The sterling bond market has double-digit losses and borrowers are put to flight.

Firms that need cash are alarmed by that. The Bank of England's rate rises, a cost-of-living crisis with inflation at the highest in 40 years, and a slow-burning legacy of low productivity are what they are up against. There is added repercussions from the decision to leave the European Union. The economy is expected to shrink 0.4% this quarter.

It makes for a difficult set up, according to a high-yield portfolio manager.

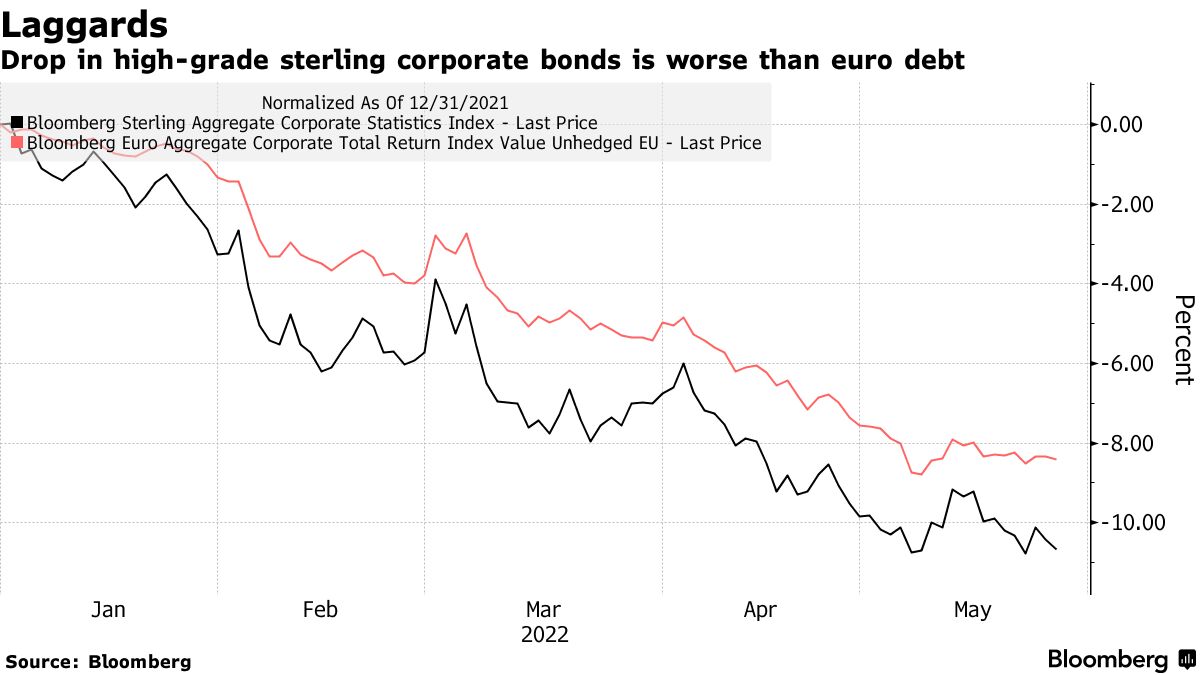

As of Thursday, euro- denominated debt has fallen by two percentage points more than sterling securities, while the top-rated sterling securities have fallen by eleven percentage points. The year-to-date contraction of the gauge's market cap is the worst since at least 2000 and is as far back as the data goes.

The market for new sterling corporate bonds, which is much smaller than its euro and dollar peers, has virtually ground to a halt. The issuance of UK-based, non-financial firms is just over 3 billion dollars, the lowest since 2016 and a third of what was sold last year. Matalan is one of the companies that are having to rethink their capital structure.

UK corporates that are struggling with the inflationary environment may struggle to service their debts or raise more capital to keep their businesses going, according to a portfolio manager.

