The UK's competition watchdog has just announced another investigation into Google over potential antitrust abuses.

The Competition and Markets Authority is investigating the ad tech practices of Google and Facebook. The US State of Texas is leading a major antitrust complaint against Google.

The Privacy Sandbox plan, which would have deprecation of tracking cookies to migrate to an alternative stack of ad targeting technologies, was the subject of a probe by the CMA last year. The revised approach to push for topic-based ad targeting was made by the company.

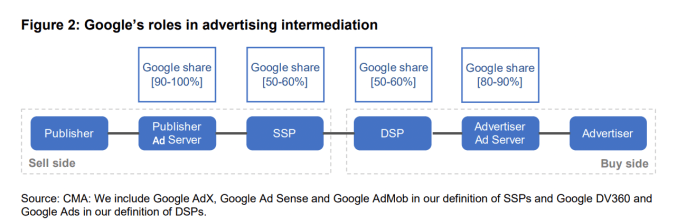

Since the tech giant owns the adtech tech stack, the regulators suspect that it could distort competition.

The parts where it will be looking at are: ad exchanges, which allow advertisers and media agencies to buy ad space from many sources, and demand side platforms, which enable advertisers and media agencies to buy publishers' inventory.

The CMA is looking at whether the practices of the ad tech stack may distort competition. The interoperability of its ad exchange with third-party publisher ad server and/or contractually tied these services together, making it more difficult for rival ad server to compete, are some of the issues the regulators are looking into.

The chart below shows how much of the adtech tech stack is held by Google. Its ad products have evolved and merged over the years, as well as undergoing some rebrands, making it a complex and even opaque market structure.

The final report on the online advertising and platforms market study was published in July 2020.

The lack of transparency in the ad market was found to be one of the reasons why it was difficult for market participants to understand or challenge how decisions are made.

Network effects, economies of scale, consumer decision making, and the power of defaults, are some of the characteristics it suggested undermined effective competition in the digital ad market.

Despite making a damning assessment of the state of the online ad market almost two years ago, the CMA has not taken any enforcement action against Google. Following publication of its preliminary report, the consultation featured breaking up the adtech giant as one of a number of potential remedies.

In the final market report, the CMA pushed for new powers so it could make pro-competition interventions to fix structural problems with tech giants with strategic market power.

The Digital Markets Unit started work in shadow form last year, but the UK government still hasn't passed legislation to empower it. It looks like it will take years more to wait, as the government has not made the competition regime an immediate priority.

The CMA opened investigations into specific adtech practices.

While it waits for the government to empower the DMU it will use its existing powers in the tech sector.

The CEO of the Competition and Markets Authority said today that it was opening a new investigation because it was concerned that the dominant position of the internet giant was being used to favor its own services.

He added:

“Weakening competition in this area could reduce the ad revenues of publishers, who may be forced to compromise the quality of their content to cut costs or put their content behind paywalls. It may also be raising costs for advertisers which are passed on through higher prices for advertised goods and services.

“It’s vital that we continue to scrutinise the behaviour of the tech firms which loom large over our lives and ensure the best outcomes for people and businesses throughout the UK.”

Significant issues, as well as possible solutions, will be considered in the investigation of the adtech practices of Google.

The latest probe was brought to the attention of the internet giant.

It told us that it hasn't seen the full complaint yet and can't respond in detail.

“Advertising tools from Google and many competitors help websites and apps fund their content, and help businesses of all sizes effectively reach their customers. Google’s tools alone have supported an estimated £55 billion in economic activity for over 700,000 businesses in the UK and when publishers choose to use our advertising services, they keep the majority of revenue. We will continue to work with the CMA to answer their questions and share the details on how our systems work.”

The European Union launched a wide-ranging probe of Google's adtech practices last summer. Last summer, the national authority hit it with a $268M penalty for a string of abuses, but France's antitrust watchdog has already conducted its own investigation.

The tech giant proposed a series of interoperability commitments that the regulator accepted as part of its binding decision. The country has been ahead of the curve on antitrust issues.

The Irish Data Protection Commission has had an enquiry open into its ad exchange, following complaints.

The DPC is being sued for failing to act on complaints that date back to last year.

The validity of consent/legal basis for the mass processing of web users has been the focus of other EU privacy complaints about real-time bidding.

Behavioral ad industry gets hard reform deadline after IAB’s TCF found to breach Europe’s GDPR