Since the beginning of the Pandemic, returns have been subdued by volatility in markets.

Barbara Shecter is a person.

3 minutes ago, May 19, 2022.

The five-year return is 10 per cent, while the ten-year return is 10.8 per cent.

Sean Kilpatrick took the photo.

/The Canadian Press.

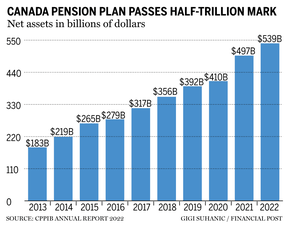

As of March 31, the Canada Pension Plan Investment Board had $539-billion in assets.

The net return for the year was 6.8 per cent, with $8-billion of the $42-billion increase coming from net transfers from the Canada Pension Plan.

The five-year return is 10 per cent, while the 10-year return is 10.8 per cent.

Despite turbulent market conditions in the wake of Russia's war on Ukraine and supply chain disruptions caused by the swine flu,CPP Investments delivered solid returns in fiscal 2022, according to John Graham, the pension management organization.

Our 10-year performance of nearly 11 per cent, the same as it stood at the end of the last fiscal year, demonstrates the enduring growth of the (CPP) Fund over the long haul.

Private equity, infrastructure, real estate and credit investments were the main contributors to the Fund's overall performance.

The pension giant said returns in the first nine months of the year were not as good as they could have been due tovolatility affecting public equities during the final quarter.

The fund's return in the 12 months of 2021, rather than the fiscal year that bled into 2022, was 13.8 per cent.

The decline in bond prices was not seen in more than 40 years.

The Canadian dollar's appreciation against the U.S. dollar and other major currencies was one of the factors that led to a $4-billion currency loss during the fiscal year.

Looking ahead, we confront uncertain business and investment conditions with higher inflation expectations, potentially worsening supply chain interruptions, sluggish global economic growth estimates and international reactions to the war in Europe, all against the backdrop of a persistent global pandemic and climate change.

He said the pension management organization has a diversified strategy and local presence that puts it in a strong position.

Graham said in an interview that the pension fund is positioned to weather higher inflation than was expected a year ago because of a longstanding strategy of investing in real assets.

It is an area we have been trying to grow. He said that it has good total returns and protection against inflation.

It has been growing faster than other areas.

In a report this week, the ratings agency said that Canadian pension funds are well positioned to cope with higher inflation and economic growth.

During the final quarter of the fiscal year, Graham said his teams will continue to invest across geographies and market sectors.

He said that they have a benefit of diversity and will continue to be active in both the public and private equity markets around the globe.

The Asia-Pacific market provides an example of the benefits of the strategy, he said, noting that the region has been the second-highest performer over the past five years.

He said that access to large and emerging economies is necessary for the longterm performance of investments.

Graham said that they don't put in hard allocations to countries.

Email: bshecter@postmedia.com