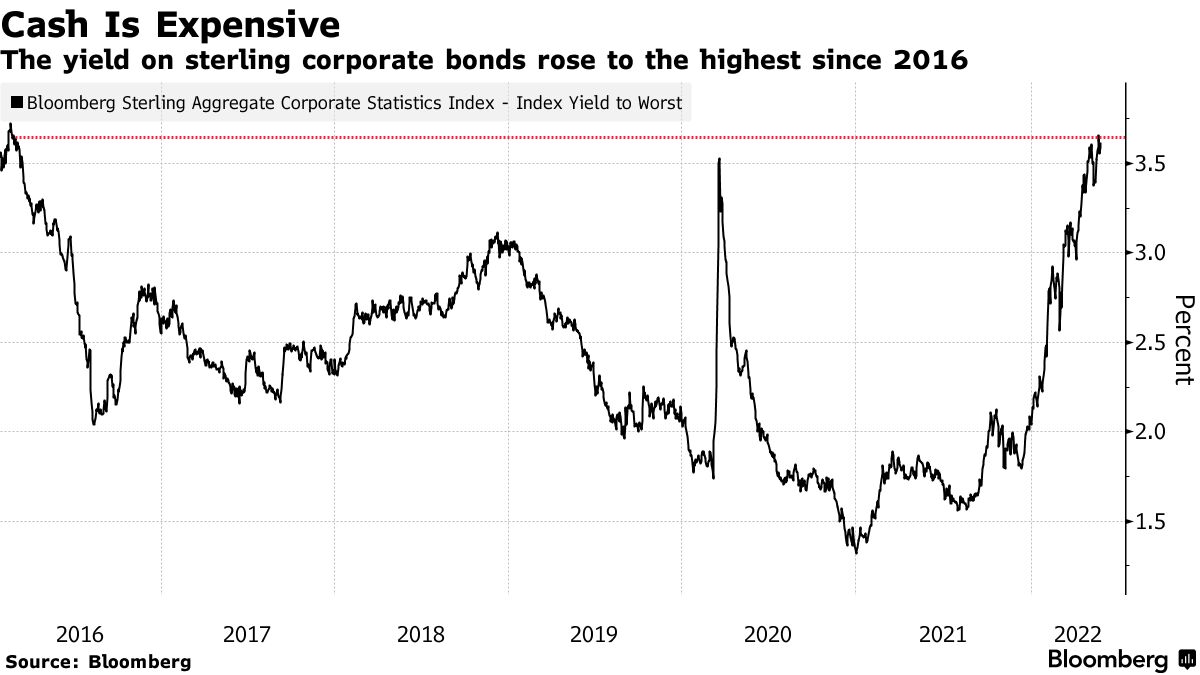

In May, the yield on sterling high-grade company bonds rose to the highest since 2016 as borrowing costs soared. The 10-year average yield is almost a percentage point above it.

A deep dive into the gauge shows that the bonds that can be measured on a year-to-date basis are down. Consumer credits dropped an average of 13%. All but a few bonds in the junk-rated sterling debt index are dropping.

James Smith, an economist at ING, said that higher borrowing costs and a more challenging borrowing environment will inevitably add to growing margin pressures facing corporates.

In 2020, sterling corporate debt sales from domestic non-financial borrowers almost doubled, and then rose again in 2021.

The issuance of pound bonds from UK firms fell to the lowest level in over a year.

Source: Bloomberg

The surge in corporate bond yields is due to inflation and the Bank of England's string of interest-rate increases to the highest since 2009, but it is also due to the prospect of slower economic growth and concern over corporate earnings. The recent package to help households cope with rising energy prices has reduced the risk of a recession, but growth will likely be lackluster.

In the third quarter, Dan Hanson expects the gross domestic product to grow. The government's measures will prompt the BOE to hike rates four more times this year. Borrowing costs would go up.

Sunak gives the economy a good chance of avoiding a recession.

The threat of deflation is driving up the cost of credit. The 100 day historical volatility gauge for sterling high-grade corporate bonds is the highest it has been since August 2020. One reason why bankers are nervous about committing to funding deals backing mergers and acquisitions is that tapping the market is a challenge.

The sale of Boots chemist is a high-street staple. The rival consortium, which included Indian tycoon Mukesh Ambani and Apollo Global Management Inc, hadn't yet secured binding financing deals from banks.

The rising cost of money and waning appetite for risk are deterrents for lenders, as they can't get off their balance sheets because of the huge amount of debt that they underwrote to fund buyouts.

Banks would be racing to provide cash if markets were calm. They have seen the struggles their peers are facing with WM Morrison Supermarkets, which was underwritten in August when borrowing costs were considerably lower. The sale of more than $2 billion of debt was delayed earlier this month.

Bankers are nervous about funding Boots bids.

Those issues are diminishing the appeal of UK assets for private equity firms.

Private equity buys stuff at the cheap part of the cycle.

For a few investors, the drop in corporate bond prices is an opportunity to find bargains, particularly for those who think rate hikes are already priced in.

Paola Binns is a senior fund manager at Royal London Asset Management. If you have the ability to not lose your nerve, that's it.