people who test positive.

In his first trip away from Kyiv since Russia invaded, the president visited front-line troops in the Kharkiv region.

Zelenskiy called the conditions in the east of the region to the east difficult, as Russia presses to take more ground. European Union nations failed to come to an agreement on a revised package of sanctions over Moscow's invasion of Ukraine, and Russian President Vladimir Putin promised Serbian President Aleksandar Vucic an unimpeded natural gas supply.

Park Ji-hyun, a South Korean activist, broke an online sex crime ring, published a memoir, and became a senior advisor to a leading presidential candidate in the five years since her 21st birthday. She didn't lose, but he did. Park has emerged as a leader of South Korea's opposition and a torchbearer for women fed up with the country's longstanding gender divide. She gave a rare interview to him. The full story can be found here.

According to the leader of the main opposition party, a new government is needed to tackle the economic crisis in Sri Lanka.

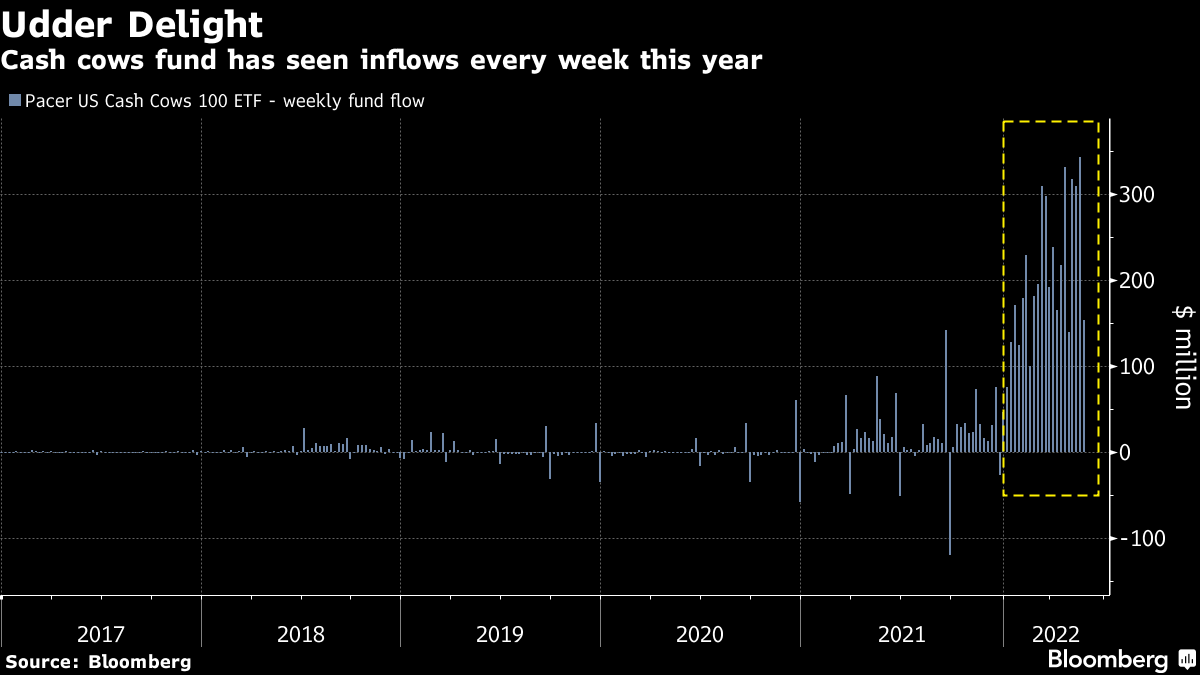

In the US, cash is king in the stock market. The shares of the most cash-rich companies are being bought by investors at a fast pace. The assets under management for the Pacer US Cash Cows 100 Exchange Traded Fund have risen to $6 billion, up from the start of the year. The fund, which tracks mid- and large-cap companies with high free-cash-flow yields, has seen an inflow every week so far this year.

The S&P 500 Index has fallen by 15% this year, but the ETFs has climbed by 6. That is even better than the performance of a gauge of high dividend yield US stocks. As the threat of a recession looms, investors are once again focusing on firms with the strongest fundamentals, as the exposure to energy stocks has helped the fund. Demand for cash-rich companies is likely to rise as default risk in the corporate sector increases.

Cormac is a deputy managing editor in the Markets team.

With assistance from Cormac Mullen.

Watch Live TVListen to Live Radio