The stock dropped more than 10% in extended trading after the chipmaker gave a light forecast for the current quarter.

The Refinitiv consensus estimates for the quarter ending May 1 were compared to the Nvidia consensus estimates.

Revenue for the current quarter is expected to be about $8.1 billion, under analyst expectations. During a period of high inflation and macroeconomic uncertainty, investors have been shunning fast-growing stocks in favor of safer bets, which has led to a steep decline in the stock of Nvidia.

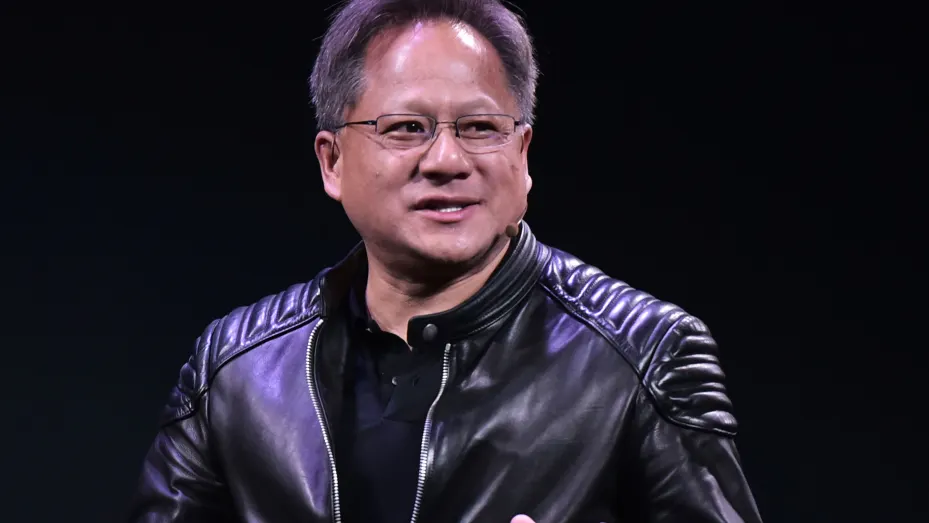

In a statement, Jensen Huang said that the company was facing a challenging macro environment. On a non-GAAP basis, the company's operating expenses increased to $1.6 billion.

If the Russian war in Ukraine had not happened, the company's revenue would be $500 million lower.

The demand for its graphics processors is still strong and is widely used for advanced gaming and artificial intelligence in the cloud. Its core businesses of data center and gaming sales both grew during the quarter.

The company's core gaming business grew 31% annually to $3.62 billion, but its data center business, which sells chips for cloud computing companies and enterprises, grew 83% annually to $3.75 billion.

Graphics cards for laptops and chips for game consoles drove the growth of gaming, according to Nvidia. The Nintendo Switch has a chip made by Nvidia.

The company said that inventory of its graphics chips for gaming, which had been difficult to find at retail prices for the past year, had normalized, suggesting that the shortage is starting to abate.

The results of the company's smaller lines of business were mixed. The company's automotive business was down 10% on a year-over-year basis.

Earlier this month, the company announced that it had reached a settlement with the SEC over disclosures in the past. The company said that the decline in other revenue was due to its CMP products.

The board of directors has authorized an additional fifteen billion dollars in share purchases by the end of next year. In the first quarter, it spent more than $2 billion on dividends and share purchases.

Arm, a chip technology company, was terminated by Nvidia earlier this year. A negative impact of 52 cents per share on a GAAP basis was the result of a charge of over $1 billion.