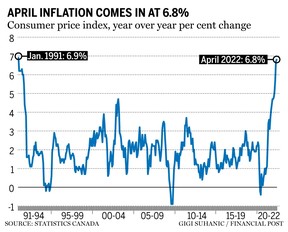

Inflation has been highest since January 1991.

Kevin Carmichael is a person.

2 days ago, on May 18, 2022.

Canada's annual inflation rate increased in April, edging ahead of analyst expectations, largely driven by rising food and shelter prices.

The photo was taken by James Park.

Canada's main inflation gauge increased in April, one of the fastest rates since the early 1980s. What you need to know is here.

The United Kingdom's inflation went up to nine per cent in April, but it was not as bad as Canada's.

The headline inflation of 6.8 per cent is pretty bad. In January 1991, the consumer price index increased by 6.9 per cent, and it stayed around six per cent for much of the year. Inflation hasn't been this hot since the early 1980s.

The pace of increases is slowing. The headline number was 6.7 per cent in March, which was a huge increase from 5.7 per cent in February and 5.1 per cent in January. Headline inflation may look better if math begins to make it look that way. Inflation tends to be discussed as year-over-year changes in the consumer price index, which aggregates hundreds of prices of goods and services each month. The index had plunged during the recession, so the calculations were being made against a low base. Base effects are no longer being used.

In May, gasoline prices, which always have an outsized influence on the headline number, jumped. Douglas Porter, chief economist at Bank of Montreal, said in a note to clients that transportation costs affect the price of almost everything.

Commodity prices and housing-related costs caused inflation to break out of the Bank of Canada's comfort zone of one per cent to three per cent.

Statistics Canada said gasoline prices were 36 per cent higher in April. The agency's measure of what it would cost to replace existing homes went up 17 percent and general home expenses went up 13 percent. The cost of food, including restaurant meals, is one of the big drivers.

The war in Ukraine and a string of poor harvests around the world have led to a 9.1 per cent increase in food purchased at stores. Canada is rich enough to absorb the shock. Poorer countries are not.

The pricing pressures are broad, but those are the most notable increases. According to an economist at Royal Bank of Canada, more than 70 per cent of the goods and services that Statistics Canada tracks increased from April to April. The index rose 5.8 per cent without gasoline, the most since Statistics Canada created that sub-index in 1999.

The initial issue was supply. Supply chains were disrupted due to Lock Downs and Absenteeism related to the Pandemic. Stores of staple foods were reduced because of the weather. The demand held up despite the recession, as governments and central banks responded to the Pandemic with unprecedented levels ofStimulus and many of the working population was able to work from home. Central bankers in Canada, the United States and other countries have conceded that they probably left interest rates too low for too long because unemployment is so low.

Not everything. The cost of travel tours fell by 18.6 per cent from April to May.

It is worth pausing on mortgages. The cost of borrowing money to buy a home was lower a year ago. It suggests homeowners who borrowed at lower rates won't be in for a shock if their rates go up.

Yes, interest rates are higher.

The Bank of Canada has acknowledged that it made a mistake. The consumer price index averaged 5.8 per cent in the first quarter, but the central bank's forecast for the second quarter is 5.8 per cent. The policymakers have little choice but to go back to a higher interest-rate setting because inflation is hotter than anticipated. Their main goal is to keep the consumer price index rising. They have a lot of work to do.

When policymakers adjust policy on June 1, Macklem said he will raise the benchmark interest rate by half a point. That would push the rate the lenders use as a guide for mortgage rates and other credit to 1.5 per cent, compared with 0.25 per cent at the start of the year.

The leaders of the central bank have indicated that they will not stop until they get the target rate to a neutral setting. Macklem said he might have to raise the benchmark rate to get inflation back to target.

Email: kcarmichael@postmedia.com