As the stock market continues to trade down, investors are looking for higher returns. The yield from lending and staking can range from 1% to as high as 15% for riskier projects.

Some people are looking at high-yield savings accounts like the one from Y Combinator-backed startup Pebble, which offers 5% annual percentage yield on all cash deposits. The use of stable coins has found themselves in the spotlight recently after Terra's UST experienced a meltdown, leading to broader instability.

In an interview, co-founder and CEO of Pebble, Aaron Bai, said that the approach of the company is less risky than stable coins.

Bai said that users first deposit currency into their accounts. The startup uses traditional reserves of cash and Treasuries to convert the cash into a digital stable coin calledUSDC, which is backed by traditional reserves of cash and Treasuries.

Once the cash is converted intoUSDC, it will lend the funds to highly regulated institutions, such as the ones mentioned above, as well as traditional financial entities that are willing to pay a premium to access stable coins. Bai told me that the borrowers put down assets worth 150% of the value of the loan as security, meaning that if institutions fail to repay the loans, users will lose their money.

A product photo from a fintech app.

Bai said that if the borrowers are not putting down an asset, there is a huge risk. We can liquidate the assets of borrowers even if they don't pay.

Bai said that the company has partnerships with two lending institutions to further mitigate its risk.

Bai said that Pebble also offers 5% cash back on all transactions with its 55 partner merchants, which include companies such as Amazon,Airbnb, and Adidas. He said that Pebble isn't a credit card. Bai said that the interface functions as one single app where the 5% interest on cash applies to all deposits made and the 5% cash back applies to all spending through the app made through these merchants.

Bai explained that traditional credit card providers rely on third parties to process their transactions, leaving less in reward cash for the customer. He said that the difference between the two programs is that Pebble is set up like an affiliate program with each merchant and issues rewards to its customers in the form of gift cards to that merchant rather than direct cash rewards.

Bai said that the system allows merchants to save up to 7% on each transaction, which makes it more lucrative for them to offer rewards through Pebble rather than a credit card provider.

Every time a customer buys a gift card through the Pebble platform, the money goes to the merchants. Bai said that the merchants love that they are actually getting their profits and they are not paying out inefficient middleman.

Bai showed me how to use the gift cards on the app, either as a barcode that can be scanned at a merchant in person or as a code that can be used online. Bai said that the feature is offered through a virtual card and physical card for certain customers.

The company came out of stealth and raised $6.2 million in a seed round. The investors in the round include Y Combinator, Lightshed Venture, Eniac Venture, Global Founders Capital, Montage Venture, and Soma Capital, as well as angel investors.

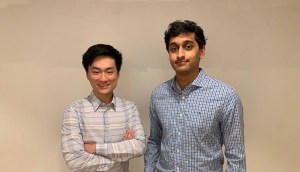

The co-founders of the Fintech app, Pebble, are.

Bai and his co-founder/CTO are working with two other team members to develop features that will help users manage their personal finances on a daily basis, they told me. Bai explained that the app has a feature that allows users to pay, track, and manage their bills by snapping pictures of them and uploading them to the app, and is further developing payroll integrations.

The co-founders are clear about their disdain for traditional banks, with their plethora of fees and often-antiquated tech interface. How will Pebble differentiate itself from a bank?

Bai wasn't sure about this. He said that customers will be able to accumulate reward points for their activity on the app, but wouldn't give much detail on what those Pebbles actually enable or represent beyond that.

Bai said that the more power you have as we advance this platform and transition to a different stage, the more you will have.

He explained that users don't need to be smart to use it.

Bai said they want to be that bridge, from the web2 user to web3 through a very simple, attractive financial app, where people can hold their first digital assets without even knowing about it